Johnson Controls 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

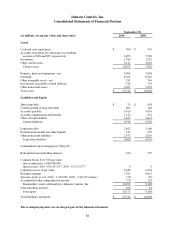

position. Amounts included within accounts receivable – net related to these contracts were $683 million and $579

million at September 30, 2010 and 2009, respectively. Amounts included within other current liabilities were $639

million and $601 million at September 30, 2010 and 2009, respectively.

Revenue Recognition

The Company’s building efficiency business recognizes revenue from certain long-term contracts over the

contractual period under the percentage-of-completion method of accounting. This method of accounting recognizes

sales and gross profit as work is performed based on the relationship between actual costs incurred and total

estimated costs at completion. Sales and gross profit are adjusted using the cumulative catch-up method for revisions

in estimated total contract costs and contract values. Estimated losses are recorded when identified. Claims against

customers are recognized as revenue upon settlement. The amount of accounts receivable due after one year is not

significant.

The building efficiency business enters into extended warranties and long-term service and maintenance agreements

with certain customers. For these arrangements, revenue is recognized on a straight-line basis over the respective

contract term.

The Company’s building efficiency business also sells certain heating, ventilating and air conditioning (HVAC)

products and services in bundled arrangements, where multiple products and/or services are involved. In accordance

with ASC 605-25, ―Multiple–Element Arrangements,‖ the Company divides bundled arrangements into separate

deliverables and revenue is allocated to each deliverable based on the relative fair value of all elements or the fair

value of undelivered elements.

In all other cases, the Company recognizes revenue at the time title passes to the customer or as services are

performed.

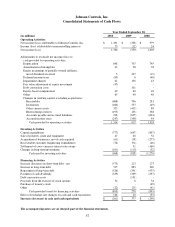

Research and Development Costs

Expenditures for research activities relating to product development and improvement are charged against income as

incurred and included within selling, general and administrative expenses in the consolidated statement of income.

Such expenditures for the years ended September 30, 2010, 2009 and 2008 were $723 million, $767 million and

$829 million, respectively.

A portion of the costs associated with these activities is reimbursed by customers and, for the fiscal years ended

September 30, 2010, 2009 and 2008 were $315 million, $431 million and $405 million, respectively.

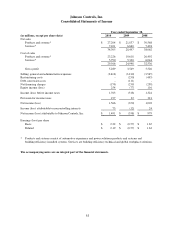

Earnings Per Share

Basic earnings per share are computed by dividing net income by the weighted average number of common shares

outstanding. Diluted earnings per share are computed by dividing net income by diluted weighted average shares

outstanding. Diluted weighted average shares include the dilutive effect of common stock equivalents which would

arise from the exercise of stock options and any outstanding Equity Units and convertible senior notes as of the

beginning of the period, for the years ended September 30, 2010 and 2008. However, dilutive shares due to stock

options, Equity Units and convertible senior notes were not included in the computation of diluted net loss per

common share for the year ended September 30, 2009, since to do so would decrease the loss per share. See Note

13, ―Earnings per Share,‖ for the calculation of earnings per share.

Foreign Currency Translation

Substantially all of the Company’s international operations use the respective local currency as the functional

currency. Assets and liabilities of international entities have been translated at period-end exchange rates, and

income and expenses have been translated using average exchange rates for the period. Monetary assets and

liabilities denominated in non-functional currencies are adjusted to reflect period-end exchange rates. The aggregate

transaction gains included in net income for the years ended September 30, 2010, 2009 and 2008 were $19 million,

$21 million and $3 million, respectively.