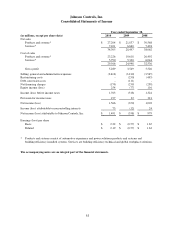

Johnson Controls 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

CRITICAL ACCOUNTING ESTIMATES AND POLICIES

The Company prepares its consolidated financial statements in conformity with accounting principles generally

accepted in the United States of America (U.S. GAAP). This requires management to make estimates and

assumptions that affect reported amounts and related disclosures. Actual results could differ from those estimates.

The following policies are considered by management to be the most critical in understanding the judgments that are

involved in the preparation of the Company’s consolidated financial statements and the uncertainties that could

impact the Company’s results of operations, financial position and cash flows.

Revenue Recognition

The Company recognizes revenue from certain long-term contracts in the building efficiency business over the

contractual period under the percentage-of-completion (POC) method of accounting. Under this method, sales and

gross profit are recognized as work is performed based on the relationship between actual costs incurred and total

estimated costs at the completion of the contract. Recognized revenues that will not be billed under the terms of the

contract until a later date are recorded in unbilled accounts receivable. Likewise, contracts where billings to date

have exceeded recognized revenues are recorded in other current liabilities. Changes to the original estimates may

be required during the life of the contract and such estimates are reviewed monthly. Sales and gross profit are

adjusted using the cumulative catch-up method for revisions in estimated total contract costs and contract values.

Estimated losses are recorded when identified. Claims against customers are recognized as revenue upon settlement.

The use of the POC method of accounting involves considerable use of estimates in determining revenues, costs and

profits and in assigning the amounts to accounting periods. The periodic reviews have not resulted in adjustments

that were significant to the Company’s results of operations. The Company continually evaluates all of the

assumptions, risks and uncertainties inherent with the application of the POC method of accounting.

The building efficiency business enters into extended warranties and long-term service and maintenance agreements

with certain customers. For these arrangements, revenue is recognized on a straight-line basis over the respective

contract term.

The Company’s building efficiency business also sells certain HVAC products and services in bundled

arrangements, where multiple products and/or services are involved. In accordance with ASC 605-25, ―Multiple-

Element Arrangements,‖ the Company divides bundled arrangements into separate deliverables and revenue is

allocated to each deliverable based on the relative fair value of all elements or the fair value of undelivered

elements.

In all other cases, the Company recognizes revenue at the time title passes to the customer or as services are

performed.

Goodwill and Other Intangible Assets

Goodwill reflects the cost of an acquisition in excess of the fair values assigned to identifiable net assets acquired.

The Company reviews goodwill for impairment during the fourth fiscal quarter or more frequently if events or

changes in circumstances indicate the asset might be impaired. The Company performs impairment reviews for its

reporting units, which have been determined to be the Company’s reportable segments, using a fair-value method

based on management’s judgments and assumptions or third party valuations. The fair value represents the amount

at which a reporting unit could be sold in a current transaction between willing parties on an arms-length basis. In

estimating the fair value, the Company uses multiples of earnings based on the average of historical, published

multiples of earnings of comparable entities with similar operations and economic characteristics. In certain

instances, the Company uses discounted cash flow analyses to further support the fair value estimates. The estimated

fair value is then compared with the carrying amount of the reporting unit, including recorded goodwill. The

Company is subject to financial statement risk to the extent that the carrying amount exceeds the estimated fair

value. The impairment testing performed by the Company in the fourth quarter of fiscal year 2010 indicated that the

estimated fair value of each reporting unit substantially exceeded its corresponding carrying amount including

recorded goodwill, and as such, no impairment existed at September 30, 2010. No reporting unit was determined to

be at risk of failing step one of the goodwill impairment test.

Indefinite lived other intangible assets are also subject to at least annual impairment testing. Other intangible assets

with definite lives continue to be amortized over their estimated useful lives and are subject to impairment testing if

events or changes in circumstances indicate that the asset might be impaired. A considerable amount of management