Johnson Controls 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

Johnson Controls, Inc.

Notes to Consolidated Financial Statements

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The consolidated financial statements include the accounts of Johnson Controls, Inc. and its domestic and non-U.S.

subsidiaries that are consolidated in conformity with accounting principles generally accepted in the United States of

America (U.S. GAAP). All significant intercompany transactions have been eliminated. Investments in partially-

owned affiliates are accounted for by the equity method when the Company’s interest exceeds 20% and the

Company does not have a controlling interest. The financial results for the year ended September 30, 2009 include

an out of period adjustment of $62 million made in the first and second quarters of fiscal 2009 to correct an error

related to the power solutions segment. The correction of the error, which reduces segment income, primarily

originated in fiscal 2007 and 2008 and resulted in the overstatement of inventory and understatement of cost of sales

in prior periods. The Company determined that the impact of the error on the originating periods was immaterial,

and accordingly a restatement of prior period amounts was not considered necessary. The Company also determined

the impact of correcting the error in fiscal 2009 was not material.

Under certain criteria as provided for in Financial Accounting Standards Board (FASB) Accounting Standards

Codification (ASC) 810, ―Consolidation,‖ the Company may consolidate a partially-owned affiliate when it has less

than a 50% ownership. In order to determine whether to consolidate a partially-owned affiliate when the Company

has less than a 50% ownership, the Company first determines if the entity is a variable interest entity (VIE). An

entity is considered to be a VIE if it has one of the following characteristics: 1) the entity is thinly capitalized; 2)

residual equity holders do not control the entity; 3) equity holders are shielded from economic losses or do not

participate fully in the entity’s residual economics; or 4) the entity was established with non-substantive voting. If

the entity meets one of these characteristics, the Company then determines if it is the primary beneficiary of the VIE.

The party exposed to the majority of the risks and rewards associated with the VIE is the VIE’s primary beneficiary

and must consolidate the entity.

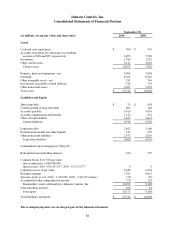

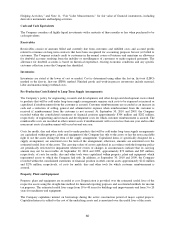

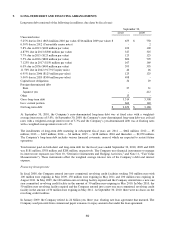

Based upon the criteria set forth in ASC 810, the Company has determined that for the reporting periods ended

September 30, 2010 and 2009 it was the primary beneficiary in two VIE’s in which it holds less than 50% ownership

as the Company funds the entities’ short-term liquidity needs. Both entities are consolidated within the automotive

experience North America segment. The Company did not have a significant variable interest in any unconsolidated

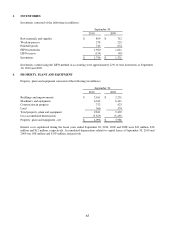

VIE’s for the presented reporting periods. The carrying amounts and classification of assets and liabilities included

in the Company’s consolidated statements of financial position for consolidated VIE’s are as follows (in millions):

September 30,

2010

2009

Current assets

$

215

$

146

Noncurrent assets

69

101

Total assets

$

284

$

247

Current liabilities

$

174

$

103

Noncurrent liabilities

-

-

Total liabilities

$

174

$

103

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent

assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments

The fair values of cash and cash equivalents, accounts receivable, short-term debt and accounts payable approximate

their carrying values. The fair value of long-term debt, which was $3.7 billion and $3.4 billion at September 30,

2010 and 2009, respectively, was determined using market quotes. See Note 10, ―Derivative Instruments and