Johnson Controls 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

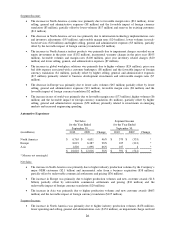

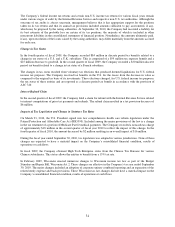

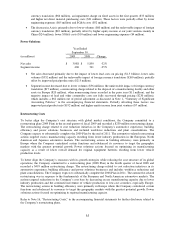

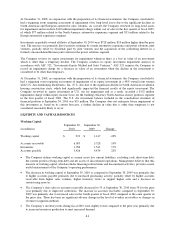

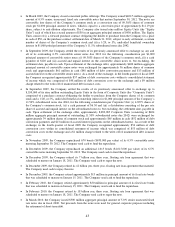

Net Financing Charges

Year Ended

September 30,

(in millions)

2009

2008

Change

Net financing charges

$

239

$

258

-7%

Net financing charges decreased primarily due to lower interest rates during fiscal 2009 partially offset by

higher debt levels.

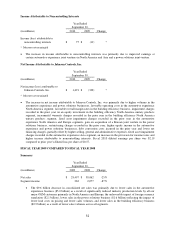

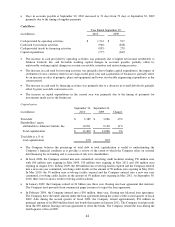

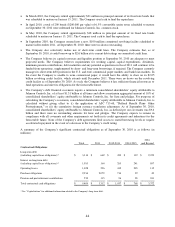

Provision for Income Taxes

The Company’s base effective income tax rate for continuing operations for fiscal years 2009 and 2008 was 22.7%

and 21.0%, respectively (prior to certain discrete period items as outlined below).

The Company’s effective tax rate for fiscal 2009 was greater than the base effective tax rate due in part to various

items during the year as discussed in detail below.

The Company’s effective tax rate for fiscal 2008 increased over the base effective tax rate due to the fourth quarter

restructuring charge, which was recorded using a blended statutory rate of 12.4% resulting in a $43 million discrete

period tax adjustment.

Restructuring Charge

In the second quarter of fiscal 2009, the Company recorded a $27 million discrete period tax adjustment related to

the second quarter 2009 restructuring costs using a blended effective tax rate of 19.2%. Due to the change in the

base effective tax rate in fiscal 2009, the discrete period tax adjustment decreased by $19 million for a total tax

adjustment of $8 million.

In the fourth quarter of fiscal 2008, the Company recorded a $43 million discrete period tax adjustment related to the

fourth quarter 2008 restructuring charge using a blended effective tax rate of 12.4%.

Impairment Charges

In the first quarter of fiscal 2009, the Company recorded a $30 million discrete period tax adjustment related to first

quarter 2009 impairment costs using a blended statutory tax rate of 12.6%. Due to the change in the base effective

tax rate in fiscal 2009, the discrete period tax adjustment decreased by $4 million for a total tax adjustment of $26

million.

Debt Conversion Costs

In the fourth quarter of fiscal 2009, the Company recorded a $15 million discrete period tax benefit related to debt

conversion costs using an effective tax rate of 36.5%.

Valuation Allowances

The Company reviews its deferred tax asset valuation allowances on a quarterly basis, or whenever events or

changes in circumstances indicate that a review is required. In determining the requirement for a valuation

allowance, the historical and projected financial results of the legal entity or consolidated group recording the net

deferred tax asset is considered, along with any other positive or negative evidence. Since future financial results

may differ from previous estimates, periodic adjustments to the Company's valuation allowances may be necessary.

In fiscal 2009, the Company recorded an overall increase to its valuation allowances by $245 million. This was

comprised of a $252 million increase in income tax expense with the remaining amount impacting the consolidated

statement of financial position.

In the third quarter of fiscal 2009, the Company determined that it was more likely than not that a portion of the

deferred tax assets in Brazil would be utilized. Therefore, the Company released $10 million of valuation