HSBC 2001 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.71

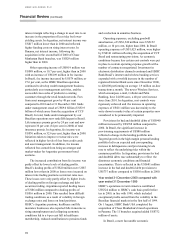

background in 2000, coupled with the focus on

delivering HSBC’s Global Strategic goals in Brazil,

resulted in a strong performance in 2000. Brazilian

operations (excluding Banco CCF Brasil S.A.)

contributed US$206 million to pre-tax profits in

2000. Second half pre-tax profits of US$84 million

were US$38 million lower than the first half

reflecting higher credit costs and restructuring

charges of US$17 million incurred to achieve further

operational efficiencies and to integrate Banco CCF

Brazil.

The economic environment in the second half of

2000 was characterised by concerns over the

Argentinian economy and a greater perceived

likelihood of a sharp US slowdown. Despite

volatility in the Brazilian foreign exchange and

interest rate markets, Brazil’s economic

fundamentals remained steady with GDP growth of 4

per cent and inflation at 5.97 per cent, in line with

the Government's target for 2000, and an

improvement on 8.64 per cent inflation in 1999. The

improved economic environment allowed interest

rates to fall by nearly 300 basis points from

December 1999.

HSBC’s strategy of embracing internet

technology in the delivery of its services has

developed rapidly in Brazil. HSBC Brasil has offered

internet banking since 1998 to its personal and small

business customers and has 200,000 registered users.

As of November 2000, internet based services were

extended to include WAP access through Brazil’ s

cellular phone network.

In Argentina, a negative economic environment,

exacerbated by higher oil prices and US economic

uncertainty, produced an increase in the Argentine

risk premium of up to 10 per cent. Since the end of

the year, the spread on Argentinian government paper

has fallen by 90 basis points.

Although GDP growth for the year ended 31

December 2000 improved markedly over 1999, when

it fell by 4 per cent, it was still negative and thus

adversely impeded opportunities for growth.

Nevertheless, the bank in Argentina continued to

follow its strategy of creating an integrated financial

services group and, despite the economic recession,

HSBC’s Argentinian operations achieved pre-tax

profits of US$107 million compared to US$67

million in 1999.

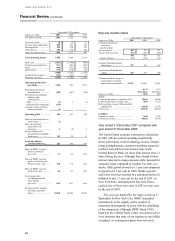

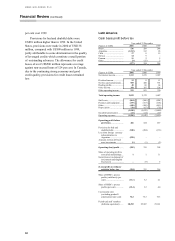

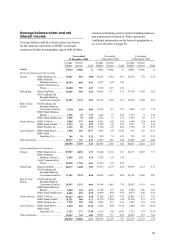

Net interest income in Latin America at

US$1,219 million in 2000 was US$122 million

higher than in 1999 with the largest increases in

Brazil and Argentina, together with smaller increases

due to the Panama acquisition and the former RNYC

operations in Mexico and Uruguay. In Brazil, net

interest income was US$886 million, 5 per cent

higher than in 1999. This reflected a 20 per cent

increase in average interest-earning assets with

robust growth achieved in interest-earning

commercial and retail assets, particularly in the areas

of consumer credit and corporate working capital

loans. There was a decline in the net interest margin

of 168 basis points principally due to lower interest

rates. In Argentina, net interest income was US$262

million, US$16 million higher than 1999, principally

as a result of higher volumes of investment securities

than in 1999. The economic uncertainty had an

impact on both the volume of the lending portfolio

and overall rates. The funding base continued to

grow, but this growth was largely deployed in liquid

assets causing spreads to drop from 5.54 per cent to

4.95 per cent because of a more liquid asset mix and

increased borrowing rates.

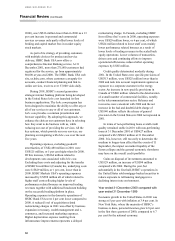

Other operating income was US$163 million

higher than 1999 with Argentina contributing US$77

million and Brazil US$53 million to the increase. In

Argentina, initiatives taken to improve both the

volume and quality of the earnings stream included

cross selling marketing campaigns, the launch of an

incentives and rewards programme and a drive to

improve service quality, in particular for

bancassurance and HSBC Premier clients. Actions

taken in prior years to curtail unprofitable motor

portfolios and increase the use of scoring in sales of

new products helped La Buenos Aires, the general

insurance business, to achieve an improved

underwriting profit of US$2.4 million despite weak

market conditions. An improved result was also

reported in the life assurance and annuity business.

Total funds under management grew by some 39 per

cent from 1999 to 2000, from US$3.1 billion to

US$4.3 billion, principally within the pension plan

administrator, Maxima. Mutual funds also grew and,

despite the economic recession, market share

improved from 5.9 per cent to 6.1 per cent reaching

fifth position in the rankings.

Brazilian operations continued to develop their

wealth management business, in the form of

insurance and asset management products, and

growing commercial and retail business. Asset

Management operations in Brazil also continued to

expand as a result of organic growth and the addition