HSBC 2001 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

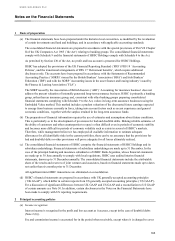

Notes on the Financial Statements (continued)

172

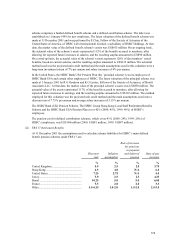

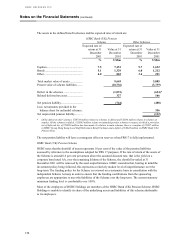

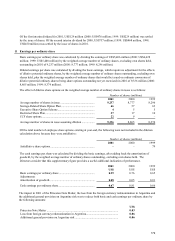

The average number of persons employed by HSBC during the year was made up as follows:

2001 2000 1999

Number Number Number

Europe.................................................................................... 77,435 68,208 58,164

Hong Kong............................................................................. 25,081 24,446 24,391

Rest of Asia-Pacific ............................................................... 25,142 22,020 20,936

North America ....................................................................... 20,363 20,737 16,070

Latin America ........................................................................ 28,661 27,217 27,336

176,682 162,628 146,897

(b) Retirement benefits

HSBC has continued to account for pensions in accordance with Statement of Standard Accounting Practice

(‘SSAP’ ) 24 ‘Accounting for pension costs’ and the disclosures given in (i) are those required by that standard.

FRS 17 ‘Retirement benefits’ was issued in November 2000 but will not be mandatory for HSBC until the year

ended 31 December 2003. Prior to this, phased transitional disclosures are required from 31 December 2001.

These disclosures, to the extent not given in (i), are set out in (ii).

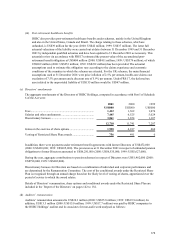

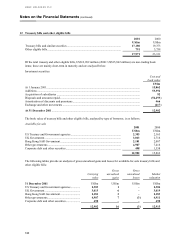

(i) HSBC Pension Schemes

HSBC operates some 144 pension schemes throughout the world, covering 92% of HSBC’ s employees,

with a total pension cost (including healthcare benefits) of US$611 million (2000: US$464 million; 1999:

US$492 million;), of which US$371 million (2000: US$235 million; 1999: US$223 million) relates to

overseas schemes. Of the overseas schemes, US$48 million (2000: US$49 million; 1999:US$25 million)

has been determined in accordance with best practice and regulations in the United States and Canada.

The majority of the schemes are funded defined benefit schemes, which cover 51% of HSBC’ s

employees, with assets, in the case of most of the larger schemes, held in trust or similar funds separate

from HSBC. The pension cost relating to these schemes was US$428 million (2000: US$341 million;

1999: US$368 million) which is assessed in accordance with the advice of qualified actuaries. The

schemes are reviewed at least on a triennial basis or in accordance with local practice and regulations. The

actuarial assumptions used to calculate the projected benefit obligations of HSBC’ s pension schemes vary

according to the economic conditions of the countries in which they are situated.

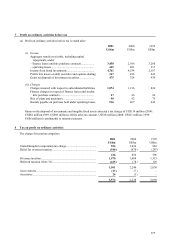

In the United Kingdom, the HSBC Bank (UK) Pension Scheme covers employees of HSBC Bank plc and

certain other employees of HSBC. This scheme comprises a funded defined benefit scheme (‘the principal

scheme’ ) and a defined contribution scheme which was established on 1 July 1996 for new employees.

The latest valuation of the principal scheme was made at 31 December 1999 by C G Singer, Fellow of the

Institute of Actuaries, of Watson Wyatt Partners. At that date, the market value of the principal scheme’ s

assets was US$10,888 million. The actuarial value of the assets represented 104% of the benefits accrued

to members, after allowing for expected future increases in earnings, and the resulting surplus amounted

to US$346 million. The method adopted for this valuation was the projected unit method and the main

assumptions used were a long-term investment return of 6.85% per annum, salary increases of 4.0% per

annum, equity dividend increases and rental growth of 3.5% per annum, and post-retirement pension

increases of 2.5% per annum.

In consultation with the actuary, the surplus has been used to reduce the employers’ long-term

contribution rate of 19.9% to 16.9% of pensionable salaries (1999: 16.1%). This is based on spreading the

surplus over the expected future working lifetime of current members (13 years). However, in view of the

volatility experienced in investment markets, HSBC is reviewing its funding plan in consultation with the

independent Scheme Actuary. The next actuarial valuation is due as at 31 December 2002.

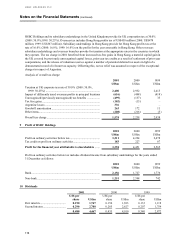

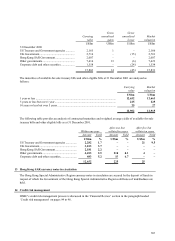

In Hong Kong, the HSBC Group Hong Kong Local Staff Retirement Benefit Scheme covers employees of

The Hongkong and Shanghai Banking Corporation Limited and certain other employees of HSBC. The