HSBC 2001 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

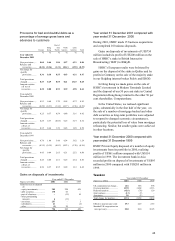

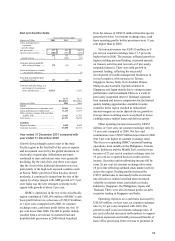

Bad and doubtful debts

Year ended 31 December

Figures in US$m 2001 2000 1999

Loans and advances to

customers

– specific charge

new provisions ..................... 449 454 720

releases and recoveries ......... (243 ) (207) (101)

206 247 619

–

general (release)/charge ..... (9) 1 (34)

Customer bad and doubtful

debt charge ...................... 197 248 585

Total bad and doubtful debt

charge .............................. 197 248 585

Customer bad debt charge as

a percentage of closing

gross loans and advances . 0.29% 0.37% 0.90%

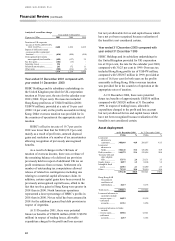

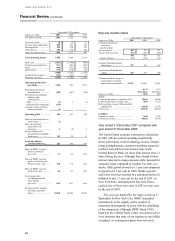

Figures in US$m

At 31

December

2001

At 31

Decembe

r

2000

Assets

Loans and advances to customers (net)... 67,359 64,369

Loans and advances to banks (net) ......... 42,516 57,154

Debt securities, treasury bills and other

eligible bills ...................................... 49,625 38,913

Total assets (excluding Hong Kong

SAR Government certificates of

indebtedness)..................................... 175,652 176,545

Liabilities

Deposits by banks................................... 3,271 2,220

Customer accounts ................................. 146,544 146,394

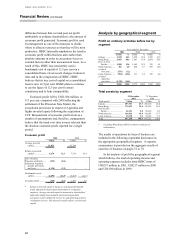

Year ended 31 December 2001 compared with

year ended 31 December 2000

Despite large interest rate cuts, the Hong Kong

economy contracted through most of 2001 as

consumer spending was hit by rising unemployment

and a weak property market. The ongoing deflation

kept demand for consumption and investment loans

weak.

Hong Kong’s operations contributed US$3,883

million to HSBC’s cash basis profit before tax, an

increase of US$191 million, or 5 per cent, compared

with 2000, and represented 48.5 per cent of HSBC’s

cash basis profit before tax.

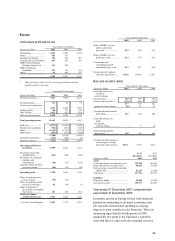

Net interest income increased by US$168

million, or 4 per cent, to US$4,165 million in 2001,

primarily reflecting a switch from interbank lending

to corporate bonds, the placement of increased

average customer deposits in debt securities and

increased spreads on treasury activities. In addition,

successful marketing campaigns to target growth in

credit card loans and wider spreads on foreign

currency customer deposits also contributed to the

increase in net interest income. This was partly offset

by reduced spreads on residential mortgages and

Hong Kong dollar deposits and subdued corporate

loan demand. The combination of increased market

liquidity and shortage of quality lending

opportunities reduced margins earned on corporate

loans.

Driven by continued growth in average customer

deposits, average interest-earning assets in Hong

Kong increased by 6 per cent. However with little

demand for new lending, these deposits together with

the switch from interbank lending, funded a

significant increase in debt securities. Despite intense

mortgage price competition and subdued demand for

corporate loans, there was a small increase in

average customer loans principally credit card

advances, term lending and residential mortgages.

The success of focused marketing initiatives was

reflected in an increase of over 23 per cent in average

credit card advances, with the number of credit cards

now in issue increasing from 2.5 million to some 2.7

million at 31 December 2001.

For The Hongkong and Shanghai Banking

Corporation in Hong Kong the net interest margin at

2.48 per cent (one basis point higher) was largely

unchanged from 2000. Spread improved by 18 basis

points mainly due to a combination of reduced

funding costs on treasury activities, increased higher-

yielding credit card balances and widening of

spreads on foreign currency deposits. In addition, a

reduction in the level of suspended interest, net of

releases and recoveries, accounted for six basis

points of the improvement in spread. This was partly

offset by reduced spreads on Hong Kong dollar

savings and time deposits and residential mortgage

loans. The contribution from net free funds fell by 17

basis points due to lower average interest rates

during the year.

In Hang Seng Bank, the net interest margin

decreased to 2.56 per cent, 12 basis points lower than

2000. Spread improved by nine basis points mainly

due to the benefits of a higher spread on increased

holdings of fixed rate investment securities, growth

in lower-cost customer deposits and a wider gap

between the Hong Kong best lending rate (‘BLR’ )

and interbank rates. These positive effects were

partly offset by a further decline in mortgage yields

and reduced spreads on term deposits. The

contribution from net free funds fell by 21 basis

points due to lower average interest rates during the

year.