HSBC 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

54

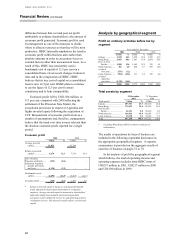

particularly in relation to new delivery channels. As a

result of business growth, HSBC Bank plc employed

3 per cent more staff on average during 2000. Non-

staff costs increased by US$130 million, or 9 per

cent. They were incurred primarily to support

business development, including internet banking

initiatives and continued branch services

improvement. Increased business volumes also

contributed to higher expenditure, including IT

processing capacity. Increased marketing costs

included higher card loyalty scheme costs.

Operating expenses also increased in Investment

Banking, where profit-related remuneration reflected

the improved performance, and in Offshore Banking,

which reflected increased staff numbers in support of

expansion. These increases were partly offset by a

US$255 million, or 5 per cent, reduction in Treasury

and Capital Markets due to improved operating

efficiencies in the front and back offices.

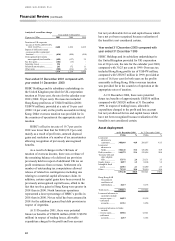

The charge for bad and doubtful debts was

US$62 million lower than 1999 at US$348 million.

In UK Banking, the charge for bad and doubtful

debts was US$397 million, US$73 million, or 16 per

cent, lower than in 1999. There was a reduction of

US$129 million in new provisions, with lower

provisioning against corporate lending, mainly due to

a small number of large provisions in 1999.

Provisions were also lower against card balances and

in First Direct. General provisions increased by

US$42 million due to balance sheet growth. The

credit environment remains satisfactory, but a small

number of business and personal customers continue

to face difficulties from market pressures and

unforeseen changes in financial circumstances.

Provisions for contingent liabilities were US$37

million lower at US$67 million partly due to a lower

charge in UK Banking for the amount of redress

potentially payable to customers who may have been

disadvantaged when transferring from or opting out

of occupational pensions schemes.

The US$47 million share of operating losses in

joint ventures principally reflects start-up costs of the

new joint venture with Merrill Lynch to establish an

online, investment led, broking and banking service

for the mass affluent.

The net US$49 million share of operating losses

in associated undertakings include losses of US$76

million reflecting HSBC Bank plc’s 20 per cent

shareholding in British Interactive Broadcasting

(‘BiB’ ) and the associated investment in building its

digital interactive television services, ‘Open....’ . In

July 2000, HSBC Bank plc agreed to sell its

investment in BiB to BSkyB.

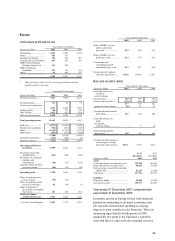

Hong Kong

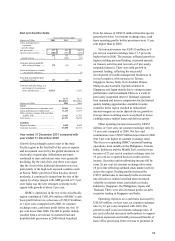

Year ended 31 December

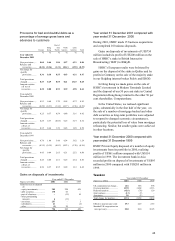

Figures in US$m 2001 2000 1999

Net interest income............... 4,165 3,997 3,735

Dividend income .................. 26 34 39

Net fees and commissions..... 1,172 1,168 964

Dealing profits...................... 218 229 211

Other income ........................ 436 359 338

Other operating income ........ 1,852 1,790 1,552

Total operating income....... 6,017 5,787 5,287

Staff costs............................. (1,279 ) (1,166) (1,145)

Premises and equipmen

t

....... (234) (218) (262 )

Othe

r

.................................... (428) (412) (299 )

Depreciatio

n

......................... (199) (190) (190 )

(2,140) (1,986 ) (1,896)

Goodwill amortisatio

n

..........

–

(1)

–

Operating expenses............... (2,140) (1,987 ) (1,896)

Operating profit before

provisions........................ 3,877 3,800 3,391

Provisions for bad and

doubtful debts .................. (197 ) (248) (585)

Provisions for

contingent liabilities and

commitments ................... 6(10) 2

Amounts written off fixed

asset investments ............. (18 ) (9 ) (5)

Operating profit.................. 3,668 3,533 2,803

Share of operating profit in

associated undertakings.... 17 21 15

Gains on disposal of

investments and tangible

fixed assets ...................... 198 137 236

Profit on ordinary

activities before ta

x

........ 3,883 3,691 3,054

Share of HSBC’ s pre-tax

profits (cash basis)

(per cent).......................... 44.1 35.9 38.1

Share of HSBC’ s pre-tax

p

rofits (per cent) .............. 48.5 37.8 38.3

Cost:income ratio

(excluding goodwill

amortisation)

(per cent).......................... 35.6 34.3 35.9

Period-end staff numbers

(full-time equivalent) ....... 24,654 24,204 23,932