HSBC 2001 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

218

HSBC HSBC

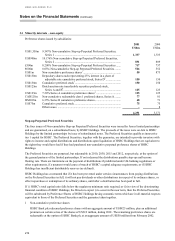

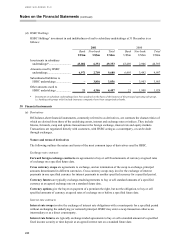

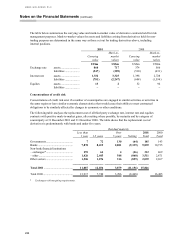

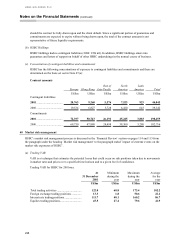

Holdings Associates

US$m US$m US$m

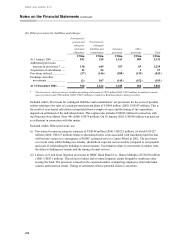

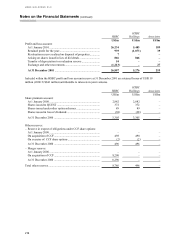

Revaluation reserves:

– Investment property revaluation reserve:

At 1 January 1999 ..................................................................... 328 – 48

Unrealised deficit on revaluation of land and buildings............ (46) – (1)

Transfer to revaluation reserve.................................................. (6) – –

Realisation on disposal of properties......................................... (1) – –

Exchange and other movements................................................ (2) – (1)

At 31 December 1999 ............................................................... 273 – 46

– Revaluation reserve:

At 1 January 1999 ..................................................................... 1,792 19,566 8

Realisation on disposal of properties......................................... (7) – –

Unrealised surplus on revaluation of properties ........................ 371 2 –

Transfer arising on redenomination of share capital ................. – (271) –

Transfer to profit and loss account reserve on disposal of

subsidiary undertakings ......................................................... – (51) –

Transfer of depreciation from profit and loss account reserve (22) – –

Transfer from investment property revaluation reserve............. 6 – –

Net increase in attributable net assets of subsidiary

undertakings........................................................................... – 2,588 –

Exchange and other movements................................................ (71) 40 (3)

At 31 December 1999 ............................................................... 2,069 21,874 5

Total revaluation reserves ............................................................. 2,342 21,874 51

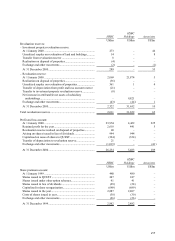

Profit and loss account:

At 1 January 1999 ..................................................................... 21,359 3,913 247

Retained profit/(deficit) for the year.......................................... 2,536 (307) 123

Transfer arising on redenomination of share capital ................. – 271 –

Transfer from revaluation reserve on disposal of subsidiary

undertakings........................................................................... – 51 –

Transfer of depreciation to revaluation reserve ......................... 22 – –

Revaluation reserve realised on disposal of properties.............. 8 – –

Arising on shares issued in lieu of dividends ............................ 679 679 –

Capitalised on issue of shares to QUEST.................................. (185) (185) –

Exchange and other movements................................................ (465) – (145)

At 31 December 1999 ............................................................... 23,954 4,422 225

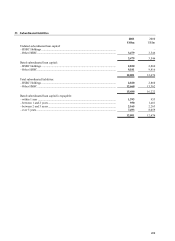

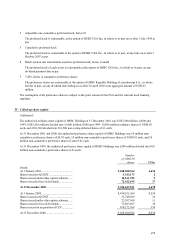

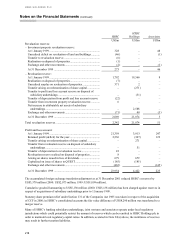

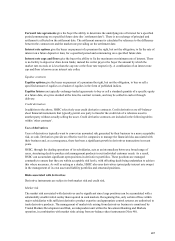

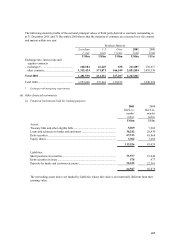

The accumulated foreign exchange translation adjustment as at 31 December 2001 reduced HSBC’ s reserves by

US$3,370 million (2000: US$2,073 million; 1999: US$1,009 million).

Cumulative goodwill amounting to US$5,138 million (2000: US$5,138 million) has been charged against reserves in

respect of acquisitions of subsidiary undertakings prior to 1 January 1998.

Statutory share premium relief under Section 131 of the Companies Act 1985 was taken in respect of the acquisition

of CCF in 2000; in HSBC’ s consolidated accounts the fair value difference of US$8,290 million was transferred to a

merger reserve.

Many of HSBC’ s banking subsidiary undertakings, joint ventures and associates operate under local regulatory

jurisdictions which could potentially restrict the amount of reserves which can be remitted to HSBC Holdings plc in

order to maintain local regulatory capital ratios. In addition, as stated in Note 32(a) above, the remittance of reserves

may result in further taxation liabilities.