HSBC 2001 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

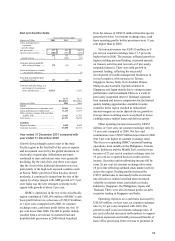

in the number of credit cards in issue) following

successful promotional campaigns. As a consequence

the net interest margin improved by 5 basis points to

2.76 per cent. Spread widened by 17 basis points

mainly due to the impact of higher yielding

residential mortgage and credit card loans and lower

cost of funds in a falling interest rate environment.

The contribution from net free funds fell by 12 basis

points reflecting lower interest rates and a reduced

volume of interest free account balances as foreign

investors repatriated surplus funds.

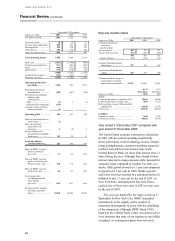

Other operating income of US$91 million was

US$7 million higher than in 2000. The continuing

focus on expanding HSBC’s personal banking

operations generated a 15 per cent increase in credit

card fee income to US$26 million. Higher profits

from bond trading and higher volumes of foreign

exchange transactions resulted in a 13 per cent

increase in dealing profits to US$34 million.

Operating expenses at US$134 million were US$15

million higher than 2000.

Operating expenses, other than staff costs

increased by 31 per cent mainly due to an increase in

marketing initiatives to support strategic

repositioning to focus more on Personal Financial

Services.

Provisions for bad and doubtful debts decreased

by US$26 million to US$7 million. Non-performing

customer loans have decreased by US$126 million or

18 per cent since 31 December 2000 as a result of a

combination of credit upgrades following loan

restructurings, recoveries and write-offs.

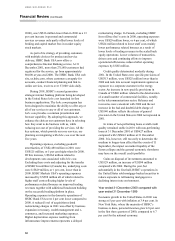

The Middle Eastern operations of HSBC Bank

Middle East benefited from the expansion of fee

income from personal banking business and a lower

charge for bad and doubtful debt provisions. Cash

basis pre-tax profits were US$40 million, 23 per cent

higher than in 2000.

Net interest income was in line with 2000 as the

benefit of increased levels of average interest-earning

assets offset a fall in net interest margin. Intense

competition for the limited quality lending

opportunities resulted in a fall in average customer

advances as scheduled repayments were received. As

a result growth in average interest-earning assets of

US$301 million or 4 per cent, was deposit-driven

and was placed in lower-yielding money market

loans. The 12 basis point fall in net interest margin to

3.84 per cent reflected the more liquid balance sheet

and a lower contribution from net free funds in the

falling interest rate environment.

Anticipating the pressure on lending income

growth HSBC Bank Middle East focused marketing

activity on fee based products generating net fee

income US$15 million, or 19 per cent, higher than

2000 as a result of growth in personal banking

products. This was the major contributor to growth in

other operating income of US$20 million, or 17 per

cent higher than in 2000. HSBC’s financial planning

management service (which provides savings,

retirement, education and protection planning

services in six countries in the region) contributed

US$10 million of net fees in its first full year of

operations, an increase of US$7 million. Credit card

fee income increased by US$3 million, or 15 per

cent, following fresh promotion of credit card

products, backed by the launch of a new loyalty

programme and a virtual card which facilitates

secure financial internet transactions. The number of

credit cards in issue increased by 25 per cent and

average outstanding credit card advances were 18 per

cent higher. Funds sold to customers rose by 51 per

cent to US$272 million compared with 2000. A

wider range of trade, cash management and

institutional products also contributed to the increase

in other operating income.

The expansion of the personal banking sales

teams and the related strengthening of the credit

function across the region drove staff costs higher

and was the principal contributor to operating

expenses being US$19 million, or 11 per cent, higher

than in 2000. Investment in new products (including

the card loyalty programme), costs associated with

centralisation of regional back office processes in

Dubai and investment in internet service capabilities

also contributed to increased operating expenses. The

bank’s new internet service was soft launched in the

United Arab Emirates in November 2001and a full

regional launch to customers is planned for the

second half of 2002.

The individually significant bad debt provisions

which burdened HSBC Bank Middle East in 2000

were not repeated and as a result the charge for bad

and doubtful debt provisions was 30 per cent lower.

This also reflected an increased level of recoveries

following investment in strengthening the credit

systems and collection processes.

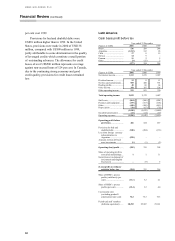

Elsewhere, HSBC operations in Korea and

Thailand each contributed in excess of US$50

million to pre-tax profits and HSBC’s operations in