HSBC 2001 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

212

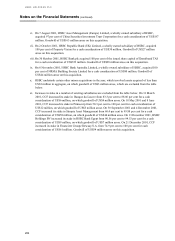

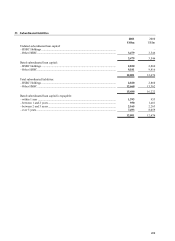

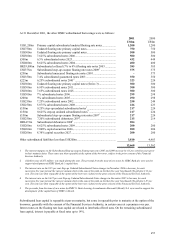

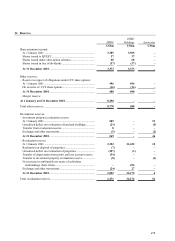

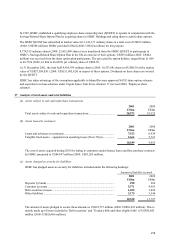

34 Minority interests – non-equity

Preference shares issued by subsidiaries:

2001 2000

US$m US$m

US$1,350m 9.547% Non-cumulative Step-up Perpetual Preferred Securities,

Series 1 ........................................................................................... 1,337 1,335

US$900m 10.176% Non-cumulative Step-up Perpetual Preferred Securities,

Series 2 ........................................................................................... 891 889

£500m 8.208% Non-cumulative Step-up Perpetual Preferred Securities ....... 717 737

€600m 8.03% Non-cumulative Step-up Perpetual Preferred Securities......... 526 552

US$1m Non-cumulative preference shares1.................................................... 50 873

US$150m Depositary shares each representing 25% interest in a share of

adjustable rate cumulative preferred stock, Series D2..................... 150 150

US$150m Cumulative preferred stock3............................................................... 150 150

US$125m Dutch auction rate transferable securities preferred stock,

Series A and B4............................................................................... 125 125

US$125m 7.20% Series A cumulative preference shares5.................................. 125 125

CAD125m Non-cumulative redeemable class 1 preferred shares, Series A......... 77 81

DM105m 6.35% Series B cumulative preference shares.................................... 68 71

US$75m Cumulative preferred stock ................................................................ 75 75

Other issues .......................................................................................

–

8

4,291 5,171

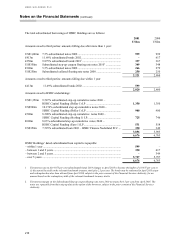

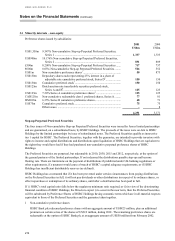

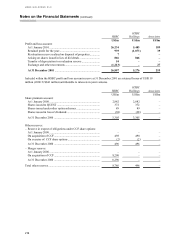

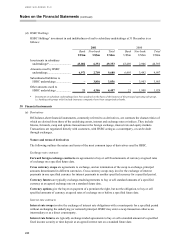

Step-up Perpetual Preferred Securities

The four issues of Non-cumulative Step-up Perpetual Preferred Securities were issued by Jersey limited partnerships

and are guaranteed, on a subordinated basis, by HSBC Holdings. The proceeds of the issue were on-lent to HSBC

Holdings by the limited partnerships by issue of subordinated notes. The Preferred Securities qualify as innovative

tier 1 capital for HSBC. The Preferred Securities, together with the guarantee, are intended to provide investors with

rights to income and capital distributions and distributions upon liquidation of HSBC Holdings that are equivalent to

the rights they would have had if they had purchased non-cumulative perpetual preference shares of HSBC

Holdings.

The Preferred Securities are perpetual, but redeemable in 2010, 2030, 2015 and 2012, respectively, at the option of

the general partners of the limited partnerships. If not redeemed the distributions payable step-up and become

floating rate. There are limitations on the payment of distributions if prohibited under UK banking regulations or

other requirements, if a payment would cause a breach of HSBC’ s capital adequacy requirements, or if HSBC

Holdings has insufficient distributable reserves (as defined).

HSBC Holdings has covenanted that if it has been prevented under certain circumstances from paying distributions

on the Preferred Securities in full, it will not pay dividends or other distributions in respect of its ordinary shares, or

effect repurchase or redemption of its ordinary shares, until after a distribution has been paid in full.

If i) HSBC’ s total capital ratio falls below the regulatory minimum ratio required, or ii) in view of the deteriorating

financial condition of HSBC Holdings, the Directors expect i) to occur in the near term, then the Preferred Securities

will be substituted by Preference Shares of HSBC Holdings having economic terms which are in all material respects

equivalent to those of the Preferred Securities and the guarantee taken together.

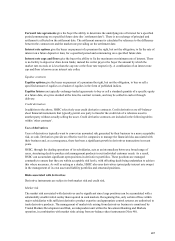

1 Non-cumulative preference shares

HSBC Bank plc redeemed preference shares with an aggregate amount of US$825 million, plus an additional

premium on certain series of the shares of US$19 million, during 2001. The remaining preference shares are

redeemable at the option of HSBC Bank plc at an aggregate amount of US$50 million from February 2002.