HSBC 2001 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

64

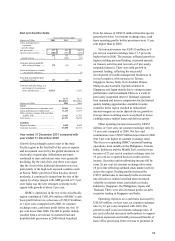

Year ended 31 December

Figures in US$m 2001 2000 1999

Net interest income ............... 2,402 2,152 1,687

Dividend income................... 29 68 12

Net fees and commissions ..... 898 853 593

Dealing profits ...................... 324 218 181

Other income ........................ 205 178 163

Other operating income......... 1,456 1,317 949

Total operating income 3,858 3,469 2,636

Staff costs ............................. (1,412 ) (1,390 ) (884)

Premises and equipmen

t

........ (317) (307) (247 )

Othe

r

.................................... (640) (552) (382 )

Depreciatio

n

.......................... (119) (114) (69 )

(2,488) (2,363 ) (1,582)

Goodwill amortisatio

n

........... (142) (143) (3 )

Operating expenses ............... (2,630) (2,506 ) (1,585)

Operating profit before

provisions ........................ 1,228 963 1,051

Provisions for bad and

doubtful debts................... (287) (147) (108)

Provisions for contingent

liabilities and

commitments....................

–

othe

r

................................... (7) 1(1)

–

Princeton Note settlement . (575 )

–

–

Amounts written off fixed

asset investments.............. (5 )

–

–

Operating profit .................. 354 817 942

Share of operating losses in

joint venture ..................... (7 )

–

–

Share of operating

profit/(losses) in

associates ......................... 5(2) 4

Gains on disposal of

investments and tangible

fixed assets....................... 129 35 13

Profit on ordinary

activities before ta

x

......... 481 850 959

Share of HSBC’ s pre-tax

profits (cash basis)

(per cent).......................... 7.1 9.6 12.0

Share of HSBC’ s pre-tax

profits (cash basis excl.

Princeton) (per cent) ........ 13.8 9.6 12.0

Share of HSBC’ s pre-tax

p

rofits (per cent)............... 6.0 8.7 12.0

Cost:income ratio

(excluding goodwill

amortisation)

(per cent).......................... 64.5 68.1 60.0

Period-end staff numbers

(full-time equivalent

b

asis)................................ 18,518 18,965 19,498

Bad and doubtful debts

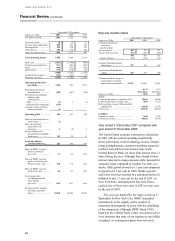

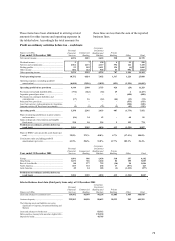

Year ended 31 December

Figures in US$m 2001 2000 1999

Loans and advances to

customers

– specific charge

new provisions...................... 402 387 231

releases and recoveries ......... (98) (102) (100 )

304 285 131

–

general (release)................. (17 ) (138) (23)

Customer bad and doubtful

debt charge....................... 287 147 108

Total bad and doubtful debt

charge .............................. 287 147 108

Customer bad debt charge as

a percentage of closing

gross loans and advances 0.39% 0.24% 0.20%

Figures in US$m

At 31

December

2001

At 31

Decembe

r

2000

Assets

Loans and advances to customers (net)... 72,064 60,835

Loans and advances to banks (net).......... 7,864 9,279

Debt securities, treasury bills and other

eligible bills ....................................... 45,200 36,770

Total assets............................................. 136,526 118,053

Liabilities

Deposits by banks................................... 7,602 7,221

Customer accounts.................................. 80,022 68,389

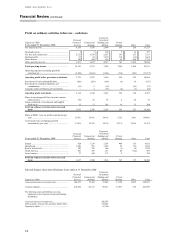

Year ended 31 December 2001 compared with

year ended 31 December 2000

The United States economy continued to deteriorate

in 2001 with investment spending significantly

down, particularly in the technology sectors. Despite

rising unemployment, consumer spending remained

resilient, boosted by lower interest rates as the

Federal Reserve Bank cut short-term interest rates 11

times during the year. Although these sharply lower

interest rates led to rising consumer debt, demand for

corporate loans continued to weaken. For 2001 as a

whole, GDP growth slowed to 1.1 per cent compared

to growth of 4.1 per cent in 2000. Weaker growth

and lower oil prices resulted in a sustained decline in

inflation to just 1.5 per cent by the end of 2001. In

New York State, unemployment has risen from a

cyclical low of 4 per cent early in 2001 to 6 per cent

by the end of 2001.

The year was marked by the tragic events on 11

September. In New York City, HSBC responded

immediately to the tragedy with a number of

donations and programs to assist with the rebuilding

of the community. Although HSBC Bank USA’s

branch at Five World Trade Center was destroyed we

were fortunate that none of our employees was killed

or injured. As contingency plans were activated,