HSBC 2001 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

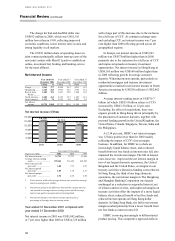

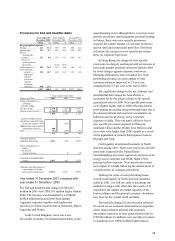

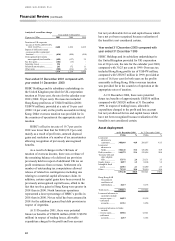

Provisions for bad and doubtful debts as a

percentage of average gross loans and

advances to customers

Europe

Hong

Kong

Rest o

f

Asia

Pacific

North

America

Latin

America Total

%% % % %%

Year ended 31

December 2001

New provisions...... 0.60 0.66 1.86 0.57 6.21 0.86

Releases and

recoveries ......... (0.24 ) (0.36 ) (1.31 ) (0.14 ) (1.90 ) (0.39 )

Net charge for

specific

p

rovisions ......... 0.36 0.30 0.55 0.43 4.31 0.47

Total provisions

charge

d

................. 0.33 0.29 0.55 0.41 13.25 0.65

Amounts written

off net of

recoveries ........... 0.28 0.88 0.93 0.39 4.98 0.61

Year ended 31

December 2000

New provisions...... 0.53 0.68 1.70 0.65 4.72 0.81

Releases and

recoveries ......... (0.28) (0.31) (1.16) (0.17 ) (1.56 ) (0.39)

Net charge for

specific

p

rovisions ......... 0.25 0.37 0.54 0.48 3.16 0.42

Total provisions

charge

d

................. 0.28 0.37 (0.05) 0.25 3.19 0.32

Amounts written

off net of

recoveries ........... 0.35 0.64 1.39 0.45 1.28 0.58

Year ended 31

December 1999

New provisions...... 0.78 1.09 3.48 0.54 3.82 1.24

Releases and

recoveries ......... (0.35) (0.15) (0.83) (0.23 ) (1.30 ) (0.36)

Net charge for

specific

p

rovisions ......... 0.43 0.94 2.65 0.31 2.52 0.88

Total provisions

charge

d

................. 0.45 0.88 2.61 0.25 2.64 0.86

Amounts written

off net of

recoveries ........... 0.30 0.37 0.95 0.28 1.33 0.42

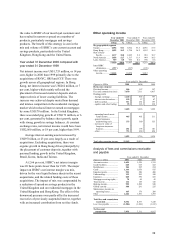

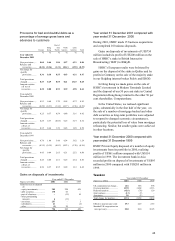

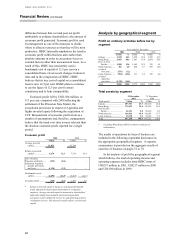

Gains on disposals of investments

Year ended 31 December

Figures in US$m 2001 2000 1999

Gains/(losses) on disposal

of:

–

equity investments............. 305 228 439

–

debt securities.................... 170 66

–

–

part of a business ...............

–

(11) 10

– other participating

interests ........................... 4(11)

–

–

associates........................... 257

–

3

–

subsidiaries........................ 21

–

(2)

–

othe

r

.................................. (3) 30

–

754 302 450

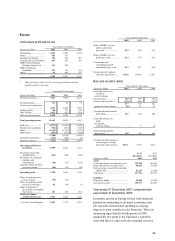

Year ended 31 December 2001 compared with

year ended 31 December 2000

During 2001, HSBC made 15 business acquisitions

and completed 10 business disposals.

Gains on disposals of investments of US$754

million included a profit of US$200 million on the

sale of HSBC’s stake in British Interactive

Broadcasting (‘BiB’ ) to BSkyB.

HSBC’s European results were bolstered by

gains on the disposal of the stake in Quilter and by

profits in Germany on the sale of the majority stake

in our fledgling internet broker Pulsiv and ERGO.

In Hong Kong we made gains on the sale of

HSBC’s investment in Modern Terminals Limited

and the disposal of our 50 per cent stake in Central

Registration Hong Kong Limited to the other 50 per

cent shareholder, Computershare.

In the United States, we realised significant

gains, substantially in the first half of the year, on

the sale of a number of mortgage-backed and other

debt securities as long-term portfolios were adjusted

to respond to changed economic circumstances,

particularly the potential loss of value from mortgage

refinancing. Similar, but smaller gains were achieved

in other locations.

Year ended 31 December 2000 compared with

year ended 31 December 1999

HSBC Private Equity disposed of a number of equity

investments from its portfolio in 2000, realising

profits of US$61 million compared with US$114

million in 1999. The investment bank in Asia

recorded profits on disposal of investments of US$95

million in 2000 compared with US$205 million in

1999.

Taxation

Year ended 31 December

Figures in US$m 2001 2000 1999

UK corporation tax charge ... 416 856 596

Overseas taxation ................. 1,570 1,468 1,313

Deferred taxation ................. (425) (78) 129

Joint ventures ....................... (13 ) (7)

–

Associates ............................ 26 (1 )

–

Total charge for taxation ...... 1,574 2,238 2,038

Effective taxation (per cent) 19.7 22.9 25.5

Standard UK corporation tax

rate (per cent) ..................... 30.0 30.0 30.25