HSBC 2001 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.169

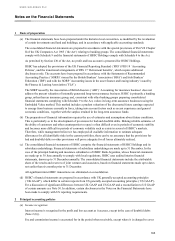

recognised over the periods of the leases so as to give a constant rate of return on the net cash investment in

the leases, taking into account tax payments and receipts associated with the leases.

(ii) Where HSBC is a lessee under finance leases the leased assets are capitalised and included in ‘Equipment,

fixtures and fittings’ and the corresponding liability to the lessor is included in ‘Other liabilities’ . Finance

charges payable are recognised over the periods of the leases based on the interest rates implicit in the

leases.

(iii) All other leases are classified as operating leases and, where HSBC is the lessor, are included in ‘Tangible

fixed assets’ . The residual values of equipment on operating leases are regularly monitored. Provision is

made to the extent that the carrying value of equipment is impaired through residual values not being fully

recoverable. Rentals payable and receivable under operating leases are accounted for on the straight-line

basis over the periods of the leases and are included in ‘Administrative expenses’ and ‘Other operating

income’ respectively.

(g) Deferred taxation

Deferred taxation is provided on timing differences, using the liability method, between the accounting and

taxation treatment of income and expenditure. Provision is made for deferred tax only to the extent that it is

probable that an actual liability will crystallise.

(h) Pension and other post-retirement benefits

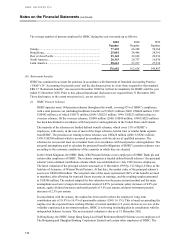

HSBC operates a number of pension and other post-retirement benefit schemes throughout the world.

For UK defined benefit schemes annual contributions are made, on the advice of qualified actuaries, for funding

of retirement benefits in order to build up reserves for each scheme member during the employee’ s working life

and used to pay a pension to the employee or dependant after retirement. The costs of providing these benefits

are charged to the profit and loss account on a regular basis.

Arrangements for staff retirement benefits in overseas locations vary from country to country and are made in

accordance with local regulations and custom. The pension cost of the major overseas schemes is assessed in

accordance with the advice of qualified actuaries so as to recognise the cost of pensions on a systematic basis

over employees’ service lives.

Since 1 January 1993, the cost of providing post-retirement health-care benefits, which is assessed in

accordance with the advice of qualified actuaries, has been recognised on a systematic basis over employees'

service lives. At 1 January 1993, there was an accumulated obligation in respect of these benefits relating to

current and retired employees which is being charged to the profit and loss account in equal instalments over 20

years.

(i) Foreign currencies

(i) Assets and liabilities denominated in foreign currencies are translated into US dollars at the rates of

exchange ruling at the year-end. The results of branches, subsidiary undertakings, joint ventures and

associates not reporting in US dollars are translated into US dollars at the average rates of exchange for the

year. Further information on the translation of assets and liabilities in Argentina is set out in Note 6.

(ii) Exchange differences arising from the retranslation of opening foreign currency net investments and the

related cost of hedging and exchange differences arising from retranslation of the result for the year from

the average rate to the exchange rate ruling at the year-end are accounted for in reserves.

(iii) Other exchange differences are recognised in the profit and loss account.

(j) Off-balance-sheet financial instruments

Off-balance-sheet financial instruments arise from futures, forward, swap and option transactions undertaken by

HSBC in the foreign exchange, interest rate and equity markets. Netting is applied where a legal right of set-off