HSBC 2001 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

102

• if loans are not in local currency, the ability of

the borrower to obtain the relevant foreign

currency.

Where specific provisions are raised on a

portfolio basis, the level of provisioning takes into

account management’s assessment of the portfolio’s

structure, past and expected credit losses, business

and economic conditions, and any other relevant

factors. The principal portfolios evaluated on a

portfolio basis are credit cards and other unsecured

consumer lending products. HSBC has in place a

minimum provisioning standard for all consumer

lending products based on time of delinquency. For

portfolios of non-mortgage personal lending, the

policy, which is based on historical loss experience,

is to have provided 100 per cent after 180 days

delinquency.

General provisions

General provisions augment specific provisions and

provide cover for loans which are impaired at the

balance sheet date but which will not be identified as

such until some time in the future. HSBC requires

operating companies to maintain a general provision

which is determined taking into account the structure

and risk characteristics of each company’s loan

portfolio. Historical levels of latent risk are regularly

reviewed by each operating company to determine

that the level of general provisioning continues to be

appropriate. Where entities operate in a significantly

higher risk environment, an increased level of

general provisioning will apply, taking into account

local market conditions and economic and political

factors.

General provisions are deducted from loans and

advances to customers in the balance sheet but,

unlike specific provisions, are included in tier 2

capital when calculating HSBC’s capital base for

regulatory purposes.

Loans on which interest is suspended

Provided that there is a realistic prospect of interest

being paid at some future date, interest on non-

performing loans is charged to the customer’ s

account. However, the interest is not credited to the

profit and loss account but to an interest suspense

account in the balance sheet which is netted against

the relevant loan. On receipt of cash (other than from

the realisation of security), suspended interest is

recovered and taken to the profit and loss account. A

specific provision of the same amount as the interest

receipt is then raised against the principal balance.

Amounts received from the realisation of security are

applied to the repayment of outstanding

indebtedness, with any surplus used to recover any

specific provisions and then suspended interest.

Non-accrual loans

Where the probability of receiving interest payments

is remote, interest is no longer accrued and any

suspended interest balance is written off.

Loans are not reclassified as accruing until

interest and principal payments are up-to-date and

future payments are reasonably assured.

Assets acquired in exchange for advances in

order to achieve an orderly realisation continue to be

reported as advances. The asset acquired is recorded

at the carrying value of the advance disposed of at

the date of the exchange and provisions are based on

any subsequent deterioration in its value.

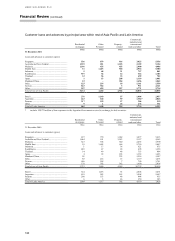

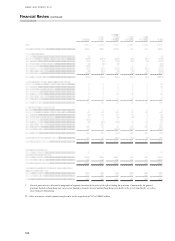

Outstanding provisions

Aggregate customer bad and doubtful debt

provisions at 31 December 2001 were in line with 31

December 2000 and at US$8.2 billion represented

2.57 per cent of gross customer advances compared

with 2.73 per cent at 31 December 2000. In Hong

Kong and the Rest of Asia-Pacific, continuing

resolution of previously provided debt contributed to

outstanding provisions falling by US$533 million as

amounts were charged off. This fall was offset in

Latin America where the stock of provisions rose by

US$492 million, in essence reflecting the US$600

million additional provision raised in respect of

Argentine risk.

Excluding Argentina, general provisions reduced

slightly to 0.71 per cent of gross customer lending

(excluding reverse repo transactions and settlement

accounts). In Argentina, general provisions were

augmented by US$600 million in view of the severe

economic conditions and political turmoil

culminating in the declaration of a default by the

Government. Following this substantial increase

general provision coverage stood at 30.7 per cent of

customer lending at 31 December 2001 or 49.7 per

cent of customer lending excluding the loans

outstanding from the Argentine Government which

arose as a result of a swap of Government bonds

from domestic creditors.