HSBC 2001 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

44

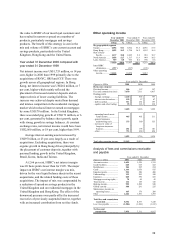

2000. In Brazil, provisioning requirements rose by

US$75 million (at constant exchange rates US$80

million) following growth in the lending portfolio.

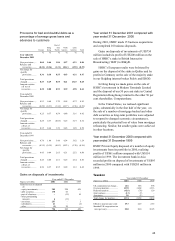

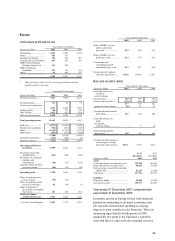

Year ended 31 December 2000 compared with

year ended 31 December 1999

The bad and doubtful debt charge at US$932 million

in 2000 was US$1,141 million lower than in 1999.

The decrease was driven by a sharp fall in new

specific provisions against customer advances,

together with increased releases and recoveries,

including a US$174 million release of the special

general provision raised in 1997 against Asian risk.

New specific provisions against customer

advances declined by 23 per cent to US$2,293

million compared with 1999. This reflected

improved economic conditions and lower interest

rates in Asia and strong liquidity in all major

markets. There was continuing progress in loan

workouts to achieve releases and recoveries.

In the United Kingdom, underlying credit

quality remained stable with the lower net charge

reflecting a higher level of recoveries, and no

individually significant provisions in 2000. The

charge for credit losses in France was minimal,

consistent with prior periods and reflective of the

quality of CCF’s business.

Asset quality in Hong Kong reflected the

improved economic conditions, with increased

provisions for residential mortgage loans more than

offset by lower provisions for other personal lending

and corporate accounts. Delinquency rates for

residential mortgages remained low.

Non-performing customer advances decreased in

the rest of Asia-Pacific due to a combination of

write-offs, credit upgrades and recoveries. The net

charge for bad and doubtful debts for exposures to

mainland China related companies was only US$3

million compared with a charge in 1999 of US$306

million. There were net releases of provisions against

exposures to customers booked in Indonesia,

Thailand and Singapore. In Malaysia, the bad debt

charge rose slightly in the second half of the year due

to lower than expected recoveries caused by delays

in debt restructuring stemming from a weak stock

market; as compared to 1999 the provisions charge in

Malaysia was US$256 million lower. In 2000, 60 per

cent of the special general provision of US$290

million made in 1997 in respect of Asia was released.

In view of the slowdown in the US economy and its

possible implications for the Asian economies as a

whole, the balance of the special general provision

has been transferred to augment the general bad debt

provision.

In North America, although the overall quality

of the portfolio remained sound, non-performing

loans rose slightly due to some deterioration in the

quality of leveraged credits: these constituted a small

portion of outstanding advances.

In Latin America, non-performing loans rose due

to severe economic conditions in Argentina, the

inclusion of new business acquired in Panama and as

a result of the expansion of profitable consumer

lending in Brazil.

At 31 December 2000, non-performing customer

advances represented 3.5 per cent of gross customer

advances compared with 4 per cent at 31 December

1999.

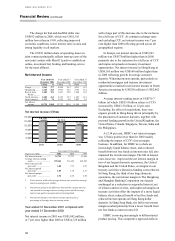

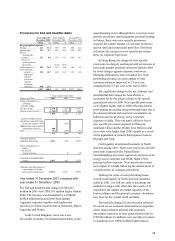

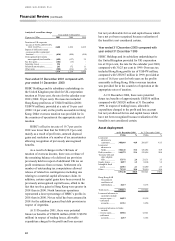

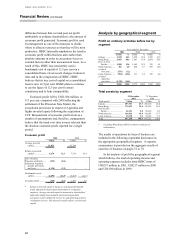

Provisions for bad and doubtful debts as a

percentage of average gross loans and

advances to customers

Average gross loans and advances to customers are

allocated to geographical segment by the location of

the principal operations of the lending subsidiary or,

in the case of The Hongkong and Shanghai Banking

Corporation Limited, HSBC Bank plc, HSBC Bank

Middle East and HSBC Bank USA operations, by

location of the lending branch.

In each of the years, the provisions for bad and

doubtful debts on loans and advances to banks

expressed as a percentage of average gross loans and

advances to banks is nil.