HSBC 2001 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

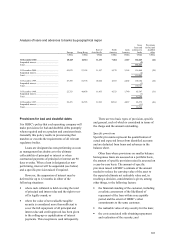

notwithstanding a weaker economic environment.

In Latin America, there was an increase in non-

performing loans in 2001 in local currency terms in

Brazil reflecting both targeted growth in consumer

lending and a generally weaker economy. In

Argentina, there was an increase in non-performing

loans in local currency terms during the year due to

the economic deterioration although this was offset

by all fully provided loans being written off. As at 31

December 2001, the impact of the economic crisis

had not yet caused individual accounts to become

non-performing against contractual terms.

Recognising the likely deterioration in the portfolio

all exposure not already classified as non-performing

has been classified as potential problem loans

against which an additional US$600 million

provision was raised.

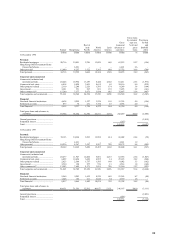

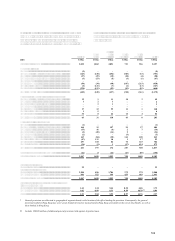

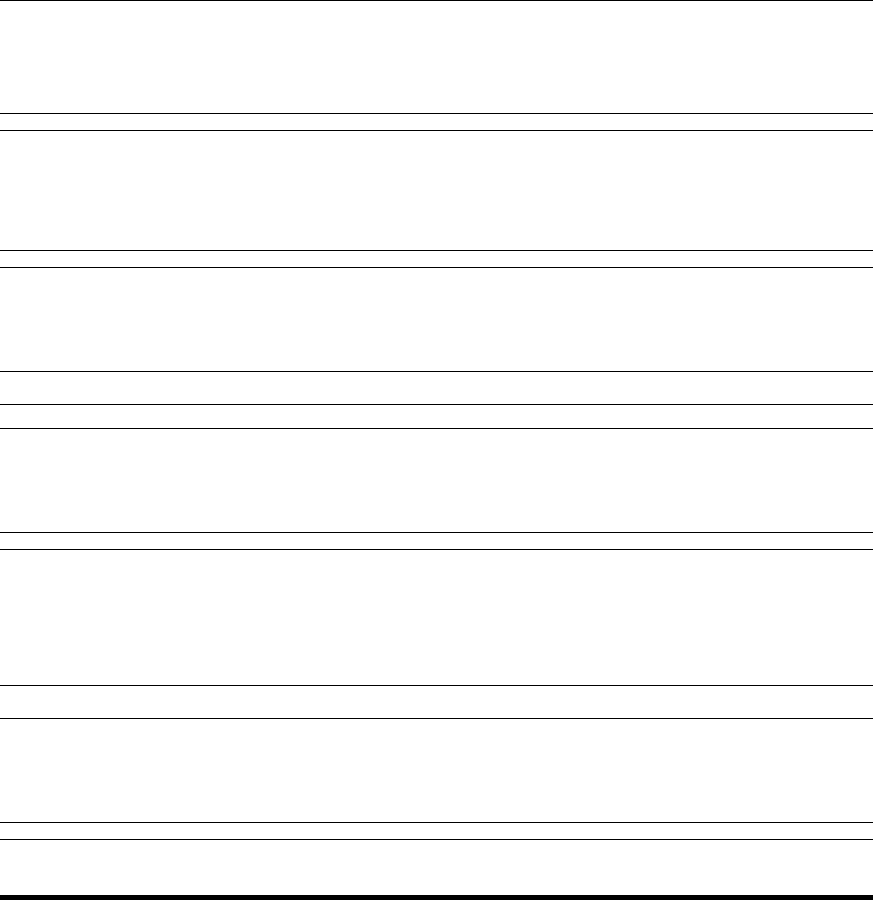

The following table provides an analysis of risk elements in the loan portfolios as at 31 December for the past five

years:

31 December

2001

US$m

31 Decembe

r

2000

US$

m

31 Decembe

r

1999

US$

m

31 Decembe

r

1998

US$

m

31 Decembe

r

1997

US$

m

Loans accounted for on a non-accrual

basis:

Europe.......................................................... 2,052 1,985 1,176 1,092 1,064

Hong Kong................................................... 213 236 163 77 22

Rest of Asia-Pacific...................................... 195 429 435 344 181

North America.............................................. 593 606 550 546 564

Latin America............................................... 429 571 447 355 260

Total non-accrual loans ................................ 3,482 3,827 2,771 2,414 2,091

Loans on which interest has been

accrued but suspended:

Europe.......................................................... 1,553 1,389 1,514 1,243 1,558

Hong Kong................................................... 1,795 2,259 2,898 2,443 597

Rest of Asia-Pacific...................................... 2,497 2,627 3,097 2,691 1,076

North America.............................................. 20 18 18 24 39

Latin America............................................... 162 181 149 48

Total suspended interest loans ...................... 6,027 6,474 7,676 6,449 3,270

Assets acquired in exchange for

advances:

Europe.......................................................... 84 25 27 28 72

Hong Kong................................................... 19 26 72

Rest of Asia-Pacific...................................... 32 24 2

North America.............................................. 14 19 17 22 35

Total assets acquired in exchange for

advances .................................................. 149 94 118 50 107

Total non-performing loans .......................... 9,658 10,395 10,565 8,913 5,468

Troubled debt restructurings:

Europe..........................................................

–

22 98

Hong Kong................................................... 381 395 266 187 6

Rest of Asia-Pacific ..................................... 131 231 138 68 38

North America.............................................. 35916

Latin America............................................... 144 144 146 18

Total troubled debt restructurings................. 659 775 559 296 148

Accruing loans contractually past due 90

days or more as to principal or

interest:

Europe.......................................................... 15 11 21 1 49

Hong Kong................................................... 98 76 84 121 91

Rest of Asia-Pacific...................................... 38 66 54 69 79

North America ............................................. 44 64 59 30 57

Latin America............................................... 55 82 58 67 57

Total accruing loans contractually past due

90 days or more ...................................... 250 299 276 288 333

Total risk elements:

Europe.......................................................... 3,704 3,410 2,738 2,386 2,841

Hong Kong................................................... 2,506 2,992 3,483 2,828 716

Rest of Asia-Pacific...................................... 2,893 3,377 3,726 3,172 1,374

North America.............................................. 674 712 653 623 701

Latin America............................................... 790 978 800 496 317

Total risk elements ....................................... 10,567 11,469 11,400 9,497 5,949

Provisions for bad and

doubtful debts as a %

of total risk elements ................................ 77.4 71.5 70.3 70.1 87.0

As at 31 December 2001, there were potential problem loans of US$2,604 million in respect of Argentine loans.