HSBC 2001 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

66

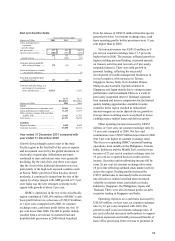

2000), was US$16 million lower than in 2000 as a 13

per cent increase in personal and commercial

services revenues only partly offset lower levels of

broking and capital market fees in weaker equity

stock markets.

As part of its strategy of providing customers

with multiple choices for product and service

delivery, HSBC Bank USA now offers a

comprehensive Internet Banking service. At 31

December 2001, more than 275,000 customers had

registered for the service, up from approximately

80,000 at year-end 2000. The HSBC Bank USA web

site, us.hsbc.com, where customers can apply for

accounts, conduct financial planning and link to

online services, receives over 37,000 visits daily.

During 2001, HSBC’s second generation

strategic internet banking platform being developed

in the United States hsbc.com launched its first

business applications. The hsbc.com program has

been designed to maximise the ability to offer any or

all of our services to any or all of our customers.

hsbc.com provides a common presentation and

browser capability. By adopting this approach, we

enhance the choices our customers have in selecting

how they want to do business with us, while

reducing our cost of providing the services. All the

key systems, which provide our core services, are

planning on integrating with hsbc.com over the next

five years.

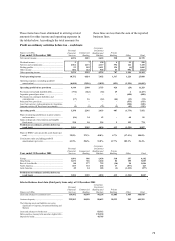

Operating expenses, excluding goodwill

amortisation, of US$2,488 million in 2001 were

US$125 million, or 5 per cent higher than for 2000.

Of this increase, US$164 million related to

development costs associated with hsbc.com.

Excluding these costs and adjusting for the transfer

of HSBC InvestDirect (Canada) Inc, underlying costs

were US$29 million, or 1 per cent, lower than in

2000. HSBC Markets USA’ s operating expenses

increased by US$58 million all of which related to

higher staff costs reflecting higher levels of

performance-related bonuses on improved trading

revenues together with additional headcount building

on the successful trading platform in place.

Operating expenses in the domestic operations of

HSBC Bank USA were 2 per cent lower compared to

2000. A reduced level of acquisition related

restructuring charges in 2001 was offset by business

expansion in treasury, wealth management and e-

commerce, and increased marketing expenses.

Higher depreciation expense resulting from

infrastructure improvements represents a delayed

restructuring charge. In Canada, excluding HSBC

Invest Direct Inc’s costs in 2000, operating expenses

were US$29 million lower, or 6 per cent, of which

US$24 million related to lower staff costs mainly

lower performance related bonuses as a result of

lower levels of trading revenues in the scaled back

equity operations. Lower volumes of transaction-

driven costs and continuing efforts to improve

operational efficiencies reduced other operating

expenses by US$5 million.

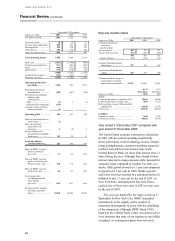

Credit quality deteriorated modestly during

2001. In the United States new specific provisions of

US$313 million, were US$25 million lower than in

2000 and took into account requirements against an

exposure to a corporate customer in the energy

sector. An increase in new specific provisions in

Canada of US$40 million related to the deterioration

of a small number of commercial facilities, notably

in the telecommunications sector. Releases and

recoveries were consistent with 2000 and the net

increase in the bad and doubtful debt charge of

US$140 million reflects the release of general

provision in the United States in 2000 not repeated in

2001.

In terms of non-performing loans overall credit

quality remained stable in 2001 with non-performing

loans at 31 December 2001 at US$627 million

compared with US$643 million at 31 December

2000. It is, however, still too early to determine the

medium to longer-term effect that the events of 11

September, the impact on market liquidity of the

Enron collapse and the general economic slowdown

may have on the overall credit portfolio.

Gains on disposal of investments amounted to

US$129 million, an increase of US$94 million

compared with 2000. During the year, but

substantially in the first half, HSBC’s operations in

the United States sold mortgage-backed securities to

reduce exposure to refinancing mortgages in a

declining interest rate environment.

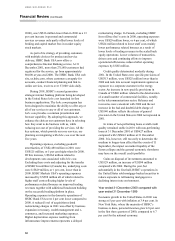

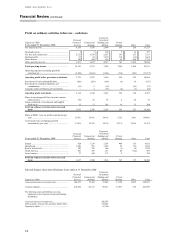

Year ended 31 December 2000 compared with

year ended 31 December 1999

Economic growth in the United States in 2000 was

strong at 5 per cent with inflation at 3.4 per cent. In

New York State, where the majority of HSBC’ s

business is done, personal incomes grew 4.8 per cent

in the first three quarters of 2000, compared to 6.7

per cent for the national economy.