HSBC 2001 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

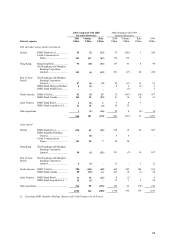

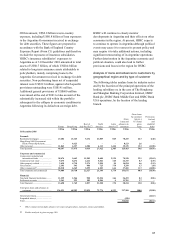

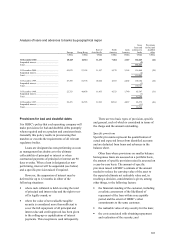

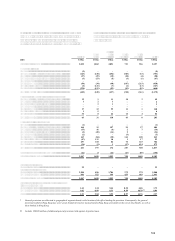

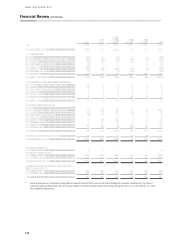

The following tables show details of the movements

in HSBCs provisions for bad and doubtful debts by

location of lending office for each of the past five

years. A discussion of the material movements in the

charge for provisions by region is included within the

analysis of results for geographical segments on

pages 48 to 72.

Euro

p

e

Hon

g

Kon

g

Rest o

f

Asia-

Pacific

North

America

Latin

America Total

2001 US$m US$m US$m US$m US$m US$m

Provisions at 1 Januar

y

..................................................... 3,025 1,802 2,091 723 556 8,197

Amounts written off:

Banks............................................................................ (5 ) – – – – (5)

Commercial, industrial and international trade.............. (123 ) (238 ) (256 ) (103 ) (33 ) (753 )

Real estate..................................................................... (27 ) (29) (18 ) (10 ) (4) (88 )

Non-bank financial institutions ..................................... (5 ) (53 ) (5 ) (3 ) (1 ) (67 )

Governments................................................................. ––––––

Other commercial.......................................................... (54 ) (34 ) (48) (107 ) (215) (458)

Residential mortgages ................................................... (4 ) (121 ) (7 ) (2 ) (13 ) (147 )

Other personal............................................................... (224 ) (155 ) (93 ) (93 ) (95 ) (660 )

Total amounts written of

f

.............................................. (442 ) (630 ) (427) (318 ) (361 ) (2,178)

Recoveries of amounts written off in previous years:

Commercial, industrial and international trade.............. 12 1 11 18 3 45

Real estate..................................................................... 121

–

–

4

Non-bank financial institutions ..................................... –31––4

Governments................................................................. ––––––

Other commercial.......................................................... 17 12 99 11 1 140

Residential mortgages ................................................... 15–––6

Other personal............................................................... 34 8 26 14 4 86

Total recoveries............................................................. 65 31 138 43 8 285

Charge to profit and loss account:

Banks............................................................................ (1 ) – – – – (1)

Commercial, industrial and international trade.............. 164 15 157 91 57 484

Real estate..................................................................... (35 ) 16 (6 ) 2 7 (16)

Non-bank financial institutions ..................................... (2 ) (20 ) (14 ) 2 – (34 )

Governments................................................................. (2 )

–

–

(3 )

–

(5)

Other commercial.......................................................... 143 (84) (58 ) 141 100 242

Residential mortgages ................................................... (47 ) 111 10 1 17 92

Other personal............................................................... 257 168 82 70 125 702

General provisions ........................................................ (36 ) (9 ) 1 (17 ) 634 573

Total charge .................................................................. 441 197 172 287 940 2,037

Foreign exchange and other movements .......................... (22 ) 8 (22 ) (27 ) (95 ) (158 )

Provisions at 31 Decembe

r

................................................ 3,067 1,408 1,952 708 1,048 8,183

Provisions against banks:

Specific provisions........................................................ 22

–

–

–

–

22

Provisions against customers:

Specific provisions........................................................ 2,204 856 1,786 275 379 5,500

General provisions* ...................................................... 841 552 166 433 669 2,661

Provisions at 31 Decembe

r

................................................ 3,067 1,408 1,952 708 1,048 8,183

Provisions against customers as a % of gross loans and

advances to customers:

Specific provisions........................................................ 1.61 1.24 5.44 0.38 6.06 1.73

General provisions ........................................................ 0.62 0.80 0.51 0.59 10.70 †0.84

Total ................................................................................. 2.23 2.04 5.95 0.97 16.76 2.57

* General provisions are allocated to geographical segments based on the location of the office booking the provision. Consequently, the general

provision booked in Hong Kong may cover assets booked in branches located outside Hong Kong, principally in the rest of Asia-Pacific, as well as

those booked in Hong Kong.

†Includes US$600 million of additional general provisions held against Argentine loans.