HSBC 2001 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

HSBC HOLDINGS PLC

Financial Review (continued)

116

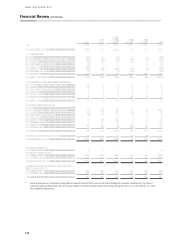

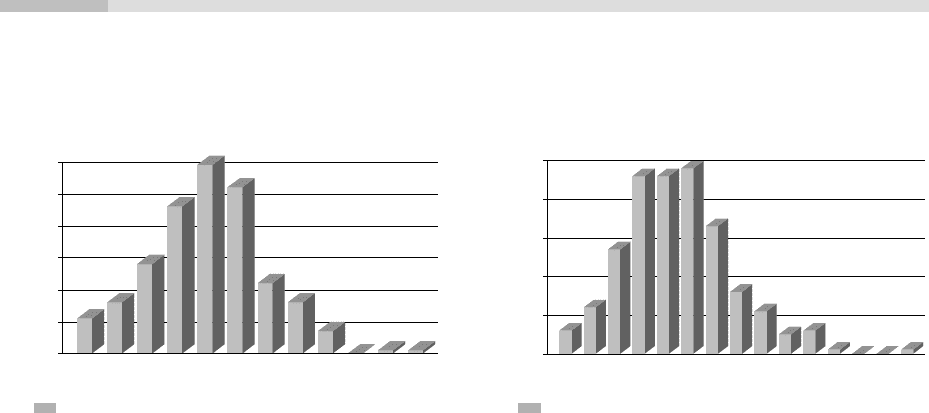

Daily distribution of market risk revenues in 2001 Daily distribution of market risk revenues 2000

Profit and loss frequency

Foreign exchange exposure

HSBCs foreign exchange exposures comprise

trading exposures and structural foreign currency

translation exposure.

Trading exposure

Foreign exchange trading exposures comprise those

which arise from foreign exchange dealing within

Treasury, and currency exposures originated by

commercial banking businesses in HSBC. The latter

are transferred to local treasury units where they are

managed, together with exposures which result from

dealing activities, within limits approved by the

Group Executive Committee. VAR on foreign

exchange trading positions is shown in the table on

page 115.

The average one-day foreign exchange revenue

in 2001 was US$3.0 million compared with US$2.8

million in 2000.

Structural currency exposure

HSBCs main operations are in the United Kingdom,

Hong Kong, France, the United States and Brazil,

although it also has operations elsewhere in Europe,

the rest of Asia-Pacific, North America and Latin

America. The main operating (or functional)

currencies in which HSBCs business is transacted

are, therefore, sterling, Hong Kong dollars, euros,

US dollars and Brazilian reais.

Since the currency in which HSBC Holdings

prepares its consolidated financial statements is US

dollars, HSBCs consolidated balance sheet is

affected by movements in the exchange rates

between these functional currencies and the US

Profit and loss frequency

dollar. These currency exposures are referred to as

structural currency exposures. Translation gains and

losses arising from these exposures are recognised in

the statement of total consolidated recognised gains

and losses. These exposures are represented by the

net asset value of the foreign currency equity and

subordinated debt investments in subsidiaries,

branches and associated undertakings.

HSBCs structural foreign currency exposures

are managed with the primary objective of ensuring,

where practical, that HSBCs and individual banking

subsidiaries tier 1 capital ratios are protected from

the effect of changes in exchange rates. This is

usually achieved by holding qualifying tier 1 capital

broadly in proportion to the corresponding foreign-

currency-denominated risk-weighted assets at a

subsidiary bank level. HSBC considers hedging

structural foreign currency exposures only in limited

circumstances, to protect the tier 1 capital ratio or the

US dollar value of capital invested. Such hedging

would be undertaken using forward foreign exchange

contracts or by financing with borrowings in the

same currencies as the functional currencies

involved.

As subsidiaries are generally able to balance

adequately foreign currency tier 1 capital with

foreign currency risk-weighted assets, HSBCs

foreign currency structural exposures are usually

unhedged, including exposures due to foreign-

currency-denominated profits arising during the year.

Selective hedges were, however, transacted during

2001. There was no material effect from foreign

currency exchange rate movements on HSBC or,

outside of Argentina, subsidiary tier 1 capital ratios

during the year. In Argentina the mandatory

6

12

27

46 46 48

33

16

11

56

1001

0

10

20

30

40

50

Number of days

0 2 4 6 8 1012141618202224262830

Revenues (US$m)

11

16

28

46

59 52

22

16

7

011

0

10

20

30

40

50

60

Number of days

-4 0 4 8 121620242832364044

Rev enu es (US$ m)