HSBC 2001 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

178

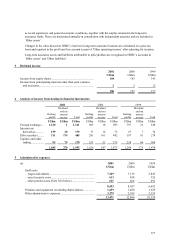

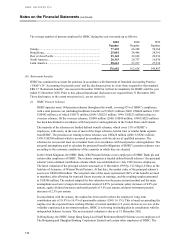

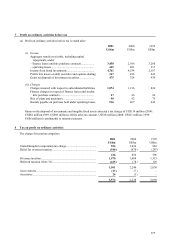

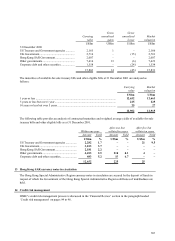

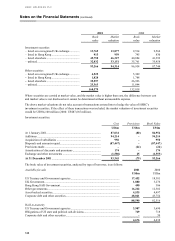

HSBC Holdings and its subsidiary undertakings in the United Kingdom provide for UK corporation tax at 30.0%

(2000: 30.0%;1999: 30.25%). Overseas tax includes Hong Kong profits tax of US$450 million (2000: US$478

million; 1999: US$367 million). Subsidiary undertakings in Hong Kong provide for Hong Kong profits tax at the

rate of 16.0% (2000: 16.0%; 1999: 16.0%) on the profits for the year assessable in Hong Kong. Other overseas

subsidiary undertakings and overseas branches provide for taxation at the appropriate rates in the countries in which

they operate. The tax charge in 2001 benefited from increased tax-free gains in Hong Kong, a material capital gain in

the UK covered by previously unrecognised capital losses, prior year tax credits as a result of settlement of prior year

computations, and the release of valuation reserves against a number of potential deferred tax assets in light of a

demonstrated record of relevant tax capacity. Offsetting this, no tax relief was assumed in respect of the exceptional

charges in respect of Argentina.

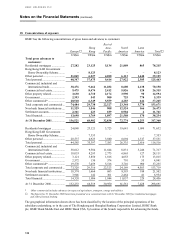

Analysis of overall tax charge:

2001 2000 1999

US$m US$m US$m

Taxation at UK corporate tax rate of 30.0% (2000: 30.0%,

1999: 30.25%) .......................................................................... 2,400 2,932 2,415

Impact of differently taxed overseas profits in principal locations (616) (498) (418)

Unrecognised/(previously unrecognised) tax benefits ................. (499) (137) 35

Tax free gains................................................................................ (102) (15) –

Argentine losses............................................................................ 336 ––

Goodwill amortisation .................................................................. 263 172 11

Other items.................................................................................... (208) (216) (5)

Overall tax charge ......................................................................... 1,574 2,238 2,038

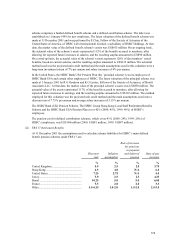

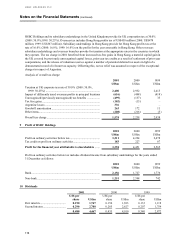

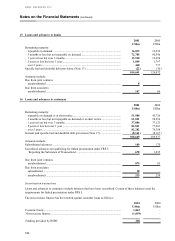

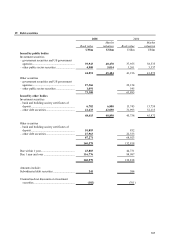

9 Profit of HSBC Holdings

2001 2000 1999

US$m US$m US$m

Profit on ordinary activities before tax.......................................... 3,211 4,224 2,478

Tax credit on profit on ordinary activities..................................... 183 227 87

Profit for the financial year attributable to shareholders ....... 3,394 4,451 2,565

Profit on ordinary activities before tax includes dividend income from subsidiary undertakings for the years ended

31 December as follows:

2001 2000 1999

US$m US$m US$m

Bank.............................................................................................. 2,156 1,727 1,776

Non-bank ...................................................................................... 1,251 2,598 742

10 Dividends

2001 2000 1999

US$ per

share US$m

US$ per

share US$m

US$ per

share US$m

First interim.................................... 0.190 1,767 0.150 1,383 0.133 1,118

Second interim............................... 0.290 2,700 0.285 2,627 0.207 1,754

0.480 4,467 0.435 4,010 0.340 2,872