HSBC 2001 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

58

Korean bonds which had been provided for in the

investment bank in 1999 and higher foreign

exchange profits as a result of increased corporate

business volumes, partly offset by mark-to-market

losses on bonds in the Investment Bank and the bank

in Hong Kong.

Operating expenses increased by US$91 million,

or 5 per cent, and included US$87 million in costs,

mainly attributable to staff costs and advertising and

promotion expenses relating to the launch of the

Mandatory Provident Fund in Hong Kong. This

represented an increase of US$65 million compared

with 1999.

Staff costs were held broadly at the same level

as last year. Increases in staff costs in the investment

bank, due to higher profit-related remuneration, and

in HBSC Insurance, due to the launch of the

Mandatory Provident Fund, were offset by a

reduction in Hang Seng Bank as a result of lower

headcount and reductions in pension costs in the

bank. Operating expenses, other than staff costs,

increased by US$70 million, or 9 per cent, mainly in

advertising and marketing expenses and development

costs relating to HSBC's e-banking initiatives.

Premises and equipment expenses were reduced

compared with 1999, reflecting lower rental

expenses.

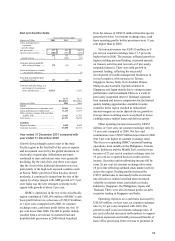

Provisions for bad and doubtful debts decreased

significantly by US$337 million, or 58 per cent. The

charge for new specific provisions decreased by

US$266 million to US$454 million whilst releases

and recoveries increased by US$106 million to

US$207 million, the latter mainly in respect of

corporate customers. The net bad debt charge for the

year fell from 90 basis points of advances in 1999 to

37 basis points in 2000.

There was a small net release of provisions for

bad and doubtful debts in respect of lending to

mainland China related companies booked in Hong

Kong in 2000 compared with a charge of US$142

million in 1999. The net charge for specific

provisions for personal lending in Hong Kong

decreased reflecting the improved economic

conditions: increased provisions for residential

mortgages were more than offset by decreased

provisions for other personal lending. Delinquency

rates for residential mortgages in 2000 remained low.

Non-performing advances as a percentage of

total advances decreased from 4.8 per cent at 31

December 1999 to 3.8 per cent at 31 December 2000

as a result of a reduction in non-performing

advances, due to a combination of write-offs,

upgrades and recoveries, and an increase in total

advances to customers.

Rest of Asia-Pacific (including the Middle

East)

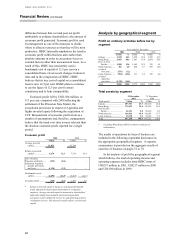

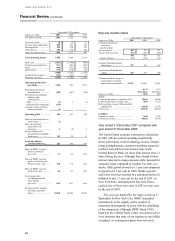

Year ended 31 December

Figures in US$m 2001 2000 1999

Net interest income............... 1,482 1,367 1,240

Dividend income .................. 332

Net fees and commissions..... 681 710 645

Dealing profits...................... 395 324 300

Other income ........................ 58 48 36

Other operating income ........ 1,137 1,085 983

Total operating income 2,619 2,452 2,223

Staff costs............................. (771 ) (733) (642)

Premises and equipment (143) (137) (127 )

Othe

r

.................................... (401) (343) (309 )

Depreciatio

n

......................... (82 ) (79 ) (70)

(1,397) (1,292 ) (1,148)

Goodwill amortisatio

n

.......... (8) (5 ) (14 )

Operating expenses............... (1,405) (1,297 ) (1,162)

Operating profit before

provisions........................ 1,214 1,155 1,061

Provisions for bad and

doubtful debts .................. (172 ) 15 (809)

Provisions for

contingent liabilities and

commitments ................... (43 ) 5 (30)

Amounts written off fixed

asset investments ............. (11 ) (3 ) (1)

Operating profit.................. 988 1,172 221

Share of operating loss in

joint venture..................... (5)

–

–

Share of operating profit in

associates ......................... 99 100 94

Gains/(losses) on disposal o

f

investments and tangible

fixed assets ...................... 6(7 ) 14

Profit on ordinary

activities before ta

x

........ 1,088 1,265 329

Share of HSBC’ s pre-tax

profits (cash basis) (per

cent)................................. 12.4 12.3 4.3

Share of HSBC’ s pre-tax

p

rofits (per cent) .............. 13.6 12.9 4.1

Cost:income ratio

(excluding goodwill

amortisation) (per cent).... 53.3 52.7 51.6

Period-end staff numbers

(full-time equivalent) ....... 26,259 22,919 21,375