HSBC 2001 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

collateral or guarantees. Banking book off-balance-

sheet items giving rise to credit, foreign exchange or

interest rate risk are assigned weights appropriate to

the category of the counterparty, taking into account

any eligible collateral or guarantees. Trading book

risk-weighted assets are determined by taking into

account market-related risks, such as foreign

exchange, interest rate and equity position risks, as

well as counterparty risk.

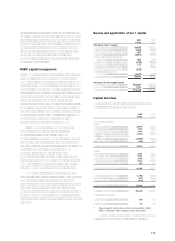

HSBC capital management

It is HSBCs policy to maintain a strong capital base

to support the development of HSBCs business.

HSBC seeks to maintain a prudent balance between

the different components of its capital and, in HSBC

Holdings, between the composition of its capital and

that of its investment in subsidiaries. This is achieved

by each subsidiary managing its own capital within

the context of an approved annual plan which

determines the optimal amount and mix of capital to

support planned business growth and to meet local

regulatory capital requirements. Capital generated in

excess of planned requirements is paid up to HSBC

Holdings normally by way of dividends and

represents a source of strength for HSBC.

It is HSBC policy that HSBC Holdings is

primarily a provider of equity capital to its

subsidiaries with such equity investment

substantially funded by HSBC Holdings own equity

issuance. Non-equity tier 1 and subordinated debt

requirements of major subsidiaries are normally met

by their own market issuance within HSBC

guidelines regarding market and investor

concentration, cost, market conditions, timing and

the effect on the components and maturity profile of

HSBC capital. Subordinated debt requirements of

other HSBC companies are provided internally.

HSBC recognises the impact on shareholder

returns of the level of equity capital employed within

HSBC and seeks to maintain a prudent balance

between the advantages and flexibility afforded by a

strong capital position and the higher returns on

equity possible with greater leverage. In the current

environment HSBC uses a benchmark tier 1 capital

ratio of 8 per cent in considering its long term capital

planning.

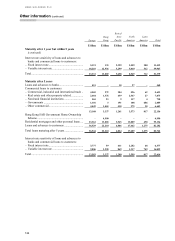

Source and application of tier 1 capital

2001

US$m

2000

US$

m

Movement of tier 1 capital

Opening tier 1 capital........................... 34,620 28,533

Attributable profits............................... 5,406 6,628

add back: goodwill amortisatio

n

......... 807 525

Dividends.............................................

(

4,467 )

(

4,010 )

add back: shares issued in lieu of

dividends......................................... 866 944

Other movement in goodwill deducte

d

.

(

199)

(

9,372 )

Shares issue

d

........................................ 112 8,794

Issue of innovative tier 1 capital...........

–

3,512

Redemption of preference shares .........

(

825)

Other (including exchange

movements).....................................

(

1,247 )

(

934)

Closing tier 1 capital ............................ 35,073 34,620

Movement in risk-weighted assets

Opening risk-weighted assets............... 383,687 336,126

Movements .......................................... 7,791 47,561

Closing risk-weighted assets ................ 391,478 383,687

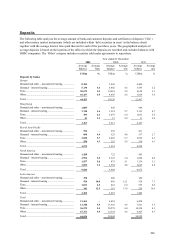

Capital structure

The table below sets out the analysis of regulatory

capital at the end of 2001 and 2000.

2001

US$m

2000

US$

m

Composition of capital

Tier 1:

Shareholders funds .............................. 45,979 45,570

Minority interests.................................. 3,515 4,419

Innovative tier 1 securities .................... 3,467 3,512

Less : property revaluation reserves ...... (2,271 ) (2,611)

goodwill capitalised and intangible

assets.......................................... (14,989) (15,597 )

own shares held*.............................. (628) (673 )

Total qualifying tier 1 capital ................ 35,073 34,620

Tier 2:

Property revaluation reserves ................ 2,271 2,611

General provisions ................................ 2,091 2,132

Perpetual subordinated debt ................. 3,338 3,531

Term subordinated debt......................... 9,912 10,224

Minority interest in tier 2 capital........... 693 697

Total qualifying tier 2 capital ................ 18,305 19,195

Unconsolidated investments.................. (1,781 ) (1,463 )

Investments in other banks ...................

(

627

)

(

1

,

241

)

Other deductions ................................... (116 ) (147)

Total capital .......................................... 50,854 50,964

Total risk-weighted assets ..................... 391,478 383,687

Capital ratios (per cent):

Total capital .......................................... 13.0 13.3

Tier 1 capital......................................... 9.0 9.0

* This principally reflects shares held in trust available to fulfil

HSBC’s obligations under employee share option plans.

The above figures were computed in accordance

with the EU Banking Consolidation Directive.