HSBC 2001 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2001 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

securities custody and clearing business. Dealing

profits improved by US$12 million, or 44 per cent,

with higher profits on interest rate derivatives trading

and foreign exchange. Operating expenses rose by

US$17 million, or 24 per cent, as a result of

continued investment required to support the growth

in business.

In mainland China, the pre-tax loss of US$26

million was US$101 million lower than last year.

Provisions for bad and doubtful debts and the costs

of opening new branches continued to be the main

factors affecting results during the year. The net

charge for bad and doubtful debts in 2000 against

mainland China related companies booked in

branches in Hong Kong, China and Macau was only

1 per cent of the charge made in 1999.

In Malaysia, HSBC Bank Malaysia reported

profits before tax of US$116 million compared to a

pre-tax loss of US$125 million in 1999. The charge

for bad and doubtful debts and contingent liability

provisions was US$243 million, or 91 per cent,

lower than in 1999.

Net interest income was slightly lower as intense

competition for the limited quality lending

opportunities restricted growth in average interest-

earning assets and reduced lending margins. The net

interest margin was slightly worse than in 1999 as a

5 basis point fall in interest spread was almost

completely offset by an increased contribution from

higher levels of net free funds. The narrowing in the

interest spread was caused by a combination of

pressure on lending margins and a change in asset

mix as surplus funds were placed at lower yields

with the Central Bank and invested through the

money market.

Other operating income was 5 per cent higher

than in 1999. An improving economic environment,

together with a focus on expanding our personal

banking operations, resulted in a 29 per cent increase

in card fee income. In addition, higher dealing profits

from the sale of debt securities as bond prices rose

also contributed to the increase.

Operating expenses were in line with those in

1999.

The Middle Eastern operations of HSBC Bank

Middle East reported an increase in pre-tax profits of

US$19 million, 12 per cent higher than in 1999.

Growth in personal lending, credit card advances and

commercial overdrafts contributed to an overall

increase in net interest income of 6 per cent during

the year. However, strong growth in customer

deposits, combined with a marginal increase in

personal lending opportunities, contributed to an

overall fall in interest margin to 3.95 per cent as

surplus funds were deployed in the interbank market

and funding costs increased.

Growth in personal banking and trade related fee

income contributed to an 8 per cent growth in net

fees. Dealing profits were slightly lower as foreign

trade flows in the region reduced opportunities in

both retail and commercial foreign exchange

dealings. Other income was sharply higher than in

1999 following the receipt of income from Saudi

British Bank.

Operating expenses, particularly staff costs,

were 8 per cent higher than in 1999. The increase in

staff costs reflected increased headcount resulting

from the expansion of personal banking direct sales

teams around the region and the introduction of

qualified personal financial planning staff in the

UAE as part of HSBC’s wealth management strategy.

The charge for bad and doubtful debts during the

year was sharply lower than in 1999 reflecting a

smaller number of significant individual provisions,

and an improvement in vehicle finance delinquencies

in the UAE.

Elsewhere, operations in Indonesia, Korea and

Thailand each contributed in excess of US$50

million pre-tax profits. In addition, operations in

Taiwan, the Philippines and Australia, each

contributed in excess of US$25 million to pre-tax

profits.

North America

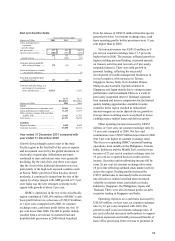

Cash basis profit before tax

Year ended 31 December

Figures in US$m 2001 2000 1999

HSBC Bank USA (excl

Princeton)........................ 1,273 871 682

HSBC Markets USA ............ (6 ) 35 8

Other USA operations.......... 13 58

USA operations.................... 1,280 911 698

Canadian operations............. 230 236 165

1,510 1,147 863

Princeton Note settlement ... (575 )

–

–

Group internet

development – hsbc.com .(161 )

–

–

Intermediate holding

companies ....................... (151) (154) 99

623 993 962