Entergy 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

Restricted Stock Awards

In January 2012 the Board approved and Entergy granted 339,700

restricted stock awards under the 2011 Equity Ownership and Long-

term Cash Incentive Plan. The restricted stock awards were made

effective as of January 26, 2012 and were valued at $71.30 per share,

which was the closing price of Entergy Corporation’s common stock

on that date. One-third of the restricted stock awards will vest upon

each anniversary of the grant date and are expensed ratably over the

three year vesting period. Shares of restricted stock have the same

dividend and voting rights as other common stock and are considered

issued and outstanding shares of Entergy upon vesting.

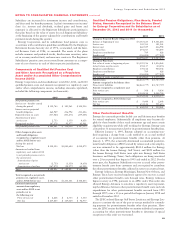

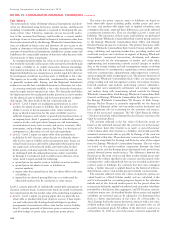

The following table includes financial information for restricted

stock for each of the years presented (in millions):

2012 2011 2010

Compensation expense included in

Entergy’s consolidated net income $11.4 $3.9 $–

Tax benefit recognized in Entergy’s

consolidated net income $ 4.4 $1.5 $–

Compensation cost capitalized as

part of fixed assets and inventory $ 2.0 $0.7 $–

Long-Term Performance Unit Program

Entergy grants long-term incentive awards earned under its stock

benefit plans in the form of performance units, which are equal to

the cash value of shares of Entergy Corporation common stock at

the end of the performance period, which is the last trading day of

the year. Performance units will pay out to the extent that the per-

formance conditions are satisfied. In addition to the potential for

equivalent share appreciation or depreciation, performance units will

earn the cash equivalent of the dividends paid during the three-year

performance period applicable to each plan. The costs of incentive

awards are charged to income over the three-year period. Beginning

with the 2012-2014 performance period, upon vesting, the perfor-

mance units granted under the Long-Term Performance Unit Program

will be settled in shares of Entergy common stock rather than cash.

In January 2012 the Board approved and Entergy granted 176,742

performance units under the 2011 Equity Ownership and Long-Term

Cash Incentive Plan. The performance units were made effective as of

January 27, 2012, and were valued at $67.11 per share. Entergy con-

siders factors, primarily market conditions, in determining the value

of the performance units. Shares of the performance units have the

same dividend and voting rights as other common stock, are consid-

ered issued and outstanding shares of Entergy upon vesting, and are

expensed ratably over the three-year vesting period.

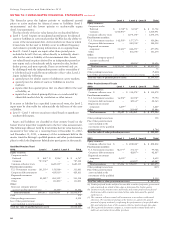

The following table includes financial information for the long-

term performance units for each of the years presented (in millions):

2012 2011 2010

Fair value of long-term performance

units as of December 31, $ 4.3 $7.3 $10.1

Compensation expense included in

Entergy’s consolidated net income $(5.0) $0.7 $ (0.9)

Tax benefit (expense) recognized in

Entergy’s consolidated net income $(1.9) $0.3 $ (0.4)

Compensation cost capitalized as

part of fixed assets and inventory $(0.9) $0.1 $ 0.1

There was no payout in 2012 for the performance units granted in

2009 applicable to the 2009 – 2011 performance period.

Restricted Unit Awards

Entergy grants restricted unit awards earned under its stock benefit

plans in the form of stock units that are subject to time-based restric-

tions. The restricted units are equal to the cash value of shares of

Entergy Corporation common stock at the time of vesting. The costs

of restricted unit awards are charged to income over the restricted

period, which varies from grant to grant. The average vesting period

for restricted unit awards granted is 36 months. As of December 31,

2012, there were 78,820 unvested restricted units that are expected

to vest over an average period of 17 months.

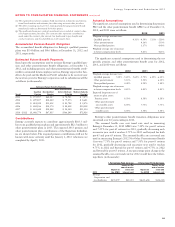

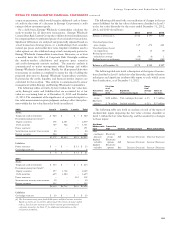

The following table includes financial information for restricted

unit awards for each of the years presented (in millions):

2012 2011 2010

Fair value of restricted awards as of

December 31, $3.0 $6.6 $8.3

Compensation expense included in

Entergy’s consolidated net income $1.3 $3.7 $3.9

Tax benefit recognized in Entergy’s

consolidated net income $0.5 $1.4 $1.5

Compensation cost capitalized as

part of fixed assets and inventory $0.2 $0.7 $0.9

Entergy paid $5.3 million in 2012 for awards under the Restricted

Units Awards Plan.

96