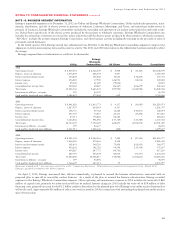

Entergy 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

December 31, 2012 and $58.9 million at December 31, 2011) and

accumulated other comprehensive income before taxes ($32.5 mil-

lion at December 31, 2012 and $27.2 million at December 31, 2011).

Accounting for Pension and Other

Postretirement Benefits

Accounting standards require an employer to recognize in its balance

sheet the funded status of its benefit plans. This is measured as the

difference between plan assets at fair value and the benefit obligation.

Entergy uses a December 31 measurement date for its pension and

other postretirement plans. Employers are to record previously

unrecognized gains and losses, prior service costs, and any remaining

transition asset or obligation (that resulted from adopting prior

pension and other postretirement benefits accounting standards) as

comprehensive income and/or as a regulatory asset reflective of the

recovery mechanism for pension and other postretirement benefit costs

in the Registrant Subsidiaries’ respective regulatory jurisdictions. For

the portion of Entergy Gulf States Louisiana that is not regulated, the

unrecognized prior service cost, gains and losses, and transition asset/

obligation for its pension and other postretirement benefit obligations

are recorded as other comprehensive income. Entergy Gulf States

Louisiana and Entergy Louisiana recover other postretirement benefit

costs on a pay as you go basis and record the unrecognized prior

service cost, gains and losses, and transition obligation for its other

postretirement benefit obligation as other comprehensive income.

Accounting standards also requires that changes in the funded status

be recorded as other comprehensive income and/or a regulatory asset

in the period in which the changes occur.

With regard to pension and other postretirement costs, Entergy

calculates the expected return on pension and other postretirement

benefit plan assets by multiplying the long-term expected rate of

return on assets by the market-related value (MRV) of plan assets.

Entergy determines the MRV of pension plan assets by calculating a

value that uses a 20-quarter phase-in of the difference between actual

and expected returns. For other postretirement benefit plan assets

Entergy uses fair value when determining MRV.

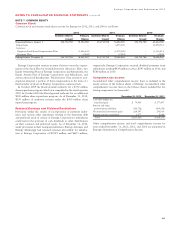

Qualified Pension and Other Postretirement

Plans’ Assets

The Plan Administrator’s trust asset investment strategy is to invest

the assets in a manner whereby long-term earnings on the assets

(plus cash contributions) provide adequate funding for retiree benefit

payments. The mix of assets is based on an optimization study that

identifies asset allocation targets in order to achieve the maximum

return for an acceptable level of risk, while minimizing the expected

contributions and pension and postretirement expense.

In the optimization studies, the Plan Administrator formulates

assumptions about characteristics, such as expected asset class invest-

ment returns, volatility (risk), and correlation coefficients among the

various asset classes. The future market assumptions used in the opti-

mization study are determined by examining historical market charac-

teristics of the various asset classes, and making adjustments to reflect

future conditions expected to prevail over the study period. Target

asset allocations adjust dynamically based on the funded status of the

pension plans. The following targets and ranges were established to

produce an acceptable, economically efficient plan to manage around

the targets. The target asset allocation range below for pension shows

the ranges within which the allocation may adjust based on funded

status, with the expectation that the allocation to fixed-income secu-

rities will increase as the pension funded status increases. The target

and range asset allocation for postretirement assets reflects changes

made in 2012 as recommended in the latest optimization study.

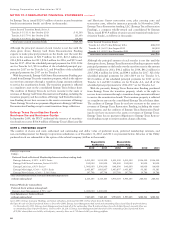

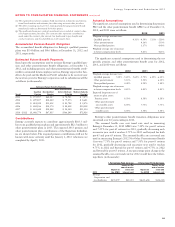

Entergy’s qualified pension and postretirement weighted-average

asset allocations by asset category at December 31, 2012 and 2011 and

the target asset allocation and ranges are as follows (in percentages):

Actual Actual

Pension Asset Allocation Target Range 2012 2011

Domestic Equity Securities 45 34 to 53 44 44

International Equity Securities 20 16 to 24 20 18

Fixed-Income Securities 35 31 to 41 35 37

Other – – to 10 1 1

Postretirement Non-Taxable Taxable

Asset Allocation Target Range 2012 2011 Target Range 2012 2011

Domestic

Equity Securities 39 34 to 44 38 39 39 34 to 44 39 35

International

Equity Securities 26 21 to 31 28 15 26 21 to 31 27 –

Fixed-Income

Securities 35 30 to 40 34 46 35 30 to 40 34 64

Other – – to 5 – – – – to 5 – 1

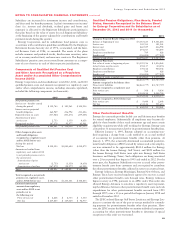

In determining its expected long-term rate of return on plan assets

used in the calculation of benefit plan costs, Entergy reviews past perfor-

mance, current and expected future asset allocations, and capital mar-

ket assumptions of its investment consultant and investment managers.

The expected long-term rate of return for the qualified pension

plans’ assets is based primarily on the geometric average of the his-

torical annual performance of a representative portfolio weighted by

the target asset allocation defined in the table above, along with other

indications of expected return on current assets and expected return

available for reinvestment. The time period reflected is a long dated

period spanning several decades.

The expected long-term rate of return for the non-taxable post-

retirement trust assets is determined using the same methodology

described above for pension assets, but the asset allocation specific to

the non-taxable postretirement assets is used.

For the taxable postretirement trust assets, the investment alloca-

tion includes tax-exempt fixed-income securities. This asset allocation

in combination with the same methodology employed to determine

the expected return for other trust assets (as described above), with a

modification to reflect applicable taxes, is used to produce the expected

long-term rate of return for taxable postretirement trust assets.

Concentrations of Credit Risk

Entergy’s investment guidelines mandate the avoidance of risk con-

centrations. Types of concentrations specified to be avoided include,

but are not limited to, investment concentrations in a single entity,

type of industry, foreign country, geographic area and individual

security issuance. As of December 31, 2012 all investment managers

and assets were materially in compliance with the approved invest-

ment guidelines, therefore there were no significant concentrations

(defined as greater than 10 percent of plan assets) of risk in Entergy’s

pension and other postretirement benefit plan assets.

The Plan Administrator’s trust asset investment strategy is to invest

the assets in a manner whereby long-term earnings on the assets

(plus cash contributions) provide adequate funding for retiree benefit

payments. The mix of assets is based on an optimization study that

identifies asset allocation targets in order to achieve the maximum

return for an acceptable level of risk, while minimizing the expected

contributions and pension and postretirement expense.

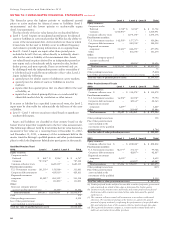

Fair Value Measurements

Accounting standards provide the framework for measuring

fair value. That framework provides a fair value hierarchy that

prioritizes the inputs to valuation techniques used to measure fair value.

91