Entergy 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

by Entergy Texas, issued $329.5 million of senior secured transition

bonds (securitization bonds) as follows (in thousands):

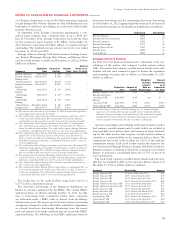

Senior Secured Transition Bonds, Series A:

Tranche A-1 (5.51%) due October 2013 $ 93,500

Tranche A-2 (5.79%) due October 2018 121,600

Tranche A-3 (5.93%) due June 2022 114,400

Total senior secured transition bonds $329,500

Although the principal amount of each tranche is not due until the

dates given above, Entergy Gulf States Reconstruction Funding

expects to make principal payments on the bonds over the next five

years in the amounts of $21.9 million for 2013, $23.2 million for

2014, $24.6 million for 2015, $26.0 million for 2016, and $27.6 mil-

lion for 2017. All of the scheduled principal payments for 2013-2016

are for Tranche A-2, $23.6 million of the scheduled principal pay-

ments for 2017 are for Tranche A-2, and $4 million of the scheduled

principal payments for 2017 are for Tranche A-3.

With the proceeds, Entergy Gulf States Reconstruction Funding pur-

chased from Entergy Texas the transition property, which is the right to

recover from customers through a transition charge amounts sufficient

to service the securitization bonds. The transition property is reflected

as a regulatory asset on the consolidated Entergy Texas balance sheet.

The creditors of Entergy Texas do not have recourse to the assets or

revenues of Entergy Gulf States Reconstruction Funding, including the

transition property, and the creditors of Entergy Gulf States Reconstruc-

tion Funding do not have recourse to the assets or revenues of Entergy

Texas. Entergy Texas has no payment obligations to Entergy Gulf States

Reconstruction Funding except to remit transition charge collections.

Entergy Texas Securitization Bonds —

Hurricane Ike and Hurricane Gustav

In September 2009, the PUCT authorized the issuance of securitiza-

tion bonds to recover $566.4 million of Entergy Texas’s Hurricane Ike

and Hurricane Gustav restoration costs, plus carrying costs and

transaction costs, offset by insurance proceeds. In November 2009,

Entergy Texas Restoration funding, LLC (Entergy Texas Restoration

Funding), a company wholly-owned and consolidated by Entergy

Texas, issued $545.9 million of senior secured transition bonds (secu-

ritization bonds), as follows (in thousands):

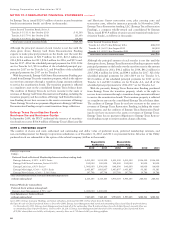

Senior Secured Transition Bonds:

Tranche A-1 (2.12%) due February 2016 $182,500

Tranche A-2 (3.65%) due August 2019 144,800

Tranche A-3 (4.38%) due November 2023 218,600

Total senior secured transition bonds $545,900

Although the principal amount of each tranche is not due until the

dates given above, Entergy Texas Restoration Funding expects to make

principal payments on the bonds over the next five years in the amount

of $39.4 million for 2013, $40.2 million for 2014, $41.2 million for

2015, $42.6 million for 2016, and $44.1 million for 2017. All of the

scheduled principal payments for 2013-2014 are for Tranche A-1,

$13.8 million of the scheduled principal payments for 2015 are for

Tranche A-1 and $27.4 million are for Tranche A-2, and all of the

scheduled principal payments for 2016-2017 are for Tranche A-2.

With the proceeds, Entergy Texas Restoration Funding purchased

from Entergy Texas the transition property, which is the right to

recover from customers through a transition charge amounts sufficient

to service the securitization bonds. The transition property is reflected

as a regulatory asset on the consolidated Entergy Texas balance sheet.

The creditors of Entergy Texas do not have recourse to the assets or

revenues of Entergy Texas Restoration Funding, including the transi-

tion property, and the creditors of Entergy Texas Restoration Fund-

ing do not have recourse to the assets or revenues of Entergy Texas.

Entergy Texas has no payment obligations to Entergy Texas Restora-

tion Funding except to remit transition charge collections.

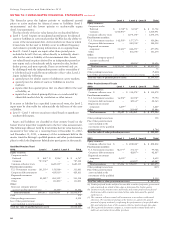

NOTE 6. PREFERRED EQUITY

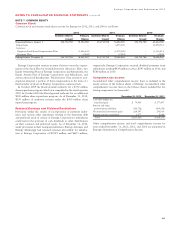

The number of shares and units authorized and outstanding and dollar value of preferred stock, preferred membership interests, and

non-controlling interest for Entergy Corporation subsidiaries as of December 31, 2012 and 2011 are presented below. All series of the Utility

preferred stock are redeemable at the option of the related company (dollars in thousands):

2012 2011 2012 2011 2012 2011

Entergy Corporation

Utility:

Preferred Stock or Preferred Membership Interests without sinking fund:

Entergy Arkansas, 4.32% - 6.45% Series 3,413,500 3,413,500 3,413,500 3,413,500 $116,350 $116,350

Entergy Gulf States Louisiana, Series A 8.25% 100,000 100,000 100,000 100,000 10,000 10,000

Entergy Louisiana, 6.95% Series(a) 1,000,000 1,000,000 840,000 840,000 84,000 84,000

Entergy Mississippi, 4.36% - 6.25% Series 1,403,807 1,403,807 1,403,807 1,403,807 50,381 50,381

Entergy New Orleans, 4.36% - 5.56% Series 197,798 197,798 197,798 197,798 19,780 19,780

Total Utility Preferred Stock or Preferred Membership Interests

without sinking fund 6,115,105 6,115,105 5,955,105 5,955,105 280,511 280,511

Entergy Wholesale Commodities:

Preferred Stock without sinking fund:

Entergy Asset Management, 8.95% rate(b) 1,000,000 1,000,000 – – – –

Total Subsidiaries’ Preferred Stock

without sinking fund 7,115,105 7,115,105 5,955,105 5,955,105 $280,511 $280,511

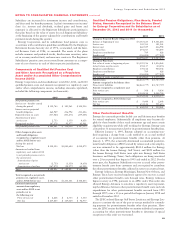

(a) In 2007, Entergy Louisiana Holdings, an Entergy subsidiary, purchased 160,000 of these shares from the holders.

(b) Upon the sale of Class B preferred shares in December 2009, Entergy Asset Management had issued and outstanding Class A and Class B preferred shares.

On December 20, 2011, Entergy Asset Management purchased all of the outstanding Class B preferred shares from the holder thereof; currently, there are

no outstanding Class B preferred shares. On December 20, 2011, Entergy Asset Management purchased all of the outstanding Class A preferred shares

(278,905 shares) that were held by a third party; currently, there are 4,759 shares held by an Entergy affiliate.

Shares/Units Shares/Units

Authorized Outstanding

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

82