Entergy 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

Derivatives

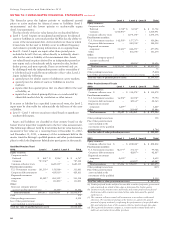

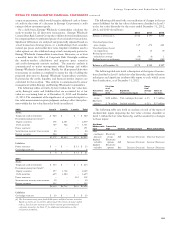

The fair values of Entergy’s derivative instruments in the consolidated balance sheet as of December 31, 2012 are as follows (in millions):

Instrument Balance Sheet Location Fair Value(a) Offset(a) Business

Derivatives designated as hedging instruments

Assets:

Electricity swaps and options Prepayments and other (current portion) $123 $ (–) Entergy Wholesale Commodities

Electricity swaps and options Other deferred debits and other assets

(non-current portion) $ 46 $(10) Entergy Wholesale Commodities

Liabilities:

Electricity swaps and options Other non-current liabilities

(non-current portion) $ 18 $(11) Entergy Wholesale Commodities

Derivatives not designated as hedging instruments

Assets:

Electricity swaps and options Prepayments and other (current portion) $ 22 $ (–) Entergy Wholesale Commodities

Electricity swaps, and options Other deferred debits and other assets

(non-current portion) $ 24 $(14) Entergy Wholesale Commodities

Liabilities:

Electricity swaps and options Other non-current liabilities

(non-current portion) $ 19 $(13) Entergy Wholesale Commodities

Natural gas swaps Other current liabilities $ 8 $ (–) Utility

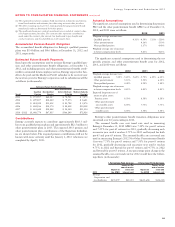

The fair values of Entergy’s derivative instruments in the consolidated balance sheet as of December 31, 2011 are as follows (in millions):

Instrument Balance Sheet Location Fair Value(a) Offset(a) Business

Derivatives designated as hedging instruments

Assets:

Electricity swaps and options Prepayments and other (current portion) $197 $(25) Entergy Wholesale Commodities

Electricity swaps and options Other deferred debits and other assets

(non-current portion) $112 $ (1) Entergy Wholesale Commodities

Liabilities:

Electricity swaps and options Other non-current liabilities

(non-current portion) $ 1 $ (1) Entergy Wholesale Commodities

Derivatives not designated as hedging instruments

Assets:

Electricity swaps and options Prepayments and other (current portion) $ 37 $ (8) Entergy Wholesale Commodities

Liabilities:

Electricity swaps and options Other current liabilities (current portion) $ 33 $(33) Entergy Wholesale Commodities

Natural gas swaps Other current liabilities $ 30 $ (–) Utility

(a) The balances of derivative assets and liabilities in these tables are presented gross. Certain investments, including those not designated as hedging instruments, are

subject to master netting agreements and are presented on the Entergy Consolidated Balance Sheets on a net basis in accordance with accounting guidance for

Derivatives and Hedging.

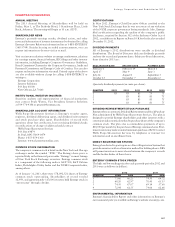

The effect of Entergy’s derivative instruments designated as cash flow hedges on the consolidated income statements for the years ended

December 31, 2012, 2011, and 2010 are as follows (in millions):

Amount of Gain Amount of Gain

Recognized in Other Reclassified From

Instrument Comprehensive Income Income Statement Location AOCI Into Income

2012

Electricity swaps and options $111 Competitive businesses operating revenues $268

2011

Electricity swaps and options $296 Competitive businesses operating revenues $168

2010

Electricity swaps and options $206 Competitive businesses operating revenues $220

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

100