Entergy 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

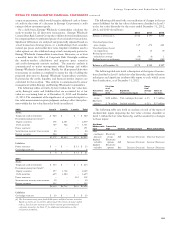

Entergy Louisiana Investment Recovery Funding I, L.L.C., a

company wholly-owned and consolidated by Entergy Louisiana,

is a variable interest entity and Entergy Louisiana is the primary

beneficiary. In September 2011, Entergy Louisiana Investment

Recovery Funding issued investment recovery bonds to recover

Entergy Louisiana’s investment recovery costs associated with the

cancelled Little Gypsy repowering project. With the proceeds,

Entergy Louisiana Investment Recovery Funding purchased from

Entergy Louisiana the investment recovery property, which is the

right to recover from customers through an investment recovery

charge amounts sufficient to service the bonds. The investment

recovery property is reflected as a regulatory asset on the consolidated

Entergy Louisiana balance sheet. The creditors of Entergy Louisiana

do not have recourse to the assets or revenues of Entergy Louisiana

Investment Recovery Funding, including the investment recovery

property, and the creditors of Entergy Louisiana Investment Recovery

Funding do not have recourse to the assets or revenues of Entergy

Louisiana. Entergy Louisiana has no payment obligations to Entergy

Louisiana Investment Recovery Funding except to remit investment

recovery charge collections. See Note 5 to the financial statements for

additional details regarding the investment recovery bonds.

Entergy Louisiana and System Energy are also considered to

each hold a variable interest in the lessors from which they lease

undivided interests in the Waterford 3 and Grand Gulf nuclear plants,

respectively. Entergy Louisiana and System Energy are the lessees

under these arrangements, which are described in more detail in

Note 10 to the financial statements. Entergy Louisiana made

payments on its lease, including interest, of $39.1 million in 2012,

$50.4 million in 2011, and $35.1 million in 2010. System Energy

made payments on its lease, including interest, of $50 million in

2012, $49.4 million in 2011, and $48.6 million in 2010. The lessors

are banks acting in the capacity of owner trustee for the benefit of

equity investors in the transactions pursuant to trust agreements

entered solely for the purpose of facilitating the lease transactions.

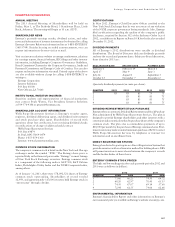

It is possible that Entergy Louisiana and System Energy may be

considered as the primary beneficiary of the lessors, but Entergy is

unable to apply the authoritative accounting guidance with respect

to these VIEs because the lessors are not required to, and could

not, provide the necessary financial information to consolidate the

lessors. Because Entergy accounts for these leasing arrangements as

capital financings, however, Entergy believes that consolidating the

lessors would not materially affect the financial statements. In the

unlikely event of default under a lease, remedies available to the

lessor include payment by the lessee of the fair value of the undivided

interest in the plant, payment of the present value of the basic rent

payments, or payment of a predetermined casualty value. Entergy

believes, however, that the obligations recorded on the balance sheets

materially represent each company’s potential exposure to loss.

Entergy has also reviewed various lease arrangements, power

purchase agreements, and other agreements in which it holds a

variable interest. In these cases, Entergy has determined that it is not

the primary beneficiary of the related VIE because it does not have the

power to direct the activities of the VIE that most significantly affect

the VIE’s economic performance, or it does not have the obligation to

absorb losses or the right to residual returns that would potentially be

significant to the entity, or both.

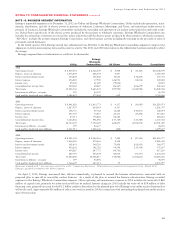

NOTE 19. QUARTERLY FINANCIAL DATA (UNAUDITED)

Operating results for the four quarters of 2012 and 2011 for Entergy

Corporation and subsidiaries were (in thousands):

Net Income

(Loss)

Operating Consolidated Attributable

Operating Income Net Income to Entergy

Revenues (Loss) (Loss) Corporation

2012:

First Quarter $2,383,659 $ (56,857) $(146,740) $(151,683)

Second Quarter $2,518,600 $342,984 $ 370,583 $ 365,001

Third Quarter $2,963,560 $690,852 $ 342,670 $ 337,088

Fourth Quarter $2,436,260 $324,202 $ 301,850 $ 296,267

2011:

First Quarter $2,541,208 $510,891 $ 253,678 $ 248,663

Second Quarter $2,803,279 $558,738 $ 320,598 $ 315,583

Third Quarter $3,395,553 $600,909 $ 633,069 $ 628,054

Fourth Quarter $2,489,033 $342,696 $ 160,027 $ 154,139

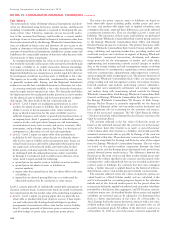

Earnings per Average Common Share

2012 2011

Basic Diluted Basic Diluted

First Quarter $(0.86) $(0.86) $1.39 $1.38

Second Quarter $ 2.06 $ 2.06 $1.77 $1.76

Third Quarter $ 1.90 $ 1.89 $3.55 $3.53

Fourth Quarter $ 1.67 $ 1.67 $0.88 $0.88

As discussed in more detail in Note 1 to the financial statements,

results of operations for 2012 include a $355.5 million ($223.5

million after-tax) impairment charge to write down the carrying

values of Vermont Yankee and related assets to their fair values.

The business of the Utility operating companies is subject to seasonal

fluctuations with the peak periods occurring during the third quarter.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS concluded

106