Entergy 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

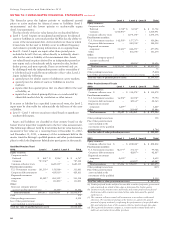

Pursuant to regulatory directives, Entergy Arkansas, Entergy

Mississippi, Entergy New Orleans, Entergy Texas, and System Energy

contribute the other postretirement benefit costs collected in rates into

external trusts. System Energy is funding, on behalf of Entergy Opera-

tions, other postretirement benefits associated with Grand Gulf.

Trust assets contributed by participating Registrant Subsidiaries

are in bank-administered master trusts, established by Entergy Cor-

poration and maintained by a trustee. Each participating Registrant

Subsidiary holds a beneficial interest in the trusts’ assets. The assets

in the master trusts are commingled for investment and administra-

tive purposes. Although assets are commingled, supporting records

are maintained for the purpose of allocating the beneficial interest in

net earnings/(losses) and the administrative expenses of the invest-

ment accounts to the various participating plans and participating

Registrant Subsidiaries. Beneficial interest in an investment account’s

net income/(loss) is comprised of interest and dividends, realized

and unrealized gains and losses, and expenses. Beneficial interest

from these investments is allocated to the plans and participating

Registrant Subsidiary based on their portion of net assets in the

pooled accounts.

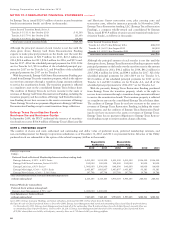

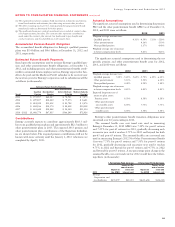

Components of Net Other Postretirement

Benefit Cost and Other Amounts Recognized

as a Regulatory Asset and/or AOCI

Entergy Corporation’s and its subsidiaries’ total 2012, 2011, and 2010

other postretirement benefit costs, including amounts capitalized and

amounts recognized as a regulatory asset and/or other comprehensive

income, included the following components (in thousands):

2012 2011 2010

Other postretirement costs:

Service cost - benefits earned

during the period $ 68,883 $ 59,340 $ 52,313

Interest cost on APBO 82,561 74,522 76,078

Expected return on assets (34,503) (29,477) (26,213)

Amortization of transition obligation 3,177 3,183 3,728

Amortization of prior service credit (18,163) (14,070) (12,060)

Recognized net loss 36,448 21,192 17,270

Net other postretirement benefit cost $138,403 $114,690 $111,116

Other changes in plan assets and benefit

obligations recognized as a regulatory asset

and/or AOCI (before tax)

Arising this period:

Prior service credit for period $ – $(29,507) $ (50,548)

Net loss 92,584 236,594 82,189

Amounts reclassified from regulatory

asset and/or AOCI to net periodic

benefit cost in the current year:

Amortization of transition obligation (3,177) (3,183) (3,728)

Amortization of prior service credit 18,163 14,070 12,060

Amortization of net loss (36,448) (21,192) (17,270)

Total $ 71,122 $196,782 $ 22,703

Total recognized as net periodic

benefit cost, regulatory asset,

and/or AOCI (before tax) $209,525 $311,472 $133,819

Estimated amortization amounts from

regulatory asset and/or AOCI to net

periodic benefit cost in the following year

Transition obligation $ – $ 3,177 $ 3,183

Prior service credit $ (13,336) $(18,163) $ (14,070)

Net loss $ 45,217 $ 43,127 $ 21,192

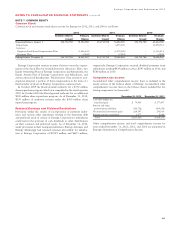

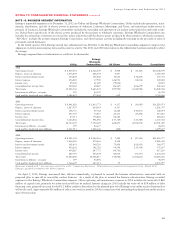

Other Postretirement Benefit Obligations,

Plan Assets, Funded Status, and Amounts Not Yet

Recognized and Recognized in the Balance Sheet

of Entergy Corporation and its Subsidiaries as of

December 31, 2012 and 2011 (in thousands):

2012 2011

Change in APBO

Balance at beginning of year $ 1,652,369 $ 1,386,370

Service cost 68,883 59,340

Interest cost 82,561 74,522

Plan amendments – (29,507)

Plan participant contributions 18,102 14,650

Actuarial loss 102,833 216,549

Benefits paid (83,825) (77,454)

Medicare Part D subsidy received 5,999 4,551

Early Retiree Reinsurance Program proceeds – 3,348

Balance at end of year $ 1,846,922 $ 1 , 6 5 2 , 3 6 9

Change in Plan Assets

Fair value of assets at beginning of year $ 427,172 $ 404,430

Actual return on plan assets 44,752 9,432

Employer contributions 82,247 76,114

Plan participant contributions 18,102 14,650

Early Retiree Reinsurance Program proceeds – –

Benefits paid (83,825) (77,454)

Fair value of assets at end of year $ 488,448 $ 427,172

Funded status $(1,358,474) $(1,225,197)

Amounts recognized in the balance sheet

Current liabilities $ (33,813) $ (32,832)

Non-current liabilities (1,324,661) (1,192,365)

Total funded status $(1,358,474) $(1,225,197)

Amounts recognized as a regulatory asset

Transition obligation $ – $ 2,557

Prior service credit (5,307) (6,628)

Net loss 367,519 353,905

$ 362,212 $ 349,834

Amounts recognized as AOCI (before tax)

Transition obligation $ – $ 620

Prior service credit (49,335) (66,176)

Net loss 355,900 313,379

$ 306 ,565 $ 247,823

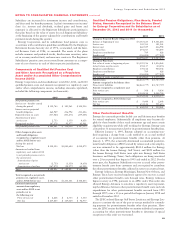

Non-Qualified Pension Plans

Entergy also sponsors non-qualified, non-contributory defined benefit

pension plans that provide benefits to certain key employees. Entergy

recognized net periodic pension cost related to these plans of $26.5

million in 2012, $24 million in 2011, and $27.2 million in 2010. In

2012, 2011, and 2010 Entergy recognized $6.3 million, $4.6 mil-

lion, and $9.3 million, respectively in settlement charges related to

the payment of lump sum benefits out of the plan that is included

in the non-qualified pension plan cost above. The projected benefit

obligation was $199.3 million and $164.4 million as of December

31, 2012 and 2011, respectively. The accumulated benefit obligation

was $180.6 million and $146.5 million as of December 31, 2012 and

2011, respectively.

Entergy’s non-qualified, non-current pension liability at December

31, 2012 and 2011 was $137.2 million and $153.2 million, respec-

tively; and its current liability was $62.1 million and $11.2 million,

respectively. The unamortized transition asset, prior service cost

and net loss are recognized in regulatory assets ($81.2 million at

90