Entergy 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

Depreciation rates on average depreciable property for Entergy

approximated 2.5% in 2012, 2.6% in 2011, and 2.6% in 2010.

Included in these rates are the depreciation rates on average deprecia-

ble Utility property of 2.4% in 2012, 2.5% in 2011, and 2.5% 2010,

and the depreciation rates on average depreciable Entergy Wholesale

Commodities property of 3.5% in 2012, 3.9% in 2011, and 3.7%

in 2010.

Entergy amortizes nuclear fuel using a units-of-production method.

Nuclear fuel amortization is included in fuel expense in the income

statements.

“Non-utility property - at cost (less accumulated depreciation)” for

Entergy is reported net of accumulated depreciation of $230.4 million

and $214.3 million as of December 31, 2012 and 2011, respectively.

Construction expenditures included in accounts payable is

$267 million and $171 million at December 31, 2012 and 2011,

respectively.

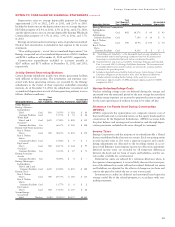

Jointly-Owned Generating Stations

Certain Entergy subsidiaries jointly own electric generating facilities

with affiliates or third parties. The investments and expenses asso-

ciated with these generating stations are recorded by the Entergy

subsidiaries to the extent of their respective undivided ownership

interests. As of December 31, 2012, the subsidiaries’ investment and

accumulated depreciation in each of these generating stations were as

follows (dollars in millions):

Total

Fuel Megawatt Accumulated

Generating Stations Type Capability(1) Ownership Investment Depreciation

Utility Business:

Entergy Arkansas -

Independence

Unit 1 Coal 836 31.50% $ 128 $ 86

Common Facilities Coal 15.75% $ 33 $ 22

White Bluff

Units 1 and 2 Coal 1,659 57.00% $ 498 $ 319

Ouachita(2)

Common Facilities Gas 66.67% $ 169 $ 142

Entergy Gulf States Louisiana -

Roy S. Nelson

Unit 6 Coal 540 40.25% $ 250 $ 170

Roy S. Nelson

Unit 6

Common Facilities Coal 15.92% $ 9 $ 3

Big Cajun 2

Unit 3 Coal 588 24.15% $ 142 $ 99

Ouachita(2)

Common Facilities Gas 33.33% $ 87 $ 73

Entergy Louisiana -

Acadia

Common Facilities Gas 50.00% $ 8 $ –

Entergy Mississippi -

Independence

Units 1 and 2 and

Common Facilities Coal 1,678 25.00% $ 250 $ 140

Entergy Texas -

Roy S. Nelson

Unit 6 Coal 540 29.75% $ 180 $ 113

Roy S. Nelson

Unit 6

Common Facilities Coal 11.77% $ 6 $ 2

Big Cajun 2

Unit 3 Coal 588 17.85% $ 107 $ 68

System Energy -

Grand Gulf

Unit 1 Nuclear 1,430(4) 90.00%(3) $4,557 $2,569

Total

Fuel Megawatt Accumulated

Generating Stations Type Capability(1) Ownership Investment Depreciation

Entergy Wholesale Commodities:

Independence

Unit 2 Coal 842 14.37% $ 69 $ 43

Independence

Common Facilities Coal 7.18% $ 16 $ 9

Roy S. Nelson

Unit 6 Coal 540 10.9% $ 104 $ 54

Roy S. Nelson

Unit 6

Common Facilities Coal 4.31% $ 2 $ 1

(1) “Total Megawatt Capability” is the dependable load carrying capability as

demonstrated under actual operating conditions based on the primary fuel

(assuming no curtailments) that each station was designed to utilize.

(2) Ouachita Units 1 and 2 are owned 100% by Entergy Arkansas and Ouachita

Unit 3 is owned 100% by Entergy Gulf States Louisiana. The investment and

accumulated depreciation numbers above are only for the common facilities

and not for the generating units.

(3) Includes a leasehold interest held by System Energy. System Energy’s Grand

Gulf lease obligations are discussed in Note 10 to the financial statements.

(4) Includes estimate, pending further testing, of the rerate for recovered

performance (approximately 55 MW) and uprate (approximately 178 MW)

completed in 2012.

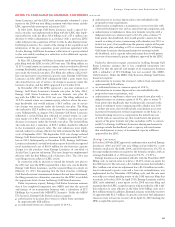

Nuclear Refueling Outage Costs

Nuclear refueling outage costs are deferred during the outage and

amortized over the estimated period to the next outage because these

refueling outage expenses are incurred to prepare the units to operate

for the next operating cycle without having to be taken off line.

Allowance for Funds Used During Construction

(AFUDC)

AFUDC represents the approximate net composite interest cost of

borrowed funds and a reasonable return on the equity funds used for

construction by the Registrant Subsidiaries. AFUDC increases both

the plant balance and earnings and is realized in cash through depre-

ciation provisions included in the rates charged to customers.

Income Taxes

Entergy Corporation and the majority of its subsidiaries file a United

States consolidated federal income tax return. Each tax-paying entity

records income taxes as if it were a separate taxpayer and consoli-

dating adjustments are allocated to the tax filing entities in accor-

dance with Entergy’s intercompany income tax allocation agreement.

Deferred income taxes are recorded for all temporary differences

between the book and tax basis of assets and liabilities, and for cer-

tain credits available for carryforward.

Deferred tax assets are reduced by a valuation allowance when, in

the opinion of management, it is more likely than not that some por-

tion of the deferred tax assets will not be realized. Deferred tax assets

and liabilities are adjusted for the effects of changes in tax laws and

rates in the period in which the tax or rate was enacted.

Investment tax credits are deferred and amortized based upon the

average useful life of the related property, in accordance with rate-

making treatment.

57