Entergy 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

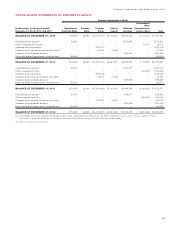

CONSOLIDATED BALANCE SHEETS

In thousands, as of December 31, 2012 2011

LIABILITIES AND EQUITY

CURRENT LIABILITIES

Currently maturing long-term debt $ 718,516 $ 2,192,733

Notes payable and commercial paper 796,002 108,331

Accounts payable 1,217,180 1,069,096

Customer deposits 359,078 351,741

Taxes accrued 333,719 278,235

Accumulated deferred income taxes 13,109 99,929

Interest accrued 184,664 183,512

Deferred fuel costs 96,439 255,839

Obligations under capital leases 3,880 3,631

Pension and other postretirement liabilities 95,900 44,031

System agreement cost equalization 25,848 80,090

Other 261,986 283,531

Total 4,106,321 4,950,699

NON-CURRENT LIABILITIES

Accumulated deferred income taxes and taxes accrued 8,311,756 8,096,452

Accumulated deferred investment tax credits 273,696 284,747

Obligations under capital leases 34,541 38,421

Other regulatory liabilities 898,614 728,193

Decommissioning and asset retirement cost liabilities 3,513,634 3,296,570

Accumulated provisions 362,226 385,512

Pension and other postretirement liabilities 3,725,886 3,133,657

Long-term debt (includes securitization bonds of

$973,480 as of December 31, 2012 and $1,070,556 as of December 31, 2011) 11,920,318 10,043,713

Other 577,910 501,954

Total 29,618,581 26,509,219

Commitments and Contingencies

Subsidiaries’ preferred stock without sinking fund 186,511 186,511

EQUITY

Common Shareholders’ Equity:

Common stock, $.01 par value, authorized 500,000,000 shares;

issued 254,752,788 shares in 2012 and in 2011 2,548 2,548

Paid-in capital 5,357,852 5,360,682

Retained earnings 9,704,591 9,446,960

Accumulated other comprehensive loss (293,083) (168,452)

Less - treasury stock, at cost (76,945,239 shares in 2012 and

78,396,988 shares in 2011) 5,574,819 5,680,468

Total common shareholders’ equity 9,197,089 8,961,270

Subsidiaries’ preferred stock without sinking fund 94,000 94,000

Total 9,291,089 9,055,270

TOTAL LIABILITIES AND EQUITY $43,202,502 $40,701,699

See Notes to Financial Statements.

53