Entergy 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS continued

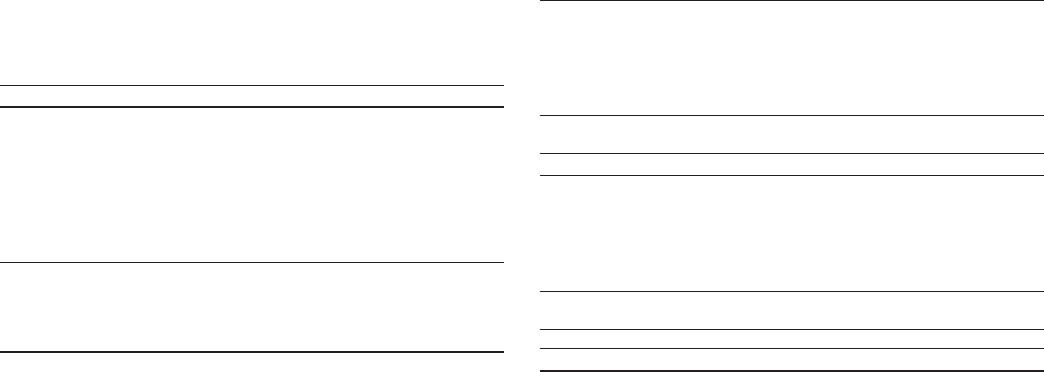

OPERATING LEASE OBLIGATIONS AND GUARANTEES

OF UNCONSOLIDATED OBLIGATIONS

Entergy has a minimal amount of operating lease obligations and

guarantees in support of unconsolidated obligations. Entergy’s guar-

antees in support of unconsolidated obligations are not likely to have

a material effect on Entergy’s financial condition, results of opera-

tions, or cash flows. Following are Entergy’s payment obligations as

of December 31, 2012 on non-cancelable operating leases with a term

over one year (in millions):

2016- After

2013 2014 2015 2017 2017

Operating lease payments $94 $97 $80 $94 $140

The operating leases are discussed in Note 10 to the financial statements.

SUMMARY OF CONTRACTUAL OBLIGATIONS OF

CONSOLIDATED ENTITIES (IN MILLIONS):

2014- 2016- After

Contractual Obligations 2013 2015 2017 2017 Total

Long-term debt(1) $1,292 $2,463 $2,929 $12,755 $19,439

Capital lease payments(2) $ 6 $ 10 $ 9 $ 34 $ 59

Operating leases(2) $ 94 $ 177 $ 94 $ 140 $ 505

Purchase obligations(3) $1,939 $3,512 $2,609 $11,195 $19,255

˜

(1) Includes estimated interest payments. Long-term debt is discussed in Note 5 to

the financial statements.

(2) Lease obligations are discussed in Note 10 to the financial statements.

(3) Purchase obligations represent the minimum purchase obligation or

cancellation charge for contractual obligations to purchase goods or services.

Almost all of the total are fuel and purchased power obligations.

In addition to the contractual obligations, Entergy currently expects

to contribute approximately $163.3 million to its pension plans and

approximately $82.5 million to other postretirement plans in 2013,

although the required pension contributions will not be known with

more certainty until the January 1, 2013 valuations are completed by

April 1, 2013. See “Critical Accounting Estimates – Qualified Pension

and Other Postretirement Benefits” below for a discussion of quali-

fied pension and other postretirement benefits funding.

Also in addition to the contractual obligations, Entergy has $148

million of unrecognized tax benefits and interest net of unused tax

attributes for which the timing of payments beyond 12 months cannot

be reasonably estimated due to uncertainties in the timing of effective

settlement of tax positions. See Note 3 to the financial statements for

additional information regarding unrecognized tax benefits.

CAPITAL FUNDS AGREEMENT

Pursuant to an agreement with certain creditors, Entergy Corporation

has agreed to supply System Energy with sufficient capital to:

n maintain System Energy’s equity capital at a minimum of 35% of

its total capitalization (excluding short-term debt);

n permit the continued commercial operation of Grand Gulf;

n pay in full all System Energy indebtedness for borrowed money

when due; and

n enable System Energy to make payments on specific System

Energy debt, under supplements to the agreement assigning

System Energy’s rights in the agreement as security for the

specific debt.

Capital Expenditure Plans and Other Uses of Capital

Following are the amounts of Entergy’s planned construction and

other capital investments by operating segment for 2013 through

2015 (in millions):

Planned Construction and

Capital Investments 2013 2014 2015

Maintenance Capital:

Utility:

Generation $ 133 $ 127 $ 135

Transmission 253 229 202

Distribution 504 494 489

Other 97 107 105

Total 987 957 931

Entergy Wholesale Commodities 108 131 176

$1,095 $1,088 $1,107

Capital Commitments:

Utility:

Generation $ 716 $ 415 $ 392

Transmission 162 240 303

Distribution 45 21 16

Other 92 88 92

Total 1,015 764 803

Entergy Wholesale Commodities 257 242 281

1,272 1,006 1,084

Total $2,367 $2,094 $2,191

The planned amounts do not reflect the expected reduction in capital

expenditures that would occur if the planned spin-off and merger

of the transmission business with ITC Holdings occurs, and do not

include material costs for capital projects that might result from the

NRC post-Fukushima requirements that remain under development.

Maintenance Capital refers to amounts Entergy plans to spend on

routine capital projects that are necessary to support reliability of

its service, equipment, or systems and to support normal customer

growth, and includes spending for the nuclear and non-nuclear plants

at Entergy Wholesale Commodities.

Capital Commitments refers to non-routine capital investments for

which Entergy is either contractually obligated, has Board approval,

or otherwise expects to make to satisfy regulatory or legal require-

ments. Amounts reflected in this category include the following.

n The currently planned construction or purchase of additional

generation supply sources within the Utility’s service territory

through the Utility’s portfolio transformation strategy, including a

self-build option at Entergy Louisiana’s Ninemile site identified in

the Summer 2009 Request for Proposal and final spending from

the Waterford 3 steam generator replacement project, both of

which are discussed below.

n Spending to support the Utility’s plan to join the MISO RTO by

December 2013 along with other transmission projects.

n Entergy Wholesale Commodities investments associated with

specific investments such as dry cask storage, nuclear license

renewal, component replacement and identified repairs, and

potential wedgewire screens at Indian Point.

n Environmental compliance spending. Entergy continues to

review potential environmental spending needs and financing

alternatives for any such spending, and future spending estimates

could change based on the results of this continuing analysis and

the implementation of new environmental laws and regulations.

The Utility’s owned generating capacity remains short of customer

demand, and its supply plan initiative will continue to seek to trans-

form its generation portfolio with new or repowered generation

resources. Opportunities resulting from the supply plan initiative,

including new projects or the exploration of alternative financing

34