Entergy 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

Medicare Prescription Drug, Improvement and

Modernization Act of 2003

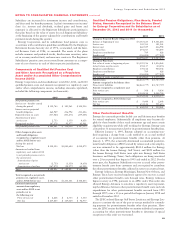

In December 2003, the Medicare Prescription Drug, Improvement

and Modernization Act of 2003 became law. The Act introduces a

prescription drug benefit cost under Medicare (Part D), which started

in 2006, as well as a federal subsidy to employers who provide a

retiree prescription drug benefit that is at least actuarially equivalent

to Medicare Part D.

The actuarially estimated effect of future Medicare subsidies

reduced the December 31, 2012 and 2011 Accumulated Postre-

tirement Benefit Obligation by $316.6 million and $274 million,

respectively, and reduced the 2012, 2011, and 2010 other postretire-

ment benefit cost by $31.2 million, $33.0 million, and $26.6 mil-

lion, respectively. In 2012, Entergy received $6 million in Medicare

subsidies for prescription drug claims.

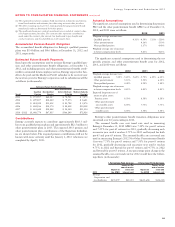

Defined Contribution Plans

Entergy sponsors the Savings Plan of Entergy Corporation and Sub-

sidiaries (System Savings Plan). The System Savings Plan is a defined

contribution plan covering eligible employees of Entergy and its sub-

sidiaries. The employing Entergy subsidiary makes matching contri-

butions for all non-bargaining and certain bargaining employees to

the System Savings Plan in an amount equal to 70% of the partici-

pants’ basic contributions, up to 6% of their eligible earnings per pay

period. The 70% match is allocated to investments as directed by

the employee.

Entergy also sponsors the Savings Plan of Entergy Corporation

and Subsidiaries IV (established in 2002), the Savings Plan of Entergy

Corporation and Subsidiaries VI (established in April 2007), and the

Savings Plan of Entergy Corporation and Subsidiaries VII (established

in April 2007) to which matching contributions are also made. The

plans are defined contribution plans that cover eligible employees, as

defined by each plan, of Entergy and its subsidiaries. Effective June

3, 2010, employees participating in the Savings Plan of Entergy Cor-

poration and Subsidiaries II (Savings Plan II) were transferred into

the System Savings Plan when Savings Plan II merged into the System

Savings Plan.

Entergy’s subsidiaries’ contributions to defined contribution plans

collectively were $43.7 million in 2012, $42.6 million in 2011, and

$41.8 million in 2010. The majority of the contributions were to the

System Savings Plan.

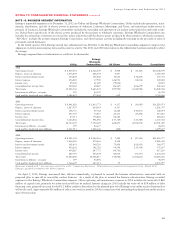

NOTE 12. STOCK-BASED COMPENSATION

Entergy grants stock options, restricted stock, performance units, and

restricted unit awards to key employees of the Entergy subsidiaries

under its Equity Ownership Plans which are shareholder-approved

stock-based compensation plans. The Equity Ownership Plan, as

restated in February 2003 (2003 Plan), had 743,129 authorized

shares remaining for long-term incentive and restricted unit awards

as of December 31, 2012. Effective January 1, 2007, Entergy’s

shareholders approved the 2007 Equity Ownership and Long-Term

Cash Incentive Plan (2007 Plan). The maximum aggregate number of

common shares that can be issued from the 2007 Plan for stock-based

awards is 7,000,000 with no more than 2,000,000 available for non-

option grants. The 2007 Plan, which only applies to awards made on

or after January 1, 2007, will expire after 10 years. As of December

31, 2012, there were 1,075,702 authorized shares remaining for

stock-based awards, all of which are available for non-option grants.

Effective May 6, 2011, Entergy’s shareholders approved the 2011

Equity Ownership and Long-Term Cash Incentive Plan (2011 Plan).

The maximum number of common shares that can be issued from

the 2011 Plan for stock-based awards is 5,500,000 with no more

than 2,000,000 available for incentive stock option grants. The

2011 Plan, which only applies to awards made on or after May 6,

2011, will expire after 10 years. As of December 31, 2012, there

were 4,263,138 authorized shares remaining for stock-based awards,

including 1,447,600 for incentive stock option grants.

Stock Options

Stock options are granted at exercise prices that equal the closing

market price of Entergy Corporation common stock on the date of

grant. Generally, stock options granted will become exercisable in

equal amounts on each of the first three anniversaries of the date

of grant. Unless they are forfeited previously under the terms of the

grant, options expire ten years after the date of the grant if they are

not exercised.

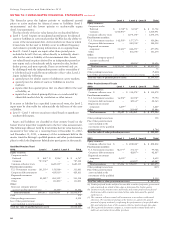

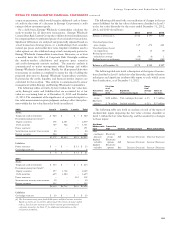

The following table includes financial information for stock

options for each of the years presented (in millions):

2012 2011 2010

Compensation expense included in

Entergy’s consolidated net income $7.7 $10.4 $15.0

Tax benefit recognized in Entergy’s

consolidated net income $3.0 $ 4.0 $ 5.8

Compensation cost capitalized as

part of fixed assets and inventory $1.5 $ 2.0 $ 2.9

Entergy determines the fair value of the stock option grants by

considering factors such as lack of marketability, stock retention

requirements, and regulatory restrictions on exercisability in accor-

dance with accounting standards. The stock option weighted-average

assumptions used in determining the fair values are as follows:

2012 2011 2010

Stock price volatility 25.11% 24.25% 25.73%

Expected term in years 6.55 6.64 5.46

Risk-free interest rate 1.22% 2.70% 2.57%

Dividend yield 4.50% 4.20% 3.74%

Dividend payment per share $3.32 $3.32 $3.24

Stock price volatility is calculated based upon the daily public stock

price volatility of Entergy Corporation common stock over a period

equal to the expected term of the award. The expected term of the

options is based upon historical option exercises and the weighted

average life of options when exercised and the estimated weighted

average life of all vested but unexercised options. In 2008, Entergy

implemented stock ownership guidelines for its senior executive

officers. These guidelines require an executive officer to own shares

of Entergy Corporation common stock equal to a specified multiple

of his or her salary. Until an executive officer achieves this ownership

position the executive officer is required to retain 75% of the after-

tax net profit upon exercise of the option to be held in Entergy

Corporation common stock. The reduction in fair value of the stock

options due to this restriction is based upon an estimate of the call

option value of the reinvested gain discounted to present value over

the applicable reinvestment period.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

94