Entergy 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

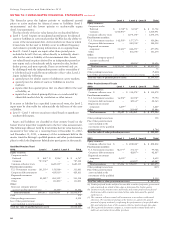

The hierarchy gives the highest priority to unadjusted quoted

prices in active markets for identical assets or liabilities (level 1

measurements) and the lowest priority to unobservable inputs

(level 3 measurements).

The three levels of the fair value hierarchy are described below:

n Level 1 - Level 1 inputs are unadjusted quoted prices for identical

assets or liabilities in active markets that the Plan has the ability to

access at the measurement date. Active markets are those in which

transactions for the asset or liability occur in sufficient frequency

and volume to provide pricing information on an ongoing basis.

n Level 2 - Level 2 inputs are inputs other than quoted prices

included in Level 1 that are, either directly or indirectly, observ-

able for the asset or liability at the measurement date. Assets

are valued based on prices derived by an independent party that

uses inputs such as benchmark yields, reported trades, broker/

dealer quotes, and issuer spreads. Prices are reviewed and can

be challenged with the independent parties and/or overridden if

it is believed such would be more reflective of fair value. Level 2

inputs include the following:

n quoted prices for similar assets or liabilities in active markets;

n quoted prices for identical assets or liabilities in inactive

markets;

n inputs other than quoted prices that are observable for the asset

or liability; or

n inputs that are derived principally from or corroborated by

observable market data by correlation or other means.

If an asset or liability has a specified (contractual) term, the Level 2

input must be observable for substantially the full term of the asset

or liability.

n Level 3 - Level 3 refers to securities valued based on significant

unobservable inputs.

Assets and liabilities are classified in their entirety based on the

lowest level of input that is significant to the fair value measurement.

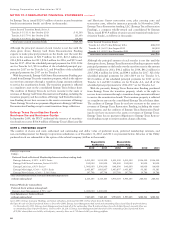

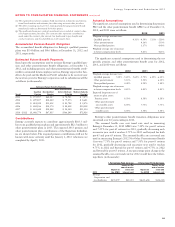

The following tables set forth by level within the fair value hierarchy,

measured at fair value on a recurring basis at December 31, 2012,

and December 31, 2011, a summary of the investments held in the

master trusts for Entergy’s qualified pension and other postretirement

plans in which the Registrant Subsidiaries participate (in thousands):

Qualified Pension Trust

2012 Level 1 Level 2 Level 3 Total

Equity securities:

Corporate stocks:

Preferred $ 861(b) $ 5,906(a) $– $ 6,767

Common 787,132(b) – – 787,132

Common collective trusts – 1,620,315(c) – 1,620,315

Fixed income securities:

U.S. Government securities 161,593(b) 150,068(a) – 311,661

Corporate debt instruments – 429,813(a) – 429,813

Registered investment

companies 50,029(d) 483,509(e) – 533,538

Other – 111,001(f) – 111,001

Other:

Insurance company general

account (unallocated contracts) – 36,252(g) – 36,252

Total investments $999,615 $2,836,864 $– $3,836,479

Cash 571

Other pending transactions 4,594

Less: Other postretirement

assets included in total investments (8,784)

Total fair value of qualified pension assets $3,832,860

2011 Level 1 Level 2 Level 3 Total

Equity securities:

Corporate stocks:

Preferred $ 3,738(b) $ 8,014(a) $– $ 11,752

Common 1,010,491(b) – – 1,010,491

Common collective trusts – 1,074,178(c) – 1,074,178

Fixed income securities:

U.S. Government securities 142,509(b) 157,737(a) – 300,246

Corporate debt instruments – 380,558(a) – 380,558

Registered investment

companies 53,323(d) 444,275(e) – 497,598

Other – 101,674(f) – 101,674

Other:

Insurance company general

account (unallocated

contracts) – 34,696(g) – 34,696

Total investments $1,210,061 $2,201,132 $– $3,411,193

Cash 75

Other pending transactions (9,238)

Less: Other postretirement assets included in total investments (2,114)

Total fair value of qualified pension assets $3,399,916

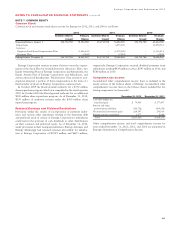

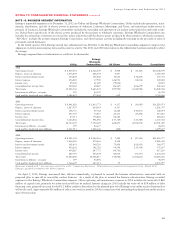

Other Postretirement Trusts

2012 Level 1 Level 2 Level 3 Total

Equity securities:

Common collective trust $ – $ 314,478(c) $– $ 314,478

Fixed income securities:

U.S. Government securities 36,392(b) 43,398(a) – 79,790

Corporate debt instruments – 42,163(a) – 42,163

Registered investment

companies 3,229(d) – – 3,229

Other – 39,846(f) – 39,846

Total investments $ 39,621 $ 439,885 $– $ 479,506

Other pending transactions 158

Plus: Other postretirement

assets included in the

investments of the qualified

pension trust 8,784

Total fair value of other postretirement assets $ 488,448

2011 Level 1 Level 2 Level 3 Total

Equity securities:

Common collective trust $ – $ 208,812(c) $– $ 208,812

Fixed income securities:

U.S. Government securities 42,577(b) 57,151(a) – 99,728

Corporate debt instruments – 42,807(a) – 42,807

Registered investment

companies 4,659(d) – – 4,659

Other – 69,287(f) – 69,287

Total investments $ 47,236 $ 378,057 $– $ 425,293

Other pending transactions (235)

Plus: Other postretirement

assets included in the

investments of the qualified

pension trust 2,114

Total fair value of other postretirement assets $ 427,172

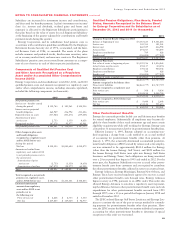

(a) Certain preferred stocks and fixed income debt securities (corporate, government,

and securitized) are stated at fair value as determined by broker quotes.

(b) Common stocks, treasury notes and bonds, and certain preferred stocks and

fixed income debt securities are stated at fair value determined by quoted

market prices.

(c) The common collective trusts hold investments in accordance with stated

objectives. The investment strategy of the trusts is to capture the growth

potential of equity markets by replicating the performance of a specified index.

Net asset value per share of the common collective trusts estimate fair value.

(d) The registered investment company is a money market mutual fund with a

stable net asset value of one dollar per share.

92