Entergy 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

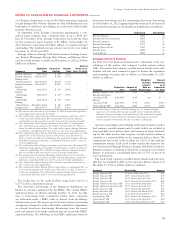

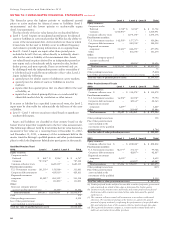

The cumulative decommissioning and retirement cost liabilities and

expenses recorded in 2011 by Entergy were as follows (in millions):

Change

Liabilities in Cash Liabilities

as of Dec. Flow as of Dec.

31, 2010 Accretion Estimate Spending 31, 2011

Utility:

Entergy Arkansas $ 602.2 $ 38.0 $ – $ – $ 640.2

Entergy Gulf States

Louisiana $ 339.9 $ 19.9 $ – $ – $ 359.8

Entergy Louisiana $ 321.2 $ 24.6 $ – $ – $ 345.8

Entergy Mississippi $ 5.4 $ 0.3 $ – $ – $ 5.7

Entergy

New Orleans $ 3.4 $ 0.2 $ – $(0.7) $ 2.9

Entergy Texas $ 3.6 $ 0.3 $ – $ – $ 3.9

System Energy $ 452.8 $ 31.5 $(38.9) $ – $ 445.4

Entergy Wholesale

Commodities $1,420.0 $115.6 $(34.1) $(8.6) $1,492.9

Entergy periodically reviews and updates estimated decommission-

ing costs. The actual decommissioning costs may vary from the esti-

mates because of regulatory requirements, changes in technology,

and increased costs of labor, materials, and equipment. As described

below, during 2012 and 2011 Entergy updated decommissioning cost

estimates for certain nuclear power plants.

In the second quarter 2012, Entergy Louisiana recorded a revision

to its estimated decommissioning cost liability for Waterford 3 as a

result of a revised decommissioning cost study. The revised estimate

resulted in a $48.9 million increase in its decommissioning cost liabil-

ity, along with a corresponding increase in the related asset retirement

costs asset that will be depreciated over the remaining life of the unit.

In the second quarter 2012, Entergy Wholesale Commodities recorded

a reduction of $60.6 million in the estimated decommissioning cost lia-

bility for a plant as a result of a revised decommissioning cost study.

The revised estimate resulted in a credit to decommissioning expense of

$49 million, reflecting the excess of the reduction in the liability over the

amount of the undepreciated asset retirement costs asset.

In the first quarter of 2011, System Energy recorded a revision

to its estimated decommissioning cost liability for Grand Gulf as a

result of a revised decommissioning cost study. The revised estimate

resulted in a $38.9 million reduction in its decommissioning liability,

along with a corresponding reduction in the related regulatory asset.

In the fourth quarter of 2011, Entergy Wholesale Commodities

recorded a reduction of $34.1 million in the decommissioning cost

liability for a plant as a result of a revised decommissioning cost study

obtained to comply with a state regulatory requirement. The revised

cost study resulted in a change in the undiscounted cash flows and

a credit to decommissioning expense of $34.1 million, reflecting the

excess of the reduction in the liability over the amount of undepreci-

ated assets.

For the Indian Point 3 and FitzPatrick plants purchased in 2000,

NYPA retained the decommissioning trusts and the decommissioning

liabilities. NYPA and Entergy subsidiaries executed decommission-

ing agreements, which specify their decommissioning obligations.

NYPA has the rights to require the Entergy subsidiaries to assume

each of the decommissioning liabilities provided that it assigns the

corresponding decommissioning trust, up to a specified level, to the

Entergy subsidiaries. If the decommissioning liabilities are retained

by NYPA, the Entergy subsidiaries will perform the decommission-

ing of the plants at a price equal to the lesser of a pre-specified level

or the amount in the decommissioning trusts. Entergy recorded an

asset, which is now $546.5 million as of December 31, 2012, rep-

resenting its estimate of the present value of the difference between

the stipulated contract amount for decommissioning the plants less

the decommissioning costs estimated in independent decommission-

ing cost studies. The asset is increased by monthly accretion based on

the applicable discount rate necessary to ultimately provide for the

estimated future value of the decommissioning contract. The monthly

accretion is recorded as interest income.

Entergy maintains decommissioning trust funds that are committed

to meeting the costs of decommissioning the nuclear power plants.

The fair values of the decommissioning trust funds and the related

asset retirement obligation regulatory assets (liabilities) of Entergy as

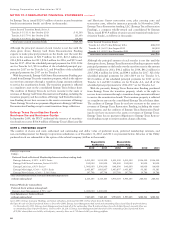

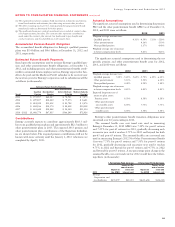

of December 31, 2012 are as follows (in millions):

Regulatory

Decommissioning Trust Fair Values Asset (Liability)

Utility:

ANO 1 and ANO 2 $ 600.6 $204.0

River Bend $ 477.4 $ (1.7)

Waterford 3 $ 287.4 $126.7

Grand Gulf $ 490.6 $ 58.9

Entergy Wholesale Commodities $2,334.1 $ –

Entergy maintains decommissioning trust funds that are com-

mitted to meeting the costs of decommissioning the nuclear power

plants. The fair values of the decommissioning trust funds and the

related asset retirement obligation regulatory assets of Entergy as of

December 31, 2011 are as follows (in millions):

Decommissioning Trust Fair Values Regulatory Asset

Utility:

ANO 1 and ANO 2 $ 541.7 $181.5

River Bend $ 420.9 $ 5.5

Waterford 3 $ 254.0 $116.1

Grand Gulf $ 423.4 $ 59.6

Entergy Wholesale Commodities $2,148.0 $ –

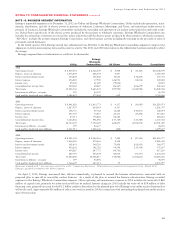

NOTE 10. LEASES

General

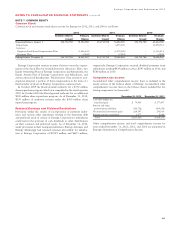

As of December 31, 2012, Entergy had capital leases and non-can-

celable operating leases for equipment, buildings, vehicles, and fuel

storage facilities (excluding nuclear fuel leases and the Grand Gulf

and Waterford 3 sale and leaseback transactions) with minimum lease

payments as follows (in thousands):

Year Operating Leases Capital Leases

2013 $ 94,422 $ 6,494

2014 97,001 4,694

2015 80,172 4,615

2016 55,083 4,457

2017 38,771 4,457

Years thereafter 139,560 34,223

Minimum lease payments 505,009 58,940

Less: Amount representing interest – 13,357

Present value of net minimum

lease payments $505,009 $45,583

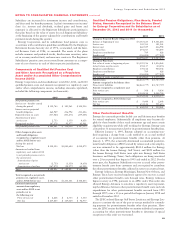

Total rental expenses for all leases (excluding nuclear fuel leases

and the Grand Gulf and Waterford 3 sale and leaseback transac-

tions) amounted to $69.9 million in 2012, $75.3 million in 2011,

and $80.8 million in 2010. In addition to the above rental expense,

railcar operating lease payments and oil tank facilities lease payments

are recorded in fuel expense in accordance with regulatory treat-

ment. Railcar operating lease payments were $8.5 million in 2012,

$8.3 million in 2011, and $8.4 million in 2010 for Entergy Arkansas

87