Entergy 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Entergy Corporation and Subsidiaries 2012

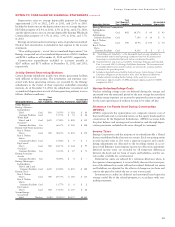

is based on a calculated fair market values of assets divided by fund-

ing liabilities, does not meet certain thresholds. For funding purposes,

asset gains and losses are smoothed in to the calculated fair market

value of assets and the funding liability is based upon a weighted

average 24-month corporate bond rate published by the U.S. Trea-

sury; therefore, periodic changes in asset returns and interest rates

can affect funding shortfalls and future cash contributions.

The Moving Ahead for Progress in the 21st Century Act (MAP-

21) became federal law on July 6, 2012. Under the law, the segment

rates used to calculate funding liabilities must be within a corridor of

the 25-year average of prior segment rates. The interest rate corridor

applies to the determination of minimum funding requirements and

benefit restrictions. The pension funding stabilization provisions will

provide for a near-term reduction in minimum funding requirements

for single employer defined benefit plans in response to the current,

historically low interest rates. The law does not reduce contribution

requirements over the long term, and it is likely that Entergy’s contri-

butions to the pension trust will increase after 2013.

Total postretirement health care and life insurance benefit costs for

Entergy in 2012 were $138.4 million, including $31.2 million in sav-

ings due to the estimated effect of future Medicare Part D subsidies.

Entergy expects 2013 postretirement health care and life insurance

benefit costs to be $146.8 million. This includes a projected $34 mil-

lion in savings due to the estimated effect of future Medicare Part

D subsidies. Entergy contributed $82.2 million to its postretirement

plans in 2012. Entergy’s current estimate of contributions to its other

postretirement plans is approximately $82.5 million in 2013.

FEDERAL HEALTHCARE LEGISLATION

The Patient Protection and Affordable Care Act (PPACA) became

federal law on March 23, 2010, and, on March 30, 2010, the Health

Care and Education Reconciliation Act of 2010 became federal law

and amended certain provisions of the PPACA. These new federal

laws change the law governing employer-sponsored group health

plans, like Entergy’s plans, and include, among other things, the fol-

lowing significant provisions.

n A 40% excise tax on per capita medical benefit costs that exceed

certain thresholds;

n Change in coverage limits for dependents; and

n Elimination of lifetime caps.

The effect of PPACA has been reflected based on Entergy’s under-

standing of current guidance on the rules and regulations. However,

there are still many technical issues that have not been finalized.

Entergy will continue to monitor these developments to determine

the possible impact on Entergy as a result of PPACA. Entergy is par-

ticipating in the programs currently provided for under PPACA, such

as the early retiree reinsurance program, which has provided for some

limited reimbursements of certain claims for early retirees aged 55 to

64 who are not yet eligible for Medicare.

One provision of the new law that is effective in 2013 eliminates

the federal income tax deduction for prescription drug expenses of

Medicare beneficiaries for which the plan sponsor also receives the

retiree drug subsidy under Part D. Entergy receives subsidy payments

under the Medicare Part D plan and therefore in the first quarter

2010 recorded a reduction to the deferred tax asset related to the

unfunded other postretirement benefit obligation. The offset was

recorded in 2010 as a $16 million charge to income tax expense

or, for the Utility, including each Registrant Subsidiary, as a regula-

tory asset.

Other Contingencies

As a company with multi-state utility operations, Entergy is subject to

a number of federal and state laws and regulations and other factors

and conditions in the areas in which it operates, which potentially

subject it to environmental, litigation, and other risks. Entergy peri-

odically evaluates its exposure for such risks and records a reserve

for those matters which are considered probable and estimable in

accordance with generally accepted accounting principles.

ENVIRONMENTAL

Entergy must comply with environmental laws and regulations appli-

cable to air emissions, water discharges, solid and hazardous waste,

toxic substances, protected species, and other environmental matters.

Under these various laws and regulations, Entergy could incur sub-

stantial costs to comply or address any impacts to the environment.

Entergy conducts studies to determine the extent of any required

remediation and has recorded reserves based upon its evaluation

of the likelihood of loss and expected dollar amount for each issue.

Additional sites or issues could be identified which require environ-

mental remediation or corrective action for which Entergy could be

liable. The amounts of environmental reserves recorded can be sig-

nificantly affected by the following external events or conditions.

n Changes to existing state or federal regulation by governmental

authorities having jurisdiction over air quality, water quality,

control of toxic substances and hazardous and solid wastes, and

other environmental matters.

n The identification of additional impacts, sites, issues, or the

filing of other complaints in which Entergy may be asserted to

be a potentially responsible party.

n The resolution or progression of existing matters through the court

system or resolution by the EPA or relevant state or local authority.

LITIGATION

Entergy is regularly named as a defendant in a number of lawsuits

involving employment, customers, and injuries and damages issues,

among other matters. Entergy periodically reviews the cases in which

it has been named as defendant and assesses the likelihood of loss in

each case as probable, reasonably estimable, or remote and records

reserves for cases which have a probable likelihood of loss and can

be estimated. Given the environment in which Entergy operates, and

the unpredictable nature of many of the cases in which Entergy is

named as a defendant, the ultimate outcome of the litigation to which

Entergy is exposed has the potential to materially affect the results of

operations of Entergy or Registrant Subsidiaries.

UNCERTAIN TAX POSITIONS

Entergy’s operations, including acquisitions and divestitures, require

Entergy to evaluate risks such as the potential tax effects of a trans-

action, or warranties made in connection with such a transaction.

Entergy believes that it has adequately assessed and provided for these

types of risks, where applicable. Any provisions recorded for these

types of issues, however, could be significantly affected by events such

as claims made by third parties under warranties, additional transac-

tions contemplated by Entergy, or completion of reviews of the tax

treatment of certain transactions or issues by taxing authorities.

NEW ACCOUNTING PRONOUNCEMENTS

The accounting standard-setting process, including projects between

the FASB and the International Accounting Standards Board (IASB) to

converge U.S. GAAP and International Financial Reporting Standards,

is ongoing and the FASB and the IASB are each currently working on

several projects that have not yet resulted in final pronouncements. Final

pronouncements that result from these projects could have a material

effect on Entergy’s future net income, financial position, or cash flows.

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS concluded

47