Entergy 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Entergy Corporation and Subsidiaries 2012

of 2014 with an annual true-up, that would retain the primary

aspects of the prior formula rate plan, including a 60% to cus-

tomers/40% to Entergy Louisiana sharing mechanism for earnings

outside the deadband, and a capacity rider mechanism that would

permit recovery of incremental capacity additions approved by

the LPSC.

Retail Rates – Gas (Entergy Gulf States Louisiana)

In January 2013, Entergy Gulf States Louisiana filed with the LPSC its

gas rate stabilization plan for the test year ended September 30, 2012.

The filing showed an earned return on common equity of 11.18%,

which results in a $43 thousand rate reduction. The sixty-day review

and comment period for this filing remains open.

Related to the annual gas rate stabilization plan proceedings, the

LPSC directed its staff to initiate an evaluation of the 10.5% allowed

return on common equity for the Entergy Gulf States Louisiana gas

rate stabilization plan. The LPSC directed that its staff should provide

an analysis of the current return on equity and justification for any

proposed changes to the return on equity. A hearing in the proceeding

was held in November 2012. The ALJ issued a proposed recommen-

dation in December 2012, finding that 9.4% is a more reasonable

and appropriate rate of return on common equity. Entergy Gulf States

Louisiana filed exceptions to the ALJ’s recommendation and an LPSC

decision is pending.

In January 2012, Entergy Gulf States Louisiana filed with the

LPSC its gas rate stabilization plan for the test year ended September

30, 2011. The filing showed an earned return on common equity of

10.48%, which is within the earnings bandwidth of 10.5%, plus or

minus fifty basis points. In April 2012, the LPSC Staff filed its find-

ings, suggesting adjustments that produced an 11.54% earned return

on common equity for the test year and a $0.1 million rate reduction.

Entergy Gulf States Louisiana accepted the LPSC Staff’s recommen-

dations, and the rate reduction was effective with the first billing cycle

of May 2012.

In January 2011, Entergy Gulf States Louisiana filed with the

LPSC its gas rate stabilization plan for the test year ended September

30, 2010. The filing showed an earned return on common equity of

8.84% and a revenue deficiency of $0.3 million. In March 2011, the

LPSC Staff filed its findings, suggesting an adjustment that produced

an 11.76% earned return on common equity for the test year and

a $0.2 million rate reduction. Entergy Gulf States Louisiana imple-

mented the $0.2 million rate reduction effective with the May 2011

billing cycle. The LPSC docket is now closed.

In January 2010, Entergy Gulf States Louisiana filed with the

LPSC its gas rate stabilization plan for the test year ended September

30, 2009. The filing showed an earned return on common equity of

10.87%, which is within the earnings bandwidth of 10.5% plus or

minus fifty basis points, resulting in no rate change. In April 2010,

Entergy Gulf States Louisiana filed a revised evaluation report reflect-

ing changes agreed upon with the LPSC Staff. The revised evaluation

report also resulted in no rate change.

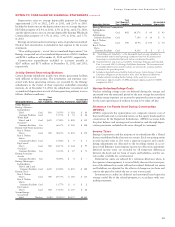

FILINGS WITH THE MPSC (ENTERGY MISSISSIPPI)

Formula Rate Plan Filings

In September 2009, Entergy Mississippi filed with the MPSC pro-

posed modifications to its formula rate plan rider. In March 2010 the

MPSC issued an order: (1) providing the opportunity for a reset of

Entergy Mississippi’s return on common equity to a point within the

formula rate plan bandwidth and eliminating the 50/50 sharing that

had been in the plan, (2) modifying the performance measurement

process, and (3) replacing the revenue change limit of two percent of

revenues, which was subject to a $14.5 million revenue adjustment

cap, with a limit of four percent of revenues, although any adjustment

above two percent requires a hearing before the MPSC. The MPSC

did not approve Entergy Mississippi’s request to use a projected test

year for its annual scheduled formula rate plan filing and, therefore,

Entergy Mississippi will continue to use a historical test year for its

annual evaluation reports under the plan.

In March 2010, Entergy Mississippi submitted its 2009 test year

filing, its first annual filing under the new formula rate plan rider. In

June 2010 the MPSC approved a joint stipulation between Entergy

Mississippi and the Mississippi Public Utilities Staff that provides for

no change in rates, but does provide for the deferral as a regulatory

asset of $3.9 million of legal expenses associated with certain litiga-

tion involving the Mississippi Attorney General, as well as ongoing

legal expenses in that litigation until the litigation is resolved.

In March 2011, Entergy Mississippi submitted its formula rate plan

2010 test year filing. The filing shows an earned return on common

equity of 10.65% for the test year, which is within the earnings band-

width and results in no change in rates. In November 2011 the MPSC

approved a joint stipulation between Entergy Mississippi and the

Mississippi Public Utilities Staff that provides for no change in rates.

In March 2012, Entergy Mississippi submitted its formula rate

plan filing for the 2011 test year. The filing shows an earned return on

common equity of 10.92% for the test year, which is within the earn-

ings bandwidth and results in no change in rates. In February 2013

the MPSC approved a joint stipulation between Entergy Mississippi

and the Mississippi Public Utilities Staff that provides for no change

in rates.

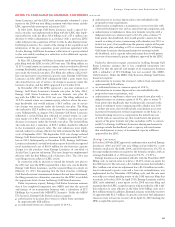

FILINGS WITH THE CITY COUNCIL (ENTERGY NEW ORLEANS)

Formula Rate Plan

In April 2009 the City Council approved a new three-year formula

rate plan for Entergy New Orleans, with terms including an 11.1%

benchmark electric return on common equity (ROE) with a +/- 40

basis point bandwidth and a 10.75% benchmark gas ROE with

a +/- 50 basis point bandwidth. Earnings outside the bandwidth

reset to the midpoint benchmark ROE, with rates changing on a

prospective basis depending on whether Entergy New Orleans was

over- or under-earning. The formula rate plan also included a recov-

ery mechanism for City Council-approved capacity additions, plus

provisions for extraordinary cost changes and force majeure events.

In May 2010, Entergy New Orleans filed its electric and gas for-

mula rate plan evaluation reports. The filings requested a $12.8 mil-

lion electric base revenue decrease and a $2.4 million gas base rev-

enue increase. Entergy New Orleans and the City Council’s Advisors

reached a settlement that resulted in an $18.0 million electric base

revenue decrease and zero gas base revenue change effective with the

October 2010 billing cycle. The City Council approved the settlement

in November 2010.

In May 2011, Entergy New Orleans filed its electric and gas for-

mula rate plan evaluation reports for the 2010 test year. The filings

requested a $6.5 million electric rate decrease and a $1.1 million gas

rate decrease. Entergy New Orleans and the City Council’s Advisors

reached a settlement that results in an $8.5 million incremental elec-

tric rate decrease and a $1.6 million gas rate decrease. The settle-

ment also provides for the deferral of $13.4 million of Michoud plant

maintenance expenses incurred in 2010 and the establishment of a

regulatory asset that will be amortized over the period October 2011

through September 2018. The City Council approved the settlement

in September 2011. The new rates were effective with the first billing

cycle of October 2011.

In May 2012, Entergy New Orleans filed its electric and gas for-

mula rate plan evaluation reports for the 2011 test year. Subsequent

adjustments agreed upon with the City Council Advisors indicate a

$4.9 million electric base revenue increase and a $0.05 million gas

base revenue increase as necessary under the formula rate plan.

As part of the original filing, Entergy New Orleans is also requesting

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

67