Entergy 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

payments. Based on recent market trends, the discount rates used

to calculate its 2012 qualified pension benefit obligation and 2013

qualified pension cost ranged from 4.31% to 4.50% for its specific

pension plans (4.36% combined rate for all pension plans). The dis-

count rates used to calculate its 2011 qualified pension benefit obliga-

tion and 2012 qualified pension cost ranged from 5.1% to 5.2% for

its specific pension plans (5.1% combined rate for all pension plans).

The discount rate used to calculate its other 2012 postretirement ben-

efit obligation and 2013 postretirement benefit cost was 4.36%. The

discount rate used to calculate its 2011 other postretirement benefit

obligation and 2012 postretirement benefit cost was 5.1%.

Entergy reviews actual recent cost trends and projected future

trends in establishing health care cost trend rates. Based on this

review, Entergy’s assumed health care cost trend rate assumption

used in measuring the December 31, 2012 accumulated postretire-

ment benefit obligation and 2013 postretirement cost was 7.50%

for pre-65 retirees and 7.25% for post-65 retirees for 2013, gradu-

ally decreasing each successive year until it reaches 4.75% in 2022

and beyond for both pre-65 and post-65 retirees. Entergy’s health

care cost trend rate assumption used in measuring the December

31, 2011 accumulated postretirement benefit obligation and 2012

postretirement cost was 7.75% for pre-65 retirees and 7.5% for

post-65 retirees for 2012, gradually decreasing each successive year

until it reaches 4.75% in 2022 and beyond for both pre-65 and post-

65 retirees.

The assumed rate of increase in future compensation levels used to

calculate 2012 and 2011 benefit obligations was 4.23%.

In determining its expected long-term rate of return on plan assets

used in the calculation of benefit plan costs, Entergy reviews past

performance, current and expected future asset allocations, and

capital market assumptions of its investment consultant and invest-

ment managers.

Since 2003, Entergy has targeted an asset allocation for its quali-

fied pension plan assets of roughly 65% equity securities and 35%

fixed-income securities. Entergy completed and adopted an optimiza-

tion study in 2011 for the pension assets which recommended that

the target asset allocation adjust dynamically over time, based on the

funded status of the plan, from its current to its ultimate allocation

of 45% equity, 55% fixed income. The ultimate asset allocation is

expected to be attained when the plan is 105% funded.

The current target allocations for Entergy’s non-taxable postretire-

ment benefit assets are 65% equity securities and 35% fixed-income

securities and, for its taxable other postretirement benefit assets, 65%

equity securities and 35% fixed-income securities. This takes into

account asset allocation adjustments that were made during 2012.

Entergy’s expected long term rate of return on qualified pension

assets used to calculate 2012, 2011 and 2010 qualified pension costs

was 8.5% and will be 8.5% for 2013. Entergy’s expected long term

rate of return on non-taxable other postretirement assets used to

calculate other postretirement costs was 8.5% for 2012 and 2011,

7.75% for 2010 and will be 8.5% for 2013. For Entergy’s taxable

postretirement assets, the expected long term rate of return was 6.5%

for 2012, 5.5% for 2011 and 2010, and will be 6.5% in 2013.

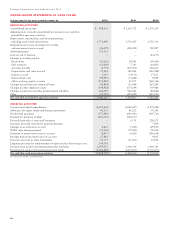

COST SENSITIVITY

The following chart reflects the sensitivity of qualified pension cost

and qualified pension projected benefit obligation to changes in

certain actuarial assumptions (dollars in thousands):

Impact on

Qualified

Impact on 2012 Projected

Change in Qualified Benefit

Actuarial Assumption Assumption Pension Cost Obligation

Increase/(Decrease)

Discount rate (0.25%) $20,142 $229,473

Rate of return on plan assets (0.25%) $ 9,337 $ –

Rate of increase in

compensation 0.25% $ 8,512 $ 48,036

The following chart reflects the sensitivity of postretirement benefit

cost and accumulated postretirement benefit obligation to changes in

certain actuarial assumptions (dollars in thousands):

Impact on

Accumulated

Impact on 2012 Postretirement

Change in Postretirement Benefit

Actuarial Assumption Assumption Benefit Cost Obligation

Increase/(Decrease)

Discount rate (0.25%) $ 8,061 $72,947

Health care cost trend 0.25% $11,422 $64,967

Each fluctuation above assumes that the other components of the

calculation are held constant.

ACCOUNTING MECHANISMS

Accounting standards require an employer to recognize in its

balance sheet the funded status of its benefit plans. Refer to Note

11 to the financial statements for a further discussion of Entergy’s

funded status.

In accordance with pension accounting standards, Entergy uti-

lizes a number of accounting mechanisms that reduce the volatility

of reported pension costs. Differences between actuarial assumptions

and actual plan results are deferred and are amortized into expense

only when the accumulated differences exceed 10% of the greater of

the projected benefit obligation or the market-related value of plan

assets. If necessary, the excess is amortized over the average remain-

ing service period of active employees.

Entergy calculates the expected return on pension and other post-

retirement benefit plan assets by multiplying the long-term expected

rate of return on assets by the market-related value (MRV) of plan

assets. Entergy determines the MRV of pension plan assets by cal-

culating a value that uses a 20-quarter phase-in of the difference

between actual and expected returns. For other postretirement benefit

plan assets Entergy uses fair value when determining MRV.

COSTS AND FUNDING

In 2012, Entergy’s total qualified pension cost was $264 million.

Entergy anticipates 2013 qualified pension cost to be $332 million.

Pension funding was approximately $170.5 million for 2012. Enter-

gy’s contributions to the pension trust are currently estimated to be

approximately $163.3 million in 2013, although the required pension

contributions will not be known with more certainty until the Janu-

ary 1, 2013 valuations are completed by April 1, 2013.

Minimum required funding calculations as determined under Pen-

sion Protection Act guidance are performed annually as of January 1

of each year and are based on measurements of the assets and fund-

ing liabilities as measured at that date. Any excess of the funding

liability over the calculated fair market value of assets results in a

funding shortfall which, under the Pension Protection Act, must be

funded over a seven-year rolling period. The Pension Protection Act

also imposes certain plan limitations if the funded percentage, which

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS continued

46