Entergy 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

In accordance with regulatory treatment, interest on the nuclear fuel company variable interest entities’ credit facilities, commercial paper, and

long-term notes payable is reported in fuel expense.

In February 2013 the Entergy Gulf States Louisiana nuclear fuel company variable interest entity issued $70 million of 3.38% Series R notes

due August 2020. The Entergy Gulf States Louisiana nuclear fuel company variable interest entity used the proceeds principally to purchase

additional nuclear fuel.

Entergy Arkansas, Entergy Gulf States Louisiana, Entergy Louisiana, and System Energy each have obtained long-term financing authorizations

from the FERC that extend through May 2013, September 2014, January 2015, and November 2013, respectively, for issuances by its nuclear

fuel company variable interest entity.

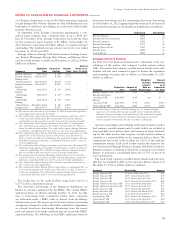

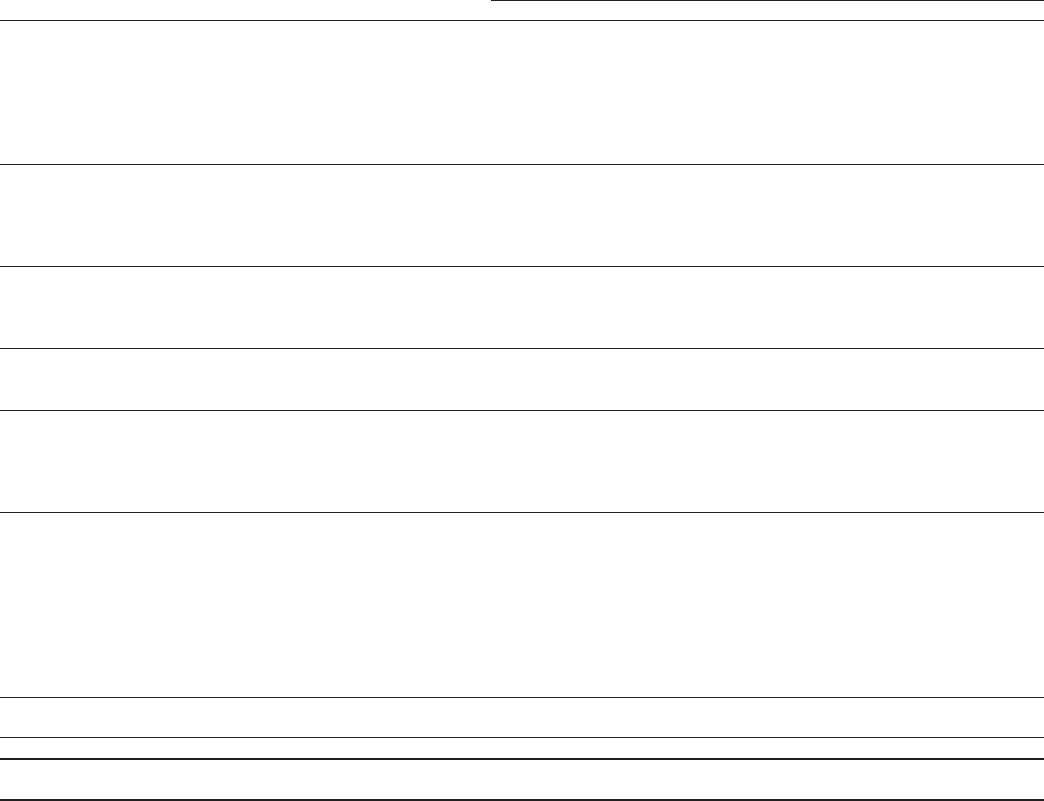

NOTE 5. LONG-TERM DEBT

Long-term debt for Entergy Corporation and subsidiaries as of December 31, 2012 and 2011 consisted of (dollars in thousands):

Weighted-Average Interest Rate Ranges Outstanding at

Interest Rate at December 31, December 31,

Type of Debt and Maturity at December 31, 2012 2012 2011 2012 2011

Mortgage Bonds

2012 - 2017 3.24% 1.88% - 5.40% 3.25% - 6.20% $ 1,045,000 $ 865,000)

2018 - 2022 5.15% 3.30% - 7.13% 3.75% - 7.13% 2,635,000 2,435,000)

2023 - 2027 4.82% 3.10% - 5.66% 4.44% - 5.66% 1,658,369 1,158,449)

2028 - 2037 6.18% 5.65% - 6.40% 5.65% - 6.40% 867,976 868,145)

2039 - 2052 6.22% 4.90% - 7.88% 5.75% - 7.88% 1,335,000 905,000

Governmental Bonds(a)

2012 - 2017 4.15% 2.88% - 4.60% 2.88% - 5.80% 86,655 97,495

2018 - 2022 5.59% 4.60% - 5.88% 4.60% - 5.9% 307,030 410,005)

2023 - 2030 5.00% 5.00% 5.0% - 6.20% 198,680 248,680

Securitization Bonds

2013 - 2020 4.18% 2.12% - 5.79% 2.12% - 5.79% 357,577 416,899)

2021 - 2023 3.74% 2.04% - 5.93% 2.04% - 5.93% 616,159 653,948)

Variable Interest Entities Notes Payable (Note 4)

2012 - 2017 3.85% 2.62% - 9.00% 2.25% - 9.00% 640,000 519,400

)

Entergy Corporation Notes

due September 2015 n/a 3.625% 3.625% 550,000 550,000)

due January 2017 n/a 4.7% n/a 500,000 –)

due September 2020 n/a 5.125% 5.125% 450,000 450,000)

Note Payable to NYPA (b) (b) (b) 109,679 133,363)

5 Year Credit Facility (Note 4) n/a 2.04% 0.75% 795,000 1,920,000)

Long-term DOE Obligation(c) –% –% –% 181,157 181,031)

Waterford 3 Lease Obligation(d) n/a 7.45% 7.45% 162,949 188,255)

Grand Gulf Lease Obligation(d) n/a 5.13% 5.13% 138,893 178,784)

Bank Credit Facility - Entergy Louisiana n/a n/a 0.67% – 50,000)

Unamortized Premium and Discount - Net (10,744) (9,531)

Other 14,454 16,523)

Total Long-Term Debt 12,638,834 12,236,446)

Less Amount Due Within One Year 718,516 2,192,733)

Long-Term Debt Excluding Amount Due Within One Year $11,920,318 $10,043,713)

Fair Value of Long-Term Debt(e) $12,849,330 $12,176,251)

(a) Consists of pollution control revenue bonds and environmental revenue bonds.

(b) These notes do not have a stated interest rate, but have an implicit interest rate of 4.8%.

(c) Pursuant to the Nuclear Waste Policy Act of 1982, Entergy’s nuclear owner/licensee subsidiaries have contracts with the DOE for spent nuclear fuel disposal service.

The contracts include a one-time fee for generation prior to April 7, 1983. Entergy Arkansas is the only Entergy company that generated electric power with nuclear

fuel prior to that date and includes the one-time fee, plus accrued interest, in long-term debt.

(d) See Note 10 for further discussion of the Waterford 3 and Grand Gulf Lease Obligations.

(e) The fair value excludes lease obligations of $163 million at Entergy Louisiana and $139 million at System Energy, long-term DOE obligations of $181 million at

Entergy Arkansas, and the note payable to NYPA of $110 million at Entergy, and includes debt due within one year. Fair values are classified as Level 2 in the fair value

hierarchy discussed in Note 16 to the financial statements and are based on prices derived from inputs such as benchmark yields and reported trades.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

80