Entergy 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Creating Sustainable Value

for Our Stakeholders

LEVERAGING HUMAN CAPITAL

ENTERGY SUSTAINABILITY HIGHLIGHTS

Throughout 2012, we announced and began implementing

key elements of our executive succession plan that had been

developed over many years by our board of directors. The

smooth transition is a testament to the depth of talent in

Entergy’s organization. We believe our human capital is

a vital asset and a key source of advantage that must be

aligned and managed with our overall strategy and direction.

We are focused on building a competitive, efficient business

environment in which engaged employees, supported by

the appropriate technologies and resources, are focused on

delivering sustainable value to our stakeholders.

In 2012, our efforts to create sustainable economic,

environmental and social value were recognized once again

by the Dow Jones Sustainability Indexes. Entergy was named

to the DJSI World Index and the North America Index, the

11th consecutive year we have been named to one or both.

We present here the strategies we implemented in 2012 on

behalf of our stakeholders.

FOR OUR OWNERS

We create value by aspiring to provide top-quartile returns

through the relentless pursuit of opportunities to optimize our

business. Delivering industry-leading returns enables us to

attract capital to invest in and grow our business. However,

recent performance has fallen short of our goals. Declining

power prices, driven by low natural gas prices, a challenging

economy and slow recovery in certain markets have had

a negative effect. Our one- and five-year total shareholder

return has significantly trailed our peer group, the

Philadelphia Utility Index, as well as the S&P 500 Index.

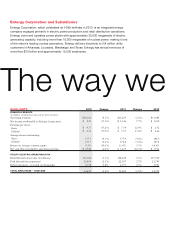

In 2012, total shareholder return was -8.4 percent, compared

to -0.6 percent for our peer group and 16.0 percent for the

S&P 500 Index. As-reported earnings per share decreased

to $4.76 from $7.55 in 2011. The steep as-reported drop

included a special impairment charge to write down the

carrying values of the Vermont Yankee Nuclear Power

Station and related assets to their fair value. On an

operational basis, 2012 earnings per share of $6.23 were

also lower than the prior year, but exceeded our original

2012 earnings guidance range. At the same time, we returned

nearly $590 million in cash dividend payments to owners

of our common stock, while maintaining solid credit

and liquidity.

While our point of view on future power prices grew more

positive in 2012, we realize we must deal with the reality

of today’s markets. We continue to project growth at the

utility business, while executing on initiatives and evaluating

further opportunities to improve cash flows and reduce

risks. Our five-year financial outlook for 2010 through

2014 included deploying $4 billion to shareholders through

dividends and share repurchases, and we continue on that

path. Our board of directors will consider Entergy’s dividend

policy in conjunction with the successful completion of the

ITC transaction. While the Entergy dividend may change at

that time, our objective remains that the combination of the

Entergy and ITC dividends, which will be paid to all Entergy

shareholders after transaction close, be accretive to the

current Entergy dividend.

We believe Entergy exists to serve its stakeholders. Our goal is to create sustainable

value for our owners, customers, employees and the communities we serve. To

do that, we use a deliberate process to develop expectations on the key economic,

environmental and social issues that present material opportunities and risks to

Entergy or its stakeholders. Our expectations are informed by sophisticated analyses

and are dynamically adjusted as internal and external conditions change. Our business

strategy is based on our dynamic views on these drivers and has two main dimensions:

operational excellence and portfolio management.

Transitions | Entergy Corporation and Subsidiaries 2012

9