Entergy 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Entergy Corporation and Subsidiaries 2012

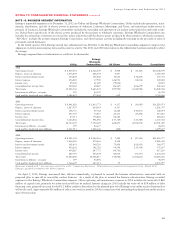

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

During the years ended December 31, 2012, 2011, and 2010, pro-

ceeds from the dispositions of securities amounted to $2,074 million,

$1,360 million, and $2,606 million, respectively. During the years

ended December 31, 2012, 2011, and 2010, gross gains of $39 mil-

lion, $29 million, and $69 million, respectively, and gross losses of

$7 million, $11 million, and $9 million, respectively, were reclassified

out of other comprehensive income into earnings.

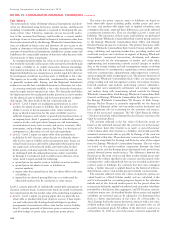

Other-Than-Temporary Impairments and

Unrealized Gains and Losses

Entergy evaluates unrealized losses at the end of each period to

determine whether an other-than-temporary impairment has

occurred. The assessment of whether an investment in a debt security

has suffered an other-than-temporary impairment is based on whether

Entergy has the intent to sell or more likely than not will be required to

sell the debt security before recovery of its amortized costs. Further, if

Entergy does not expect to recover the entire amortized cost basis of

the debt security, an other-than-temporary impairment is considered

to have occurred and it is measured by the present value of cash flows

expected to be collected less the amortized cost basis (credit loss).

Entergy did not have any material other-than-temporary impairments

relating to credit losses on debt securities for the years ended

December 31, 2012, 2011, and 2010. The assessment of whether an

investment in an equity security has suffered an other-than-temporary

impairment continues to be based on a number of factors including,

first, whether Entergy has the ability and intent to hold the investment

to recover its value, the duration and severity of any losses, and,

then, whether it is expected that the investment will recover its value

within a reasonable period of time. Entergy’s trusts are managed by

third parties who operate in accordance with agreements that define

investment guidelines and place restrictions on the purchases and

sales of investments. Entergy did not record material charges to other

income in 2012, 2011, and 2010, respectively, resulting from the

recognition of the other-than-temporary impairment of certain equity

securities held in its decommissioning trust funds.

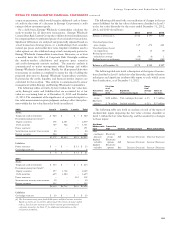

NOTE 18. VARIABLE INTEREST ENTITIES

Under applicable authoritative accounting guidance, a variable

interest entity (VIE) is an entity that conducts a business or holds

property that possesses any of the following characteristics: an

insufficient amount of equity at risk to finance its activities, equity

owners who do not have the power to direct the significant activities

of the entity (or have voting rights that are disproportionate to their

ownership interest), or where equity holders do not receive expected

losses or returns. An entity may have an interest in a VIE through

ownership or other contractual rights or obligations, and is required

to consolidate a VIE if it is the VIE’s primary beneficiary. The primary

beneficiary of a VIE is the entity that has the power to direct the

activities of the VIE that most significantly affect the VIE’s economic

performance, and has the obligation to absorb losses or has the right

to residual returns that would potentially be significant to the entity.

Entergy Arkansas, Entergy Gulf States Louisiana, Entergy

Louisiana, and System Energy consolidate the respective companies

from which they lease nuclear fuel, usually in a sale and leaseback

transaction. This is because Entergy directs the nuclear fuel companies

with respect to nuclear fuel purchases, assists the nuclear fuel com-

panies in obtaining financing, and, if financing cannot be arranged,

the lessee (Entergy Arkansas, Entergy Gulf States Louisiana, Entergy

Louisiana, or System Energy) is responsible to repurchase nuclear fuel

to allow the nuclear fuel company (the VIE) to meet its obligations.

During the term of the arrangements, none of the Entergy operat-

ing companies have been required to provide financial support apart

from their scheduled lease payments. See Note 4 to the financial state-

ments for details of the nuclear fuel companies’ credit facility and

commercial paper borrowings and long-term debt that are reported

by Entergy, Entergy Arkansas, Entergy Gulf States Louisiana,

Entergy Louisiana, and System Energy. These amounts also represent

Entergy’s and the respective Registrant Subsidiary’s maximum expo-

sure to losses associated with their respective interests in the nuclear

fuel companies.

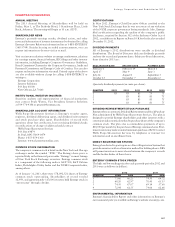

Entergy Gulf States Reconstruction Funding I, LLC, and Entergy

Texas Restoration Funding, LLC, companies wholly-owned and

consolidated by Entergy Texas, are variable interest entities and

Entergy Texas is the primary beneficiary. In June 2007, Entergy Gulf

States Reconstruction Funding issued senior secured transition bonds

(securitization bonds) to finance Entergy Texas’s Hurricane Rita

reconstruction costs. In November 2009, Entergy Texas Restoration

Funding issued senior secured transition bonds (securitization bonds)

to finance Entergy Texas’s Hurricane Ike and Hurricane Gustav

restoration costs. With the proceeds, the variable interest entities

purchased from Entergy Texas the transition property, which is the

right to recover from customers through a transition charge amounts

sufficient to service the securitization bonds. The transition property

is reflected as a regulatory asset on the consolidated Entergy Texas

balance sheet. The creditors of Entergy Texas do not have recourse

to the assets or revenues of the variable interest entities, including the

transition property, and the creditors of the variable interest entities

do not have recourse to the assets or revenues of Entergy Texas.

Entergy Texas has no payment obligations to the variable interest

entities except to remit transition charge collections. See Note 5 to

the financial statements for additional details regarding the

securitization bonds.

Entergy Arkansas Restoration Funding, LLC, a company wholly-

owned and consolidated by Entergy Arkansas, is a variable interest

entity and Entergy Arkansas is the primary beneficiary. In August

2010, Entergy Arkansas Restoration Funding issued storm cost

recovery bonds to finance Entergy Arkansas’s January 2009 ice storm

damage restoration costs. With the proceeds, Entergy Arkansas

Restoration Funding purchased from Entergy Arkansas the storm

recovery property, which is the right to recover from customers

through a storm recovery charge amounts sufficient to service the

securitization bonds. The storm recovery property is reflected as a

regulatory asset on the consolidated Entergy Arkansas balance sheet.

The creditors of Entergy Arkansas do not have recourse to the assets

or revenues of Entergy Arkansas Restoration Funding, including

the storm recovery property, and the creditors of Entergy Arkansas

Restoration Funding do not have recourse to the assets or revenues

of Entergy Arkansas. Entergy Arkansas has no payment obligations

to Entergy Arkansas Restoration Funding except to remit storm

recovery charge collections. See Note 5 to the financial statements for

additional details regarding the storm cost recovery bonds.

105