Entergy 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

corporate guarantees, which would require additional cash or letters

of credit in the event of a decrease in Entergy Corporation’s credit

rating to below investment grade.

On a daily basis, Entergy Wholesale Commodities calculates the

mark-to-market for all derivative transactions. Entergy Wholesale

Commodities Risk Control Group also validates forward market prices

by comparing them to settlement prices of actual market transactions.

Significant differences are analyzed and potentially adjusted based on

actual transaction clearing prices, or a methodology that considers

natural gas prices and market heat rates. Implied volatilities used to

value options are also validated using actual counterparty quotes for

Entergy Wholesale Commodities transactions. Moreover, on at least

a monthly basis the Office of Corporate Risk Oversight confirms

the mark-to-market calculations and prepares price scenarios

and credit downgrade scenario analysis. The scenario analysis is

communicated to senior management within Entergy and within

Entergy Wholesale Commodities. Finally, for all proposed derivative

transactions an analysis is completed to assess the risk of adding the

proposed derivative to Entergy Wholesale Commodities’ portfolio.

In particular, the credit, liquidity, and financial metrics impacts are

calculated for this analysis. This analysis is communicated to senior

management within Entergy and Entergy Wholesale Commodities.

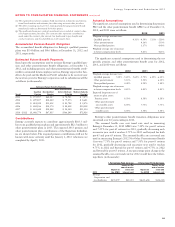

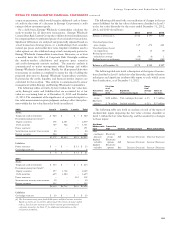

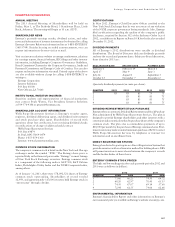

The following tables set forth, by level within the fair value hier-

archy, Entergy’s assets and liabilities that are accounted for at fair

value on a recurring basis as of December 31, 2012 and December

31, 2011. The assessment of the significance of a particular input to a

fair value measurement requires judgment and may affect their place-

ment within the fair value hierarchy levels (in millions):

2012 Level 1 Level 2 Level 3 Total

Assets:

Temporary cash investments $ 420 $ – $ – $ 420

Decommissioning trust funds(a):

Equity securities 358 2,101 – 2,459

Debt securities 769 962 – 1,731

Power contracts – – 191 191

Securitization recovery trust account 46 – – 46

Escrow accounts 386 – – 386

$1,979 $3,063 $191 $5,233

Liabilities:

Power contracts $ – $ – $ 13 $ 13

Gas hedge contracts 8 – – 8

$ 8 $ – $ 13 $ 21

2011

Assets:

Temporary cash investments $ 613 $ – $ – $ 613

Decommissioning trust funds(a):

Equity securities 397 1,732 – 2,129

Debt securities 639 1,020 – 1,659

Power contracts – – 312 312

Securitization recovery trust account 50 – – 50

Escrow accounts 335 – – 335

$2,034 $2,752 $312 $5,098

Liabilities:

Gas hedge contracts $ 30 $ – $ – $ 30

(a) The decommissioning trust funds hold equity and fixed income securities.

Equity securities are invested to approximate the returns of major market

indices. Fixed income securities are held in various governmental and

corporate securities. See Note 17 for additional information on the

investment portfolios.

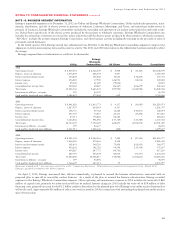

The following table sets forth a reconciliation of changes in the net

assets (liabilities) for the fair value of derivatives classified as Level 3

in the fair value hierarchy for the years ended December 31, 2012,

2011, and 2010 (in millions):

2012 2011 2010

Balance as of January 1, $ 312 $ 197 $ 200

Unrealized gains from

price changes 139 274 220

Unrealized gains (losses)

on originations 9 15 (4)

Realized gains (losses)

included in earnings (14) (6) 1

Realized gains on settlements (268) (168) (220)

Balance as of December 31, $ 178 $ 312 $ 197

The following table sets forth a description of the types of transac-

tions classified as Level 3 in the fair value hierarchy, and the valuation

techniques and significant unobservable inputs to each which cause

that classification, as of December 31, 2012:

Fair Value Range

as of from

Transaction Dec. 31, Significant Average Effect on

Type 2012 Unobservable Inputs % Fair Value

Electricity

swaps $104 million Unit contingent discount +/-3% $ 5 million

Electricity

options $ 74 million Implied volatility +/-21% $37 million

The following table sets forth an analysis of each of the types of

unobservable inputs impacting the fair value of items classified as

Level 3 within the fair value hierarchy, and the sensitivity to changes

to those inputs:

Significant

Unobservable Transaction

Input Type Position Changes to Input Effect on Fair Value

Unit

contingent Electricity

discount swaps Sell Increase (Decrease) Decrease (Increase)

Implied Electricity

volatility options Sell Increase (Decrease) Increase (Decrease)

Implied Electricity

volatility options Buy Increase (Decrease) Increase (Decrease)

103