Entergy 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

Entergy’s Accounting Policy group, which reports to the Chief

Accounting Officer, was primarily responsible for determining the

valuation of the Vermont Yankee plant and related assets, in con-

sultation with external advisors. Accounting Policy obtained and

reviewed information from other Entergy departments with expertise

on the various inputs and assumptions that were necessary to calcu-

late the fair value of the asset group.

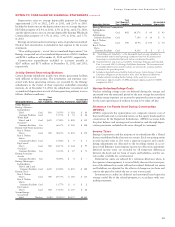

River Bend AFUDC

The River Bend AFUDC gross-up is a regulatory asset that represents

the incremental difference imputed by the LPSC between the AFUDC

actually recorded by Entergy Gulf States Louisiana on a net-of-tax

basis during the construction of River Bend and what the AFUDC

would have been on a pre-tax basis. The imputed amount was only

calculated on that portion of River Bend that the LPSC allowed in

rate base and is being amortized through August 2025.

Reacquired Debt

The premiums and costs associated with reacquired debt of Entergy’s

Utility operating companies and System Energy (except that portion allo-

cable to the deregulated operations of Entergy Gulf States Louisiana) are

included in regulatory assets and are being amortized over the life of the

related new issuances, or over the life of the original debt issuance if the

debt is not refinanced, in accordance with ratemaking treatment.

Taxes Imposed on Revenue-Producing Transactions

Governmental authorities assess taxes that are both imposed on and

concurrent with a specific revenue-producing transaction between a

seller and a customer, including, but not limited to, sales, use, value

added, and some excise taxes. Entergy presents these taxes on a net

basis, excluding them from revenues, unless required to report them

differently by a regulatory authority.

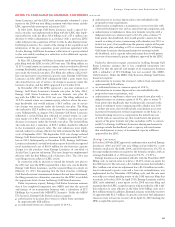

Presentation of Preferred Stock without Sinking Fund

Accounting standards regarding non-controlling interests and the

classification and measurement of redeemable securities require the

classification of preferred securities between liabilities and share-

holders’ equity on the balance sheet if the holders of those securities

have protective rights that allow them to gain control of the board of

directors in certain circumstances. These rights would have the effect

of giving the holders the ability to potentially redeem their securi-

ties, even if the likelihood of occurrence of these circumstances is

considered remote. The Entergy Arkansas, Entergy Mississippi, and

Entergy New Orleans articles of incorporation provide, generally,

that the holders of each company’s preferred securities may elect a

majority of the respective company’s board of directors if dividends

are not paid for a year, until such time as the dividends in arrears are

paid. Therefore, Entergy Arkansas, Entergy Mississippi, and Entergy

New Orleans present their preferred securities outstanding between

liabilities and shareholders’ equity on the balance sheet. Entergy Gulf

States Louisiana and Entergy Louisiana, both organized as limited

liability companies, have outstanding preferred securities with similar

protective rights with respect to unpaid dividends, but provide for the

election of board members that would not constitute a majority of

the board; and their preferred securities are therefore classified for all

periods presented as a component of members’ equity.

The outstanding preferred securities of Entergy Arkansas, Entergy

Mississippi, Entergy New Orleans, and Entergy Asset Management

(whose preferred holders also had protective rights until the securities

were repurchased in December 2011), are similarly presented between

liabilities and equity on Entergy’s consolidated balance sheets and

the outstanding preferred securities of Entergy Gulf States Louisiana

and Entergy Louisiana are presented within total equity in Entergy’s

consolidated balance sheets. The preferred dividends or distributions

paid by all subsidiaries are reflected for all periods presented outside

of consolidated net income.

New Accounting Pronouncements

The accounting standard-setting process, including projects between

the FASB and the International Accounting Standards Board (IASB)

to converge U.S. GAAP and International Financial Reporting Stan-

dards, is ongoing and the FASB and the IASB are each currently

working on several projects that have not yet resulted in final pro-

nouncements. Final pronouncements that result from these projects

could have a material effect on Entergy’s future net income, financial

position, or cash flows.

NOTE 2. RATE AND REGULATORY MATTERS

Regulatory Assets

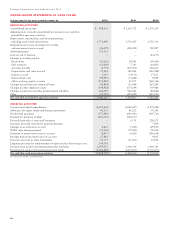

OTHER REGULATORY ASSETS

Regulatory assets represent probable future revenues associated with

costs that are expected to be recovered from customers through the

regulatory ratemaking process affecting the Utility business. In addi-

tion to the regulatory assets that are specifically disclosed on the

face of the balance sheets, the tables below provide detail of “Other

regulatory assets” that are included on Entergy’s balance sheets as of

December 31, 2012 and 2011 (in millions):

2012 2011

Asset retirement obligation - recovery dependent

upon timing of decommissioning (Note 9)(b) $ 422.6 $ 395.9

Deferred capacity - (Note 2 - Retail Rate

Proceedings - Filings with the LPSC) 6.8 –

Grand Gulf fuel - non-current and power

management rider - recovered through rate

riders when rates are redetermined periodically

(Note 2 - Fuel and purchased power cost recovery) 35.1 12.4

New nuclear generation development costs

(Note 2) 56.8 56.8

Gas hedging costs - recovered through fuel rates 8.3 30.3

Pension & postretirement costs

(Note 11 - Qualified Pension Plans,

Other Postretirement Benefits, and

Non-Qualified Pension Plans)(b) 2,866.3 2,542.0

Postretirement benefits - recovered through 2012

(Note 11 - Other Postretirement Benefits)(b) – 2.4

Provision for storm damages, including hurricane

costs - recovered through securitization,

insurance proceeds, and retail rates (Note 2 -

Hurricane Isacc and Storm Cost Recovery Filings

with Retail Regulators) 970.8 996.4

Removal costs - recovered through depreciation rates

(Note 9)(b) 155.7 81.2

River Bend AFUDC - recovered through August 2025

(Note 1 - River Bend AFUDC) 22.4 24.3

Spindletop gas storage facility - recovered through

December 2032(a) 29.4 31.0

Transition to competition costs - recovered over a

15-year period through February 2021 82.1 89.2

Little Gypsy cost - recovered

through securitiazation (Note 5 - Entergy Louisiana

Securitization Bonds - Little Gypsy) 177.6 198.4

Incremental ice storm costs - recovered through 2032 10.0 10.5

Michoud plant maintenance - recovered over a

7-year period through September 2018 11.0 12.9

Unamortized loss on reacquired debt -

recovered over term of debt 95.9 108.8

Other 75.1 44.4

Total $5,025.9 $4,636.9

(a) The jurisdictional split order assigned the regulatory asset to Entergy Texas.

The regulatory asset, however, is being recovered and amortized at Entergy

Gulf States Louisiana. As a result, a billing occurs monthly over the same term

as the recovery and receipts will be submitted to Entergy Texas. Entergy Texas

has recorded a receivable from Entergy Gulf States Louisiana and Entergy Gulf

States Louisiana has recorded a corresponding payable.

(b) Does not earn a return on investment, but is offset by related liabilities.

61