Entergy 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

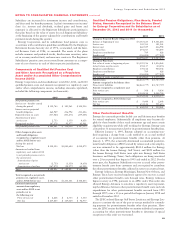

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

Subsidiary are increased for investment income and contributions,

and decreased for benefit payments. A plan’s investment net income/

(loss) (i.e. interest and dividends, realized gains and losses and

expenses) is allocated to the Registrant Subsidiaries participating in

that plan based on the value of assets for each Registrant Subsidiary

at the beginning of the quarter adjusted for contributions and benefit

payments made during the quarter.

Entergy Corporation and its subsidiaries fund pension costs in

accordance with contribution guidelines established by the Employee

Retirement Income Security Act of 1974, as amended, and the Inter-

nal Revenue Code of 1986, as amended. The assets of the plans

include common and preferred stocks, fixed-income securities, inter-

est in a money market fund, and insurance contracts. The Registrant

Subsidiaries’ pension costs are recovered from customers as a compo-

nent of cost of service in each of their respective jurisdictions.

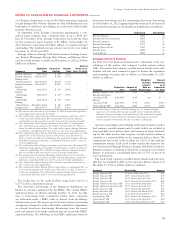

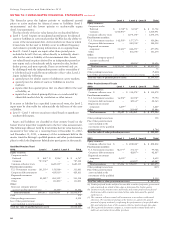

Components of Qualified Net Pension Cost

and Other Amounts Recognized as a Regulatory

Asset and/or Accumulated Other Comprehensive

Income (AOCI)

Entergy Corporation and its subsidiaries’ total 2012, 2011, and 2010

qualified pension costs and amounts recognized as a regulatory asset

and/or other comprehensive income, including amounts capitalized,

included the following components (in thousands):

2012 2011 2010

Net periodic pension cost:

Service cost - benefits earned

during the period $ 150,763 $ 121,961 $ 104,956

Interest cost on projected

benefit obligation 260,929 236,992 231,206

Expected return on assets (317,423) (301,276) (259,608)

Amortization of prior

service cost 2,733 3,350 4,658

Recognized net loss 167,279 92,977 65,901

Net periodic pension costs $ 264,281 $ 154,004 $ 147,113

Other changes in plan assets

and benefit obligations

recognized as a regulatory asset

and/or AOCI (before tax)

Arising this period:

Net loss $ 552,303 $1,045,624 $ 232,279

Amounts reclassified from

regulatory asset and/or AOCI

to net periodic pension cost in

the current year:

Amortization of prior

service cost (2,733) (3,350) (4,658)

Amortization of net loss (167,279) (92,977) (65,901)

Total $ 382,291 $ 949,297 $ 161,720

Total recognized as net periodic

pension cost, regulatory asset,

and/or AOCI (before tax) $ 646,572 $1,103,301 $ 308,833

Estimated amortization

amounts from regulatory

asset and/or AOCI to net

periodic cost in

the following year

Prior service cost $ 2,268 $ 2,733 $ 3,350

Net loss $ 219,805 $ 169,064 $ 92,977

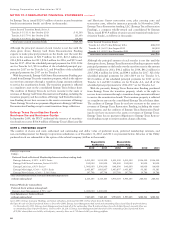

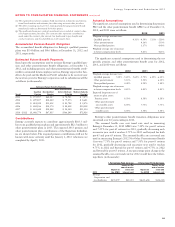

Qualified Pension Obligations, Plan Assets, Funded

Status, Amounts Recognized in the Balance Sheet

for Entergy Corporation and Its Subsidiaries as of

December 31, 2012 and 2011 (in thousands):

2012 2011

Change in Projected Benefit Obligation (PBO)

Balance at beginning of year $ 5,187,635 $ 4,301,218

Service cost 150,763 121,961

Interest cost 260,929 236,992

Actuarial loss 693,017 703,895

Employee contributions 789 828

Benefits paid (196,494) (177,259)

Balance at end of year $ 6,096,639 $ 5,187,635

Change in Plan Assets

Fair value of assets at beginning of year $ 3,399,916 $ 3,216,268

Actual return on plan assets 458,137 (40,453)

Employer contributions 170,512 400,532

Employee contributions 789 828

Benefits paid (196,494) (177,259)

Fair value of assets at end of year $ 3,832,860 $ 3,399,916

Funded status $(2,263,779) $(1,787,719)

Amount recognized in the balance sheet

Non-current liabilities $(2,263,779) $(1,787,719)

Amount recognized as a regulatory asset

Prior service cost $ 308 $ 9,836

Net loss 2,352,234 2,048,743

$ 2,352,542 $ 2,058,579

Amount recognized as AOCI (before tax)

Prior service cost $ 9,444 $ 2,648

Net loss 633,146 551,613

$ 642,590 $ 554,261

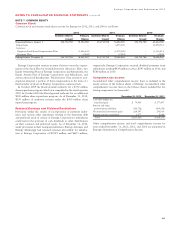

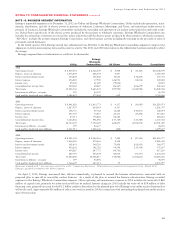

Other Postretirement Benefits

Entergy also currently provides health care and life insurance benefits

for retired employees. Substantially all employees may become eli-

gible for these benefits if they reach retirement age and meet certain

eligibility requirements while still working for Entergy. Entergy uses

a December 31 measurement date for its postretirement benefit plans.

Effective January 1, 1993, Entergy adopted an accounting stan-

dard requiring a change from a cash method to an accrual method

of accounting for postretirement benefits other than pensions. At

January 1, 1993, the actuarially determined accumulated postretire-

ment benefit obligation (APBO) earned by retirees and active employ-

ees was estimated to be approximately $241.4 million for Entergy

(other than the former Entergy Gulf States) and $128 million for

the former Entergy Gulf States (now split into Entergy Gulf States

Louisiana and Entergy Texas). Such obligations are being amortized

over a 20-year period that began in 1993 and ended in 2012. For the

most part, the Registrant Subsidiaries recover accrued other postre-

tirement benefit costs from customers and are required to contribute

the other postretirement benefits collected in rates to an external trust.

Entergy Arkansas, Entergy Mississippi, Entergy New Orleans, and

Entergy Texas have received regulatory approval to recover accrued

other postretirement benefit costs through rates. Entergy Arkansas

began recovery in 1998, pursuant to an APSC order. This order also

allowed Entergy Arkansas to amortize a regulatory asset (represent-

ing the difference between other postretirement benefit costs and cash

expenditures for other postretirement benefits incurred from 1993

through 1997) over a 15-year period that began in January 1998 and

ended in December 2012.

The LPSC ordered Entergy Gulf States Louisiana and Entergy Lou-

isiana to continue the use of the pay-as-you-go method for ratemak-

ing purposes for postretirement benefits other than pensions. How-

ever, the LPSC retains the flexibility to examine individual companies’

accounting for other postretirement benefits to determine if special

exceptions to this order are warranted.

89