Entergy 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

Arkansas’s assistance to determine the additional fuel and purchased

energy costs associated with these findings and file the analysis within

60 days of the order. After a final determination of the costs is made

by the APSC, Entergy Arkansas would be directed to refund that

amount with interest to its customers as a credit on the energy cost

recovery rider. Entergy Arkansas requested rehearing of the order. In

March 2007, in order to allow further consideration by the APSC, the

APSC granted Entergy Arkansas’s petition for rehearing and for stay

of the APSC order.

In October 2008, Entergy Arkansas filed a motion to lift the stay

and to rescind the APSC’s January 2007 order in light of the argu-

ments advanced in Entergy Arkansas’s rehearing petition and because

the value for Entergy Arkansas’s customers obtained through the

resolved railroad litigation is significantly greater than the incremen-

tal cost of actions identified by the APSC as imprudent. In December

2008 the APSC denied the motion to lift the stay pending resolution

of Entergy Arkansas’s rehearing request and the unresolved issues in

the proceeding. The APSC ordered the parties to submit their unre-

solved issues list in the pending proceeding, which the parties did.

In February 2010 the APSC denied Entergy Arkansas’s request for

rehearing, and held a hearing in September 2010 to determine the

amount of damages, if any, that should be assessed against Entergy

Arkansas. A decision is pending. Entergy Arkansas expects the

amount of damages, if any, to have an immaterial effect on its results

of operations, financial position, or cash flows.

The APSC also established a separate docket to consider the resolved

railroad litigation, and in February 2010 it established a procedural

schedule that concluded with testimony through September 2010.

Testimony has been filed, and the APSC will decide the case based on

the record in the proceeding, including the prefiled testimony.

Entergy Gulf States Louisiana and Entergy Louisiana

Entergy Gulf States Louisiana and Entergy Louisiana recover electric

fuel and purchased power costs for the billing month based upon the

level of such costs incurred two months prior to the billing month.

Entergy Gulf States Louisiana’s purchased gas adjustments include

estimates for the billing month adjusted by a surcharge or credit that

arises from an annual reconciliation of fuel costs incurred with fuel

cost revenues billed to customers, including carrying charges.

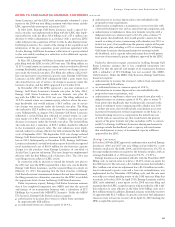

In January 2003 the LPSC authorized its staff to initiate a pro-

ceeding to audit the fuel adjustment clause filings of Entergy Gulf

States Louisiana and its affiliates. The audit included a review of the

reasonableness of charges flowed by Entergy Gulf States Louisiana

through its fuel adjustment clause for the period 1995 through 2004.

Entergy Gulf States Louisiana and the LPSC Staff reached a settle-

ment to resolve the audit that requires Entergy Gulf States Louisiana

to refund $18 million to customers, including the realignment to base

rates of $2 million of SO2 costs. The ALJ held a stipulation hear-

ing and in November 2011 the LPSC issued an order approving the

settlement. The refund was made in the November 2011 billing cycle.

Entergy Gulf States Louisiana had previously recorded provisions for

the estimated outcome of this proceeding.

In December 2011 the LPSC authorized its staff to initiate another

proceeding to audit the fuel adjustment clause filings of Entergy Gulf

States Louisiana and its affiliates. The audit includes a review of the

reasonableness of charges flowed by Entergy Gulf States Louisiana

through its fuel adjustment clause for the period 2005 through 2009.

Discovery is in progress, but a procedural schedule has not been

established.

In April 2010 the LPSC authorized its staff to initiate an audit of

Entergy Louisiana’s fuel adjustment clause filings. The audit includes

a review of the reasonableness of charges flowed through the fuel

adjustment clause by Entergy Louisiana for the period from 2005

through 2009. The LPSC Staff issued its audit report in January

2013. The LPSC staff recommended that Entergy Louisiana refund

approximately $1.9 million, plus interest, to customers and realign

the recovery of approximately $1.0 million from Entergy Louisiana’s

fuel adjustment clause to base rates. Two parties have intervened in

the proceeding. A procedural schedule has not yet been established.

Entergy Louisiana has recorded provisions for the estimated outcome

of this proceeding.

Entergy Mississippi

Entergy Mississippi’s rate schedules include an energy cost recovery

rider that, effective January 1, 2013, is adjusted annually to reflect

accumulated over- or under-recoveries. Entergy Mississippi’s fuel cost

recoveries are subject to annual audits conducted pursuant to the

authority of the MPSC.

Mississippi Attorney General Complaint

The Mississippi attorney general filed a complaint in state court in

December 2008 against Entergy Corporation, Entergy Mississippi,

Entergy Services, and Entergy Power alleging, among other things,

violations of Mississippi statutes, fraud, and breach of good faith

and fair dealing, and requesting an accounting and restitution. The

complaint is wide ranging and relates to tariffs and procedures

under which Entergy Mississippi purchases power not generated in

Mississippi to meet electricity demand. Entergy believes the complaint

is unfounded. In December 2008, the defendant Entergy companies

removed the attorney general’s suit to U.S. District Court in Jackson,

Mississippi. The Mississippi attorney general moved to remand the

matter to state court. In August 2012, the District Court issued an

opinion denying the Attorney General’s motion for remand, finding

that the District Court has subject matter jurisdiction under the Class

Action Fairness Act.

The defendant Entergy companies answered the complaint and

filed a counterclaim for relief based upon the Mississippi Public

Utilities Act and the Federal Power Act. In May 2009, the defen-

dant Entergy companies filed a motion for judgment on the pleadings

asserting grounds of federal preemption, the exclusive jurisdiction of

the MPSC, and factual errors in the attorney general’s complaint. In

September 2012 the District Court heard oral argument on Entergy’s

motion for judgment on the pleadings. The District Court’s ruling on

the motion for judgment on the pleadings is pending.

Entergy New Orleans

Entergy New Orleans’s electric rate schedules include a fuel adjust-

ment tariff designed to reflect no more than targeted fuel and pur-

chased power costs, adjusted by a surcharge or credit for deferred

fuel expense arising from the monthly reconciliation of actual fuel

and purchased power costs incurred with fuel cost revenues billed to

customers, including carrying charges.

Entergy New Orleans’s gas rate schedules include a purchased

gas adjustment to reflect estimated gas costs for the billing month,

adjusted by a surcharge or credit similar to that included in the elec-

tric fuel adjustment clause, including carrying charges.

Entergy Texas

Entergy Texas’s rate schedules include a fixed fuel factor to recover

fuel and purchased power costs, including interest, not recovered in

base rates. Semi-annual revisions of the fixed fuel factor are made in

March and September based on the market price of natural gas and

changes in fuel mix. The amounts collected under Entergy Texas’s

fixed fuel factor and any interim surcharge or refund are subject to

fuel reconciliation proceedings before the PUCT.

In October 2009, Entergy Texas filed with the PUCT a request

to refund approximately $71 million, including interest, of fuel cost

recovery over-collections through September 2009. Pursuant to a

63