Entergy 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

HURRICANE ISAAC

In August 2012, Hurricane Isaac caused extensive damage to por-

tions of Entergy’s service area in Louisiana, and to a lesser extent

in Mississippi and Arkansas. The storm resulted in widespread

power outages, significant damage primarily to distribution infra-

structure, and the loss of sales during the power outages. Total

restoration costs for the repair or replacement of Entergy’s electric

facilities in areas with damage from Hurricane Isaac are currently

estimated to be approximately $370 million, including approximate

amounts of $7 million at Entergy Arkansas, $70 million at Entergy

Gulf States Louisiana, $220 million at Entergy Louisiana, $22 mil-

lion at Entergy Mississippi, and $48 million at Entergy New Orleans.

The Utility operating companies are considering all reason-

able avenues to recover storm-related costs from Hurricane Isaac,

including, but not limited to, accessing funded storm reserves; securi-

tization or other alternative financing; and traditional retail recovery

on an interim and permanent basis. Each Utility operating company

is responsible for its restoration cost obligations and for recovering

or financing its storm-related costs. In November 2012, Entergy New

Orleans drew $10 million from its funded storm reserves. In January

2013, Entergy Gulf States Louisiana and Entergy Louisiana drew

$65 million and $187 million, respectively, from their funded storm

reserves. Storm cost recovery or financing may be subject to review by

applicable regulatory authorities.

Entergy recorded accruals for the estimated costs incurred that

were necessary to return customers to service. Entergy recorded cor-

responding regulatory assets of approximately $120 million and con-

struction work in progress of approximately $250 million. Entergy

recorded the regulatory assets in accordance with its accounting poli-

cies and based on the historic treatment of such costs in its service

area because management believes that recovery through some form

of regulatory mechanism is probable. Because Entergy has not gone

through the regulatory process regarding these storm costs, however,

there is an element of risk, and Entergy is unable to predict with

certainty the degree of success it may have in its recovery initiatives,

the amount of restoration costs that it may ultimately recover, or the

timing of such recovery.

CORRECTION OF REGULATORY ASSET FOR INCOME TAXES

In the first quarter 2012, Entergy Gulf States Louisiana determined

that its regulatory asset for income taxes was overstated because of a

difference between the regulatory treatment of the income taxes asso-

ciated with certain items (primarily pension expense) and the finan-

cial accounting treatment of those taxes. Beginning with Louisiana

retail rate filings using the 1994 test year, retail rates were developed

using the normalization method of accounting for income taxes. With

respect to these items, however, the financial accounting for income

taxes was computed using the flow-through method of accounting.

As a result, over the years Entergy Gulf States Louisiana accumulated

a regulatory asset representing the expected future recovery of tax

expense for the affected items even though the tax expense was being

collected currently in rates from customers and would not be recov-

ered in the future.

The effect was immaterial to the consolidated balance sheets,

results of operations, and cash flows of Entergy for all prior report-

ing periods and on a cumulative basis. Therefore, a cumulative

adjustment was recorded in the first quarter 2012 to remove the reg-

ulatory asset previously recorded. This adjustment increased 2012

income tax expense by $46.3 million, decreased the regulatory asset

for income taxes by $75.3 million, and decreased accumulated

deferred income taxes by $29 million.

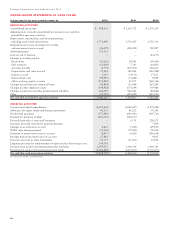

FUEL A N D PU R C HASE D POWER COS T REC OV ERY

Entergy Arkansas, Entergy Gulf States Louisiana, Entergy Louisiana,

Entergy Mississippi, Entergy New Orleans, and Entergy Texas are

allowed to recover fuel and purchased power costs through fuel

mechanisms included in electric and gas rates that are recorded as

fuel cost recovery revenues. The difference between revenues col-

lected and the current fuel and purchased power costs is generally

recorded as “Deferred fuel costs” on the Utility operating companies’

financial statements. The table below shows the amount of deferred

fuel costs as of December 31, 2012 and 2011 that Entergy expects to

recover (or return to customers) through fuel mechanisms, subject to

subsequent regulatory review (in millions):

2012 2011

Entergy Arkansas $ 97.3 $ 209.8

Entergy Gulf States Louisiana(a) $ 99.2 $ 2.9

Entergy Louisiana(a) $ 94.6 $ 1.5

Entergy Mississippi $ 26.5 $ (15.8)

Entergy New Orleans(a) $ 1.9 $ (7.5)

Enter gy Texas $(93. 3) $ (6 4.7)

(a) 2012 and 2011 include $100.1 million for Entergy Gulf States Louisiana,

$68 million for Entergy Louisiana, and $4.1 million for Entergy New Orleans

of fuel, purchased power, and capacity costs, which do not currently earn a

return on investment and whose recovery periods are indeterminate but are

expected to be over a period greater than twelve months.

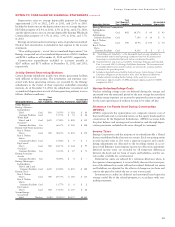

Entergy Arkansas

Production Cost Allocation Rider

The APSC approved a production cost allocation rider for recovery

from customers of the retail portion of the costs allocated to Entergy

Arkansas as a result of the System Agreement proceedings, which are

discussed in the “System Agreement Cost Equalization Proceedings”

section below. These costs cause an increase in Entergy Arkansas’s

deferred fuel cost balance because Entergy Arkansas pays the costs over

seven months but collects them from customers over twelve months.

Energy Cost Recovery Rider

Entergy Arkansas’s retail rates include an energy cost recovery rider

to recover fuel and purchased energy costs in monthly bills. The rider

utilizes prior calendar year energy costs and projected energy sales

for the twelve-month period commencing on April 1 of each year

to develop an energy cost rate, which is redetermined annually and

includes a true-up adjustment reflecting the over-recovery or under-

recovery, including carrying charges, of the energy costs for the prior

calendar year. The energy cost recovery rider tariff also allows an

interim rate request depending upon the level of over- or under-recov-

ery of fuel and purchased energy costs.

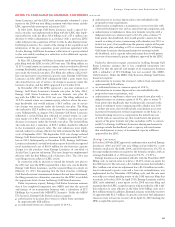

In October 2005 the APSC initiated an investigation into Entergy

Arkansas’s interim energy cost recovery rate. The investigation

focused on Entergy Arkansas’s 1) gas contracting, portfolio, and

hedging practices; 2) wholesale purchases during the period; 3)

management of the coal inventory at its coal generation plants; and

4) response to the contractual failure of the railroads to provide coal

deliveries. In March 2006, the APSC extended its investigation to

cover the costs included in Entergy Arkansas’s March 2006 annual

energy cost rate filing, and a hearing was held in the APSC energy cost

recovery investigation in October 2006.

In January 2007 the APSC issued an order in its review of the

energy cost rate. The APSC found that Entergy Arkansas failed to

maintain an adequate coal inventory level going into the summer of

2005 and that Entergy Arkansas should be responsible for any incre-

mental energy costs resulting from two outages caused by employee

and contractor error. The coal plant generation curtailments were

caused by railroad delivery problems and Entergy Arkansas has since

resolved litigation with the railroad regarding the delivery problems.

The APSC staff was directed to perform an analysis with Entergy

62