Entergy 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2012

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

In February 2012 the Vermont defendants appealed the decision

to the United States Court of Appeals for the Second Circuit. Vermont

Yankee cross-appealed on two grounds: (1) the Federal Power Act alter-

natively preempts conditioning the issuance of a new Certificate of Pub-

lic Good upon the existence of a below wholesale market power sale

agreement with Vermont utilities or Vermont Yankee’s selling power to

Vermont utilities at rates below those available to wholesale customers

in other states (an issue the District Court found unnecessary to decide

in light of its ruling under the Commerce Clause); and (2) a request to

make permanent the injunction pending appeal that the District Court

entered on March 19, 2012 which prohibits Vermont from enforcing a

statutory provision to compel Vermont Yankee to shut down because

the cumulative total amount of spent fuel stored at the site exceeds the

amount derived from the operation of the facility up to, but not beyond,

March 21, 2012 (a provision the enforcement of which the January 2012

decision had not enjoined). The appeal and cross-appeal remain pending.

In January 2012, Entergy filed a motion requesting that the VPSB

grant, based on the existing record in its proceeding, Vermont Yankee’s

pending application for a new Certificate of Public Good. Entergy sub-

sequently filed another motion asking the VPSB to declare that title 3,

section 814(b) of the Vermont statutes (3 V.S.A. § 814(b)) authorized

Vermont Yankee to operate while the Certificate of Public Good pro-

ceeding was pending because Entergy had timely filed a petition for a

new Certificate of Public Good that had not yet been decided. In March

2012, the VPSB issued orders denying Entergy’s motion with respect to

3 V.S.A. § 814(b) but stating that the order did not require Vermont

Yankee to cease operations, denying Entergy’s motion to issue a new

Certificate of Public Good based on the existing record, determining

to open a new docket and to create a new record to decide Vermont

Yankee’s request for a new Certificate of Public Good (without preju-

dice to any rights that Entergy might have under 3 V.S.A. § 814(b)),

and directing Entergy to file an amended Certificate of Public Good

petition that identified the specific approvals it was seeking in light of

the district court’s decision. In April 2012, Entergy filed its amended

Certificate of Public Good petition and in June 2012 filed its initial

testimony in support of that petition. The VPSB’s current schedule

provides for hearings and briefs to be filed through August 2013, but

no date for a decision by the VPSB.

In May 2012, Entergy filed a motion asking the VPSB to amend

the 2002 and 2006 VPSB orders respectively approving Entergy’s

acquisition of Vermont Yankee and Vermont Yankee’s construction

of a spent nuclear fuel storage facility. These orders contained condi-

tions respectively precluding the operation of Vermont Yankee after

March 21, 2012 absent issuance of a new or renewed certificate of

public good and limiting the amount of spent nuclear fuel stored at the

site, in each case without explicitly addressing whether those condi-

tions were subject to 3 V.S.A. § 814(b). In its March 2012 order the

VPSB had found 3 V.S.A. § 814(b) did not apply to the conditions in

those orders even though it did apply to the certificates of public good

issued by the orders. In November 2012 the VPSB denied Entergy’s

motion to amend the 2002 and 2006 VPSB orders. In December 2012

the Conservation Law Foundation filed a complaint in the Vermont

Supreme Court, based on the VPSB’s November order, which sought

an order shutting down Vermont Yankee while its Certificate of

Public Good application is pending. Entergy moved to dismiss that

complaint on the basis, among other grounds, that 3 V.S.A. § 814(b)

allows Vermont Yankee to operate while its Certificate of Public Good

application is being decided. The Vermont Supreme Court heard oral

argument on the motion in January 2013. Also in January 2013,

the VPSB issued an order closing the old Certificate of Public Good

docket (the one superseded by Entergy’s April 2012 amended peti-

tion) in which the VPSB’s March 2012 and November 2012 orders

had been issued, making an appeal from those orders ripe. Entergy

immediately filed a notice appealing those VPSB orders to the Vermont

Supreme Court. Entergy expects to file its appeal brief in March 2013.

In September 2012, Entergy filed a petition asking the VPSB to

issue a Certificate of Public Good allowing construction at Vermont

Yankee for a diesel generator to provide power in the event of a station

blackout. Vermont Yankee currently can obtain such power from the

Vernon Dam. Due to changes instituted by ISO-New England, Vermont

Yankee will no longer be able to rely upon the Vernon Dam in the

event of a station blackout after August 31, 2013 and therefore plans

to install a new diesel generator as a replacement power source. The

VPSB requested and received comments on Entergy’s September 2012

petition and its relationship to Entergy’s other petition for a Certificate

of Public Good. In December 2012 the VPSB issued an order opening

an investigation into Vermont Yankee’s Certificate of Public Good die-

sel generator application. In February 2013 the VPSB issued a notice

allowing comments to be filed by March 15, 2013, but not otherwise

establishing a schedule for completing that investigation.

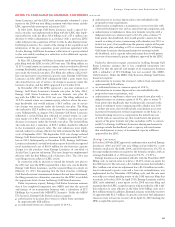

IMPAIRMENT

Because of the uncertainty regarding the continued operation of

Vermont Yankee, Entergy has tested the recoverability of the plant

and related assets each quarter since the first quarter 2010. The

determination of recoverability is based on the probability-weighted

undiscounted net cash flows expected to be generated by the plant

and related assets. Projected net cash flows primarily depend on the

status of the pending legal and state regulatory matters, as well as

projections of future revenues and expenses over the remaining life

of the plant. Prior to the first quarter 2012, the probability-weighted

undiscounted net cash flows exceeded the carrying value of the Ver-

mont Yankee plant and related assets. The decline, however, in the

overall energy market and the projected forward prices of power as

of March 31, 2012, which are significant inputs in the determination

of net cash flows, resulted in the probability-weighted undiscounted

future cash flows being less than the asset group’s carrying value.

Entergy performed a fair value analysis based on the income approach, a

discounted cash flow method, to determine the amount of impair-

ment. The estimated fair value of the plant and related assets at

March 31, 2012 was $162.0 million, while the carrying value was

$517.5 million. Therefore, the assets were written down to their fair

value and an impairment charge of $355.5 million ($223.5 million

after-tax) was recognized. The impairment charge is recorded as a

separate line item in Entergy’s consolidated statement of income for

2012, and is included within the results of the Entergy Wholesale

Commodities segment.

The estimate of fair value was based on the price that Entergy

would expect to receive in a hypothetical sale of the Vermont Yankee

plant and related assets to a market participant on March 31, 2012.

In order to determine this price, Entergy used significant observable

inputs, including quoted forward power and gas prices, where avail-

able. Significant unobservable inputs, such as projected long-term

pre-tax operating margins (cash basis), and estimated weighted aver-

age costs of capital were also used in the estimation of fair value.

In addition, Entergy made certain assumptions regarding future tax

deductions associated with the plant and related assets. Based on the

use of significant unobservable inputs, the fair value measurement

for the entirety of the asset group, and for each type of asset within

the asset group, is classified as Level 3 in the fair value hierarchy dis-

cussed in Note 16 to the financial statements.

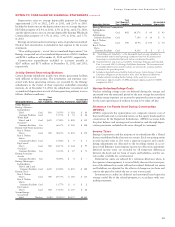

The following table sets forth a description of significant unobserv-

able inputs used in the valuation of the Vermont Yankee plant and

related assets as of March 31, 2012:

Significant Unobservable Inputs Range Weighted Average

Weighted average cost of capital 7.5% - 8.0% 7.8%

Long-term pre-tax

operating margin (cash basis) 6.1% - 7.8% 7.2%

60