ComEd 2002 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

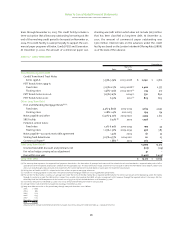

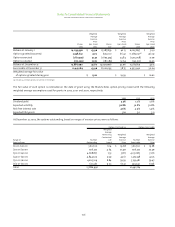

note 08 • accounts receivable

Accounts Receivable—Customer at December 31,2002 and 2001

included unbilled operating revenues of $442 million and $438

million,respectively.The allowance for uncollectible accounts at

December 31, 2002 and 2001 was $132 million and $213 million,

respectively.

PECO is party to an agreement with a financial institution

under which it can sell or finance with limited recourse an

undivided interest, adjusted daily, in up to $225 million of des-

ignated accounts receivable until November 2005.At December

31, 2002, PECO had sold a $225 million interest in accounts

receivable, consisting of a $164 million interest in accounts

receivable which PECO accounted for as a sale under SFAS No.

140, “Accounting for Transfers and Servicing of Financial Assets

and Extinguishment of Liabilities—a Replacement of FASB

Statement No. 125,” and a $61 million interest in special-agree-

ment accounts receivable which was accounted for as a long-

term note payable (see Note 13—Long-Term Debt). PECO retains

the servicing responsibility for these receivables.The agreement

requires PECO to maintain the $225 million interest, which, if

not met, requires cash, which would otherwise be received by

PECO under this program,to be held in escrow until the require-

ment is met. At December 31, 2002 and 2001, PECO met this

requirement and was not required to make any cash deposits.

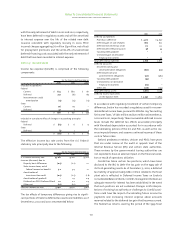

note 09 • property, plant, and equipment

A summary of property, plant and equipment by classification

as of December 31,2002 and 2001 is as follows:

Asset Category 2002 2001

Electric-Transmission and Distribution $10,980 $ 10,156

Electric-Generation 5,678 4,344

Gas 1,319 1,281

Common 404 399

Nuclear Fuel 3,112 2,681

Construction Work in Progress 2,783 1,294

Other Property, Plant and Equipment 1,628 1,371

Total Property, Plant and Equipment 25,904 21,526

Less Accumulated Depreciation

(including accumulated amortization

of nuclear fuel of $2,212 and $1,838 as of

December 31, 2002 and 2001, respectively) 8,770 7,735

Property, Plant and Equipment, net $17,134 $ 13,791

note 10 • jointly owned electric utility plant

Exelon’s undivided ownership interests in jointly owned electric

plant at December 31, 2002 and 2001 were as follows:

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

96

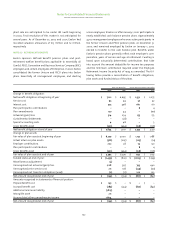

Production Plant Transmission

December 31, 2002 Peach Bottom Salem Keystone Conemaugh Quad Cities

and Other Plant

Operator Generation PSE&G Reliant Reliant Generation Various Co.

Participating Interest 50% 42.59% 20.99% 20.72% 75% 21 to 44%

Exelon’s Share:

Plant $ 417 $ 44 $ 131 $ 214 $ 171 $ 58

Accumulated Depreciation 243 12 117 145 4 22

Construction Work in Progress 52 36 28 1 35 –

Production Plant Transmission

December 31, 2001 Peach Bottom Salem Keystone Conemaugh Quad Cities

and Other Plant

Operator Generation PSE&G Reliant Reliant Generation Various Co.

Participating Interest 50% 42.59% 20.99% 20.72% 75% 21 to 44%

Exelon’s Share:

Plant $ 387 $ 12 $ 121 $ 193 $ 96 $ 66

Accumulated Depreciation 220 4 98 124 10 25

Construction Work in Progress 13 53 13 12 52 1

Exelon’s undivided ownership interests are financed with

Exelon funds and, when placed in service, all operations are

accounted for as if such participating interests were wholly

owned facilities. Direct expenses of the jointly owned plants are

included in the corresponding operating expenses on the

Consolidated Income Statements.