ComEd 2002 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

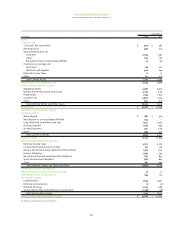

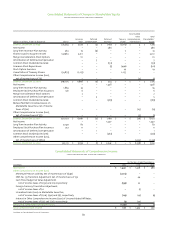

(Dollars in millions, except per share data unless otherwise noted)

note 01 • significant accounting policies

Description of Business

Exelon Corporation (Exelon) is a utility services holding com-

pany formed as a result of the merger of Unicom Corporation

(Unicom), the former parent company of Commonwealth

Edison Company (ComEd), and PECO Energy Company (PECO)

(Merger) (see Note 2—Merger). Exelon is engaged, through its

subsidiaries, in the energy delivery, wholesale generation and

the enterprises businesses discussed below (see Note 20—

Segment Information). The Energy Delivery segment’s busi-

nesses include the sale of electricity and distribution and

transmission services by ComEd in northern Illinois and PECO

in southeastern Pennsylvania and the sale of natural gas

and distribution services by PECO in the Pennsylvania counties

surrounding the City of Philadelphia.The wholesale generation

business consists of the electric generating facilities and energy

marketing operations of Exelon Generation Company, LLC

(Generation) and Generation’s interests in Sithe Energies, Inc.

(Sithe) and AmerGen Energy Company, LLC (AmerGen). Exelon

Enterprises Company, LLC (Enterprises) includes energy and

infrastructure services,competitive retail energy sales,commu-

nications joint ventures and other investments weighted

towards the communications, energy services and retail

services industries.

Basis of Presentation

The consolidated financial statements of Exelon include the

accounts of its majority-owned subsidiaries after the elimina-

tion of intercompany transactions. Investments and joint ven-

tures in which a 20% to 50% interest is owned and a significant

influence is exerted are accounted for under the equity method

of accounting. The proportionate interests in jointly owned

electric utility plants are consolidated. Investments in which

less than a 20% interest is owned are primarily accounted for

under the cost method of accounting. Exelon owns 100% of

all significant consolidated subsidiaries, either directly or

indirectly, except for ComEd of which Exelon owns more than

99%, InfraSource Inc. (InfraSource) of which Exelon owns 95%

and Southeast Chicago Energy Project, LLC of which Exelon

owns 70% through Generation. Exelon has reflected the third-

party interests in the above majority owned investments as

minority interests in its Consolidated Statements of Cash

Flows, Consolidated Balance Sheets and in Other, Net on the

Consolidated Statements of Income. Accounting policies for

regulated operations are in accordance with those prescribed

by the regulatory authorities having jurisdiction, principally

the Illinois Commerce Commission (ICC), the Pennsylvania

Public Utility Commission (PUC), the Federal Energy Regulatory

Commission (FERC) and the Securities and Exchange Commission

(SEC) under the Public Utility Holding Company Act of 1935 (PUHCA).

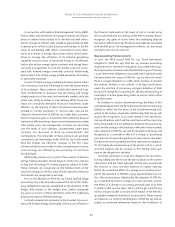

On October 20, 2000, Exelon became the parent of PECO

through a share exchange and Unicom was merged into Exelon.

As a result of these transactions, Unicom ceased to exist and

Exelon became the parent of ComEd and PECO (see Note 2—

Merger). For accounting purposes, PECO was deemed the

acquiror in the Merger. Accordingly, the financial statements of

Exelon for the periods presented prior to October 20,2000 rep-

resent the historical financial statements of PECO and for the

periods from October 20, 2000 include the operations acquired

from Unicom.

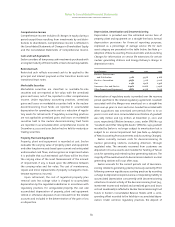

Accounting for the Effects of Regulation

Exelon accounts for all of its regulated electric and gas opera-

tions in accordance with the Financial Accounting Standards

Board (FASB) Statement of Financial Accounting Standards

(SFAS) No. 71, “Accounting for the Effects of Certain Types of

Regulation,”(SFAS No.71) requiring Exelon to record in its finan-

cial statements the effects of rate regulation. Use of SFAS No. 71

is applicable to the utility operations of Exelon that meet the

following criteria: (1) third-party regulation of rates; (2) cost-

based rates; and (3) a reasonable assumption that all costs will

be recoverable from customers through rates. Exelon believes

that it is probable that currently recorded regulatory assets will

be recovered. If a separable portion of Exelon’s business no longer

meets the provisions of SFAS No.71,Exelon is required to eliminate

the financial statement effects of regulation for that portion.

Use of Estimates

The preparation of financial statements in conformity with

generally accepted accounting principles (GAAP) requires

management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from

those estimates.Areas in which significant estimates have been

made include, but are not limited to, the accounting for deriva-

tives, nuclear decommissioning liabilities, asset impairment

analyses,environmental costs and pension costs.

Revenues

Operating revenues are generally recorded as service is rendered

or energy is delivered to customers. At the end of each month,

Exelon accrues an estimate for the unbilled amount of energy

delivered or services provided to its electric and gas customers

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

81